online pharmacy https://kendrickfoundation.org/wp-content/uploads/2022/09/new/trazodone.html no prescription drugstore

Foreign outflows from stocks and bonds accelerated from Sri Lanka as a result of a constitutional crisis which the country's speaker termed a "coup without guns.

online pharmacy https://kendrickfoundation.org/wp-content/uploads/2022/09/new/temovate.html no prescription drugstore

" The crisis has now been resolved, but political uncertainty remains with a lingering presidential election expected in the next 12 months or sooner. Outflows have been cited by the Governor of the Central Bank Indrajit Coomaraswamy as being one of the main factors that has caused Sri Lanka's currency to significantly depreciate in 2018. The Governor in recent comments indicated that the Sri Lanka Rupee was undervalued, highlighting that it is trading below the "real effective exchange rare (REER)."

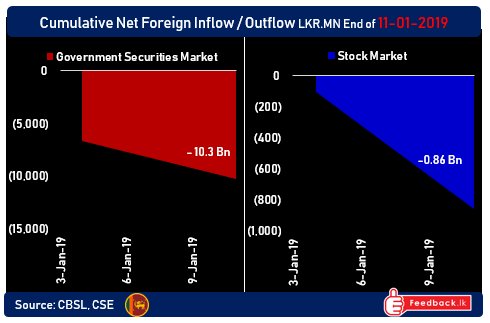

Update #SriLanka net foreign Inflow / Outflow to SL Government Bond market and Stock market 11th Jan 2019. Hot money is stilling moving out of the capital market of Sri Lanka. pic.twitter.com/BWhPKUSGHL

— Sanjeewa Dayarathne (@DayarathneSa) January 12, 2019