Sri Lanka CSE records highest ever foreign inflow last year: 2014 CSE Annual Report

June 03, 2015 (LBO) – Sri Lanka’s Colombo Stock Exchange has recorded its highest ever inflow of foreign investment into the secondary equity market amounting to 104.7 billion rupees by December 2014.

Releasing the 2014 Annual Report of the CSE, its CEO Rajeeva Bandaranaike said Market capitalization has surpassed 3 trillion rupees, closing the year at 3.1 trillion rupees.

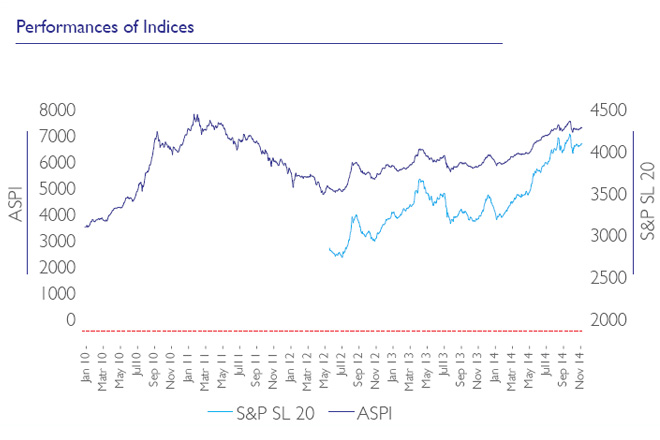

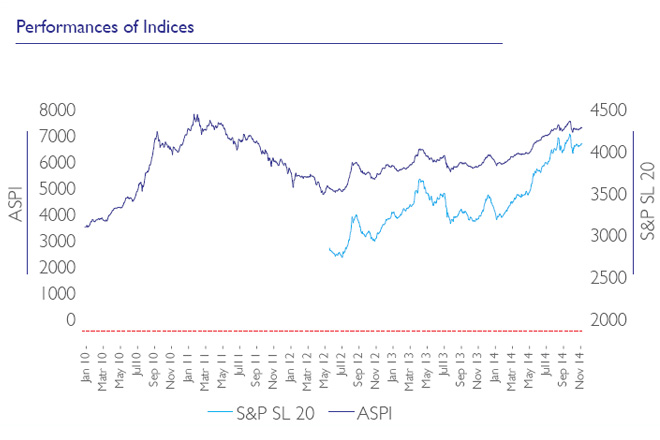

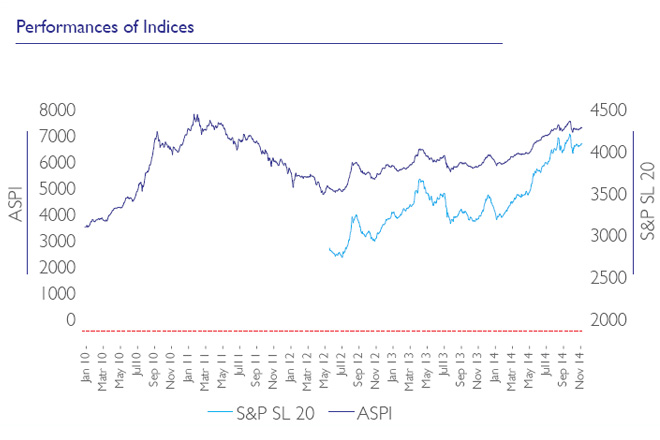

“Both key indices (ASPI & S&P) demonstrated outstanding results for the year, signaling the progressive stability and growth potential associated with Sri Lanka’s equity markets,” Bandaranaike said.

After crossing the 7,500 mark in November, the All Share Price Index (ASPI) ended the year with a growth of 23.4 percent year on year, a significant increase comparative to the 4.8 percent recorded in the previous year.

The S&P SL 20 Index grew by 25.3 percent year on year, an increase over the 5.8 percent growth seen in 2013.

“The S&P SL20 also achieved a key milestone by crossing the 4,000 mark for the first time since its launch.” Bandaranaike said.

Turnover has increased by 71 percent over the previous year from 828 million rupees in 2013 to 1.4 billion rupees in 2014.

The primary market remained active throughout the year with over 77.8 billion rupees being raised through equity and debt IPO’s, rights issues and private placements.

During the course of 2014 there were five Equity IPO’s, one Equity Introduction and 20 Debt IPO’s.

The five equity IPO’s raised a total of 2.7 billion rupees, the highest recorded since 2011.

Releasing the Annual Report, its Chairman, Vajira Kulatilaka said they have planned strategies to grow the current market capitalization to 50 billion US Dollars.

“2015 will also see a complete revision to the CSE Listing Rules to ensure a more effective and efficient listing process that serves the needs of all stakeholders.” Kulatilaka added.