Sri Lanka tourism daily rate performance ahead of peers: STR

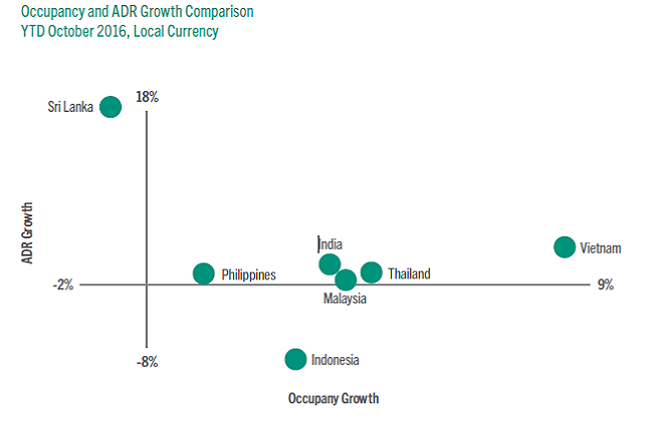

Dec 05, 2016 (LBO) - Sri Lanka’s 15.6 percent increase in the average room or daily rate (ADR) for tourism during the first ten months of the year puts its performance ahead of other countries in Southeast Asia in terms of rate growth, including, India, Thailand, Philippines, Malaysia, Vietnam and Indonesia, STR said in a research note.

The country’s hotel demand has increased 3.5 percent based on October 2016 year-to-date data. Supply, however, has also increased (+4.2 percent), with around 900 new rooms added to the market in the first ten months of the year.

Sri Lanka has reported a slight decline in occupancy (-0.7 percent to 66.3 percent), while average daily rate (ADR) rose 15.6 percent to LKR 15,854.99, resulting in double-digit revenue per available room (RevPAR) growth to LKR 10,512.93, a 14.8 percent increase.

In comparison, India, saw supply growth slowing to 3.2 percent for October 2016 year-to-date, while hotel demand increased 6.7 percent compared with last year.

This was largely influenced by a 10.5 percent increase in international arrivals, helped by the country’s e-Tourist VISA programme that launched in August 2015. As the second largest country in the world by population, along with recent economic growth and a rising middle class with increasing disposable income, India’s domestic tourism is expanding.

The research was presented at the Asian Hotel and Tourism Investment Conference held in Colombo last week.

For October 2016 year-to-date, Thailand’s occupancy rose 4.2 percent to 76.0 percent, its highest level since 2010. Meanwhile, ADR increased 1.3 percent to THB 3524.97, leading to a 5.6 percent increase in RevPAR to THB 2678.75.

The country’s hotel market has recorded growth following the political situation in 2013-2014, as the Tourism Authority of Thailand has launched efforts to attract visitors. Also, an increase in the number of direct flights to Thailand from Russia and the Middle East is expected to further boost arrivals.

As of October, hotels in the Philippines have recorded growth across all key performance indicators this year: occupancy (+1.1 percent to 68.2 percent), average daily rate (+1.0 percent to PHP 5,201.88), and revenue per available room (+2.1 percent to PHP 3548.80).

Demand increased 5.4 percent, while supply grew 4.3 percent. As of August 2016, the country’s total arrivals increased by 12.6 percent (4 million visitors) compared with the first eight months of 2015. South Korea, USA and China are the top three source markets for the Philippines’ tourism.

So far this year, Malaysia’s performance has been driven by occupancy (+3.7 percent to 63.8 percent), while ADR has also increased at a slighter pace (+0.8 percent to MYR 348.74), resulting in a 4.6 percent increase in RevPAR to MYR 222.39.

As the second most visited nation in the ASEAN (following Thailand) according to the UNWTO, Malaysia’s demand rose 7.1 percent year-to-date, more than double its rate of supply growth (+3.3 percent).

After welcoming 8.1 million visitors between January and October 2016 (according to the Vietnam Tourism Authority), Vietnam’s international arrivals increased 125.4 percent compared with the same time period last year. This was largely due to a major influx of Chinese visitors, accounting for roughly 27.6 percent of all arrivals.

An increase in the number of direct flights between Vietnam and China as well as other ASEAN countries has given this market a huge boost in tourism, contributing to a double-digit growth in RevPAR (+11.4 percent) for October 2016 year-to-date.

Indonesia’s hotel market is facing significant increases in supply. Since the start of the year, 54 new properties have opened, accounting for around 8,500 rooms. Most of these new properties are in the Upper Midscale class, while development in the Luxury and Upper Upscale classes has been more modest.

This appears to have impacted Indonesia’s ADR, which dropped 6.5 percent to IDR 1,017,745.69 for the first ten months of the year. Occupancy, however, increased 2.8 percent to 60.0 percent.

According to STR’s Pipeline Report for October 2016, about 4,200 rooms will be added to Sri Lanka’s hotel market over the next two to three years, with most of the projects located in Colombo.

The Luxury and Upper Upscale segments still dominate the nation’s hotel development, with 2,400 rooms currently in the pipeline.

Marriott International has the most projects in the pipeline, with four properties indevelopment under the brands of Sheraton, Marriott, and Ritz-Carlton.

After the opening of their first property in Hambantota, Shangri-La Hotels andResorts is now developing its second property in Colombo. Hyatt Hotel Corporation will join the scene with their flagship property, Grand HyattColombo, expected to open in 2018.

Mövenpick Hotels and Resorts will soon join the market with the addition of theMövenpick Hotel Colombo. Currently in the planning phase is InterContinental Hotel Group’s Crowne PlazaColombo Beira Lake.

Among initiatives to develop tourism and target 2.2 million tourists this year, an increase in the number of direct flights from countries in the Asia Pacific region, as well as discussions on an open sky policy could further drive air traffic to the country, the note said.

A new terminal in development at Colombo’s Bandaranike International Airport, could also increase the airport’s passenger capacity.