Updated

Updated Sri Lanka records a deflation of 0.2-pct in July after two decades

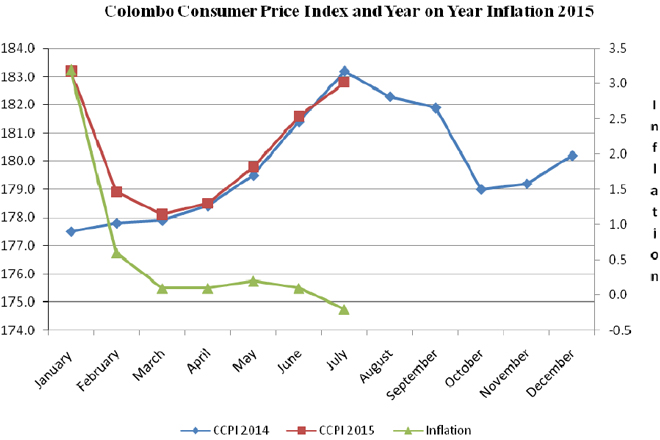

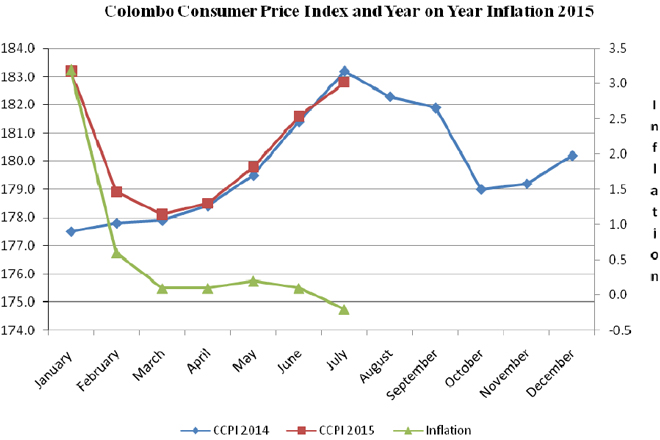

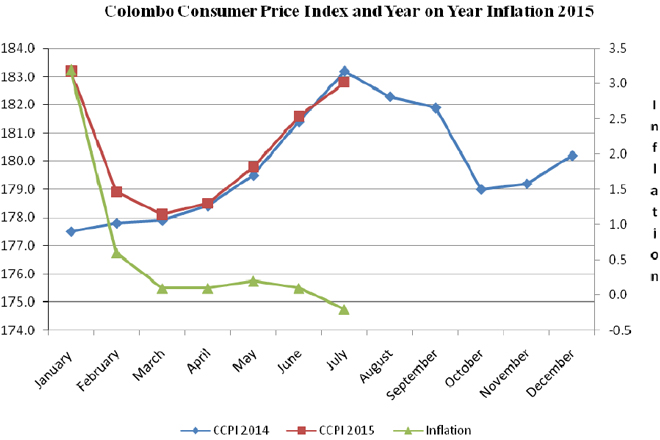

July 30, 2015 (LBO) – Sri Lanka has experienced a deflation of 0.2 percent for July 2015, for the first time after March 1995.

The main contributor for this decline was the major decrease in non food prices, statistics department said.

“This was mainly due to the decrease of electricity and water bills, LP gas, kerosene, petrol and diesel.”

Year on year inflation of food group has decreased from 4.0 percent in June 2015 to 2.5 percent in July 2015 while non‐food group increased by ‐3.2 percent to ‐2.5 percent during this period.

The overall rate of inflation measured by Colombo Consumer Price Index on year on year basis is ‐0.2 percent in July 2015 and inflation calculated for June 2015 was 0.1 percent.

The CCPI for all items for the month of July was 182.8.

An increase of 1.2 index point or a percentage of 0.68 has been recorded in July compared to June 2015.

The moving average inflation rate for the month is 1.3 percent and the corresponding rate for June 2015 was 1.7 percent.

Updated

Updated

Updated

Updated

There are many countries @ present having deflation. Within this context with the following events one may wonder weather global deflation is a symptom of many causes. . The USD in spite of mild set backs has been gaining against 6 major world currencies. With this we could see an acceleration of the commodity rout. These moves have been pressuring major commodity currencies like the AUD,NZD,CAD for some time now,(From Iron ore, oil, to Milk to Gold is under pressure).The China stock markets in spite of massive government intervention recorded an decline of around 14% for the month of July & many believe of a economic slowdown in the worlds second largest economy . Many US companies have been having asset write offs.(ie. Proctor & Gamble in Latin America around USD 2 bn),Countries like Japan has been exporting it’s deflation with lower JPY for some time now whilst an IMF up date talk of slow growth in Emerging markets & a pick up in developed economies.