online pharmacy buy strattera with best prices today in the USA

online pharmacy buy spiriva inhaler with best prices today in the USA

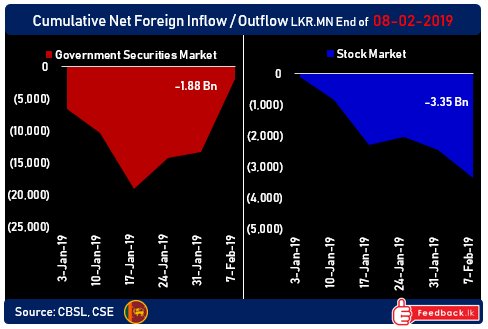

In the last 3 weeks, foreign investors have invested close to a net of US0mn into Sri Lanka's bonds.

online pharmacy buy abilify with best prices today in the USA

buy antabuse online https://www.indcheminternational.com/wp-content/uploads/2022/08/png/antabuse.html no prescription pharmacy

This comes on the back of close to a billion dollar outflow in 2018.

online pharmacy buy periactin with best prices today in the USA

Stability has returned to Sri Lanka's economy after constitutional democracy was strongly upheld amid moves to execute an illegal transfer of governmental power.

online pharmacy buy glucophage with best prices today in the USA

buy clomiphene online http://abucm.org/assets/pdf/clomiphene.html no prescription pharmacy

Confidence in Sri Lanka's government and Prime Minister Ranil Wickremesinghe is starting to exhibit itself in Sri Lanka's capital markets.

buy amoxil online http://abucm.org/assets/pdf/amoxil.html no prescription pharmacy

Bond investors, often termed the 'smart money' have made an aggressive move back into Sri Lanka, while foreign equity investors continue to exit. Inflows into Sri Lanka's bond market are likely one of the key factors which have lead to a 3% surge in Sri Lanka's currency (LKR) versus the dollar 2019.

online pharmacy buy ciprodex with best prices today in the USA

online pharmacy buy diflucan with best prices today in the USA

buy avodart online https://www.indcheminternational.com/wp-content/uploads/2022/08/png/avodart.html no prescription pharmacy

Analysts expect more inflows if Sri Lanka is able to execute a successful sovereign bond offering.

buy renova online https://www.indcheminternational.com/wp-content/uploads/2022/08/png/renova.html no prescription pharmacy

online pharmacy buy azithromycin with best prices today in the USA

buy azithromycin online http://abucm.org/assets/pdf/azithromycin.html no prescription pharmacy

#SriLanka capital market enjoined once again with Net inflow of LKR 11.5Bn (appro. $ 65Mn) to LKR denominated Government Bond market during this week. During last three weeks foreigners have invested net LKR 17.18Bn ( $ 97Mn) in to Gov. Bonds. pic.twitter.com/ksWnIuwlbJ

— Sanjeewa Dayarathne (@DayarathneSa) February 8, 2019