online pharmacy buy ciprodex with best prices today in the USA

buy antabuse online https://www.indcheminternational.com/wp-content/uploads/2022/08/png/antabuse.html no prescription pharmacy

online pharmacy buy antabuse with best prices today in the USA

buy champix online https://fromaddictiontorecovery.com/NAV2/_notes/mno/champix.html no prescription pharmacy

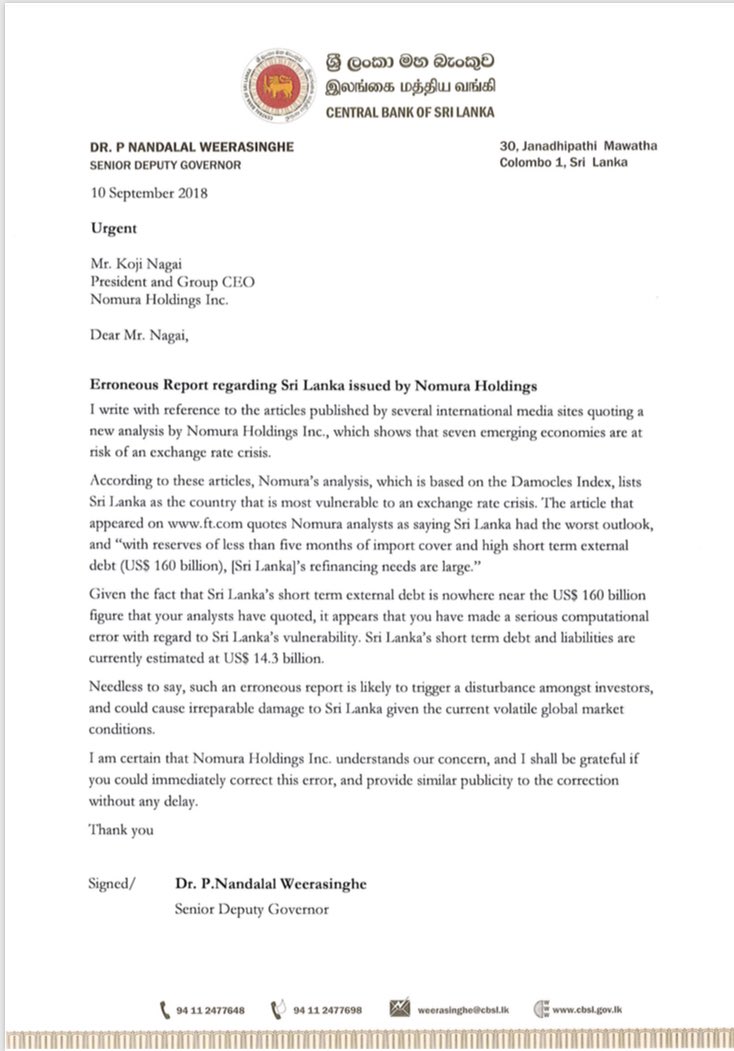

The Central Bank of Sri Lanka (CBSL) as well as finance ministry officials have pointed out that they have made a significant calculation error. This error has significantly skewed the results of their analysis.

online pharmacy buy diflucan with best prices today in the USA

buy stromectol online https://fromaddictiontorecovery.com/NAV2/_notes/mno/stromectol.html no prescription pharmacy

In the CBSL's official and rapid response, Senior Deputy Governor Nandalal Weerasinghe has pointed out that: "Needless to say, such an erroneous report is likely to trigger a disturbance among investors, and could cause irreparable damage to Sri Lanka given the volatile global market conditions." "I am certain that Nomura Holdings Inc. understands our concern, and I should be grateful if you could immediately correct this error, and provide similar publicity to the correction without delay." Nomura has yet to comply with the CBSL Deputy Governor's request. Nomura is a large global investment bank with a market capitalisation of over USbn, and over 25,000 employees worldwide.

online pharmacy buy spiriva inhaler with best prices today in the USA

online pharmacy buy female cialis with best prices today in the USA

buy abilify online http://sinusys.com/images/icons/png/abilify.html no prescription pharmacy

Despite the problematic report, the Sri Lanka rupee was stable on the day at 162 to the US$.

buy advair online http://sinusys.com/images/icons/png/advair.html no prescription pharmacy

buy naprosyn online https://fromaddictiontorecovery.com/NAV2/_notes/mno/naprosyn.html no prescription pharmacy

The currency has been weak this year and is near its all-time low. However, other emerging market currencies have fared much worse than the LKR in 2018.

online pharmacy buy abilify with best prices today in the USA

buy renova online https://www.indcheminternational.com/wp-content/uploads/2022/08/png/renova.html no prescription pharmacy

online pharmacy buy fluoxetine with best prices today in the USA

buy flexeril online https://curohealthservices.com/wp-content/uploads/2022/08/png/flexeril.html no prescription pharmacy

CBSL response to Nomura report below: