Nov 24, 2020 (LBO) – First Capital Research believes that CBSL will maintain the same policy stance in this monetary policy review, but given the concerns around economic growth, CBSL is likely to retain the monetary policy stance at accommodative.

At the last policy meeting held in Oct 2020, CBSL maintained its monetary policy stance, particularly as market lending rates are yet to reflect the full pass-through of policy easing measures implemented thus far.

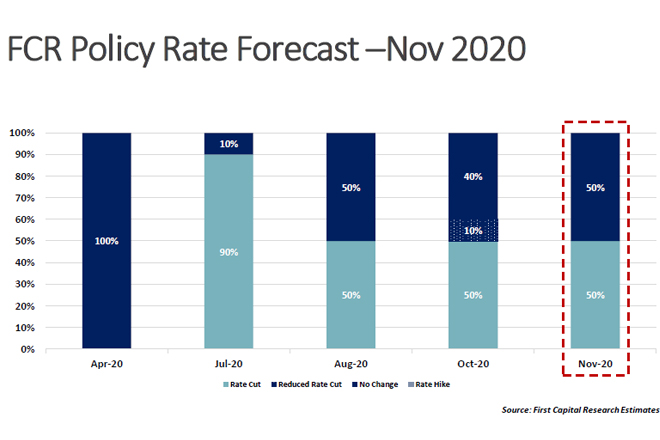

In line with the previous Pre-Policy report, First Capital Research maintain the same probabilities of 50% each for a rate cut and no change in rates.

"As per our view, CBSL either can choose to hold policy rates steady or cut by a 25 bps or 50 bps while, hike is off the table due to the lackluster economic growth," First Capital Research said.

"We believe that there is a 50% probability to hold rates due to improvement in high-frequency indicators. Moreover, there is a 25% probability for 25 bps and 50 bps respectively to support economic growth."

Considering the reduction of SRR by 300 bps in two instances to 2%, they expect SRR to remain unchanged at same levels.

Arguments against further relaxation in monetary policy

Improvement in high frequency indicators with surplus liquidity in the system

As a response to the measures taken by the Govt, private sector credit has improved to LKR 87.4Bn in Sep while the market liquidity has reached LKR 140.0Bn by 13th Nov indicating that there is surplus liquidity in the system. Moreover, the unemployment rate, which was at 5.

7% in the 1Q2020 has declined to 5.4% in the second quarter. These indicators suggest that economic activity has remained steady without much deterioration in the 2Q. Except the GDP growth numbers, where the 2Q2020 figures are yet to be seen, other indicators are signifying a recovery, inquiring the need of further policy easing at the upcoming review.

Extended Moratorium: A solution for grievances

Considering the encounters faced by the businesses and individuals due to the second wave of COVID-19, CBSL has extended the debt moratorium for another period of six months commencing from 01 Oct. 2020. We believe that the extension of moratorium is one of the relief packages offered by the CBSL for individual/businesses to revive their business activities.

Rock bottom Market Rates!!!

In response to previous monetary easing measures implemented by CBSL, to bring down costs of borrowing of businesses and households, both market deposit and lending rates adjusted notably so far during the year.

AWPR declined to historic lows in recent weeks, while banks’ lending rates also witnessed a downward adjustment in line with CBSL’s expectations. We believe that considering the recovery in the private credit and historic low levels in AWPR, there is no vital requirement for CBSL to provide a rate cut and to further bring down the market lending rates drastically.

Arguments for further relaxation in monetary policy

A thrust for Development: the need of the current government

First Capital Research estimates that Sri Lanka’s GDP would see its steepest contraction in history of -5.8% in 2020 following the unexpected contraction in 1Q GDP growth of -1.6% while 2Q GDP figures are yet to be seen. However, the current Govt.’s key drive is the development oriented economic growth which was spelled out through the Budget 2021 as well. Accordingly, Govt. plans to reach 6% and above GDP growth during the next 5 years commencing from 2021. As we believe a development-oriented budget coupled with further low interest rate environment can support the Govt.’s medium-term goals. Therefore, the need to accelerate the GDP growth can be considered as a major factor favouring, further policy easing at the upcoming review.

Access to less expensive domestic funding

It is reasonable to assume that Govt. is more focused on domestic funding to finance the budget deficit. This is reflected by the improved domestic to foreign debt ratio to 54:46 by end Jul 2020 from the previous 51:49 as at end of 2019. In the midst of limited access to the international financial markets, Govt. opt to rely more on domestic borrowings to finance the budget deficit and hence easing rates at the upcoming policy meeting results in reduced funding cost favouring the Govt

Yields heading north with auctions being undersubscribed

Despite the improved liquidity position, yields in the secondary market witnessed a slight increase with low activities as market participants followed a wait and see approach amidst the looming uncertainty. T-Bond auction on 12th Nov and T-Bill auction on 18th Nov were both undersubscribed by a considerable amount reflecting the lack of clarity of market participants with the given economic condition and COVID 19 impacts. We believe a rate cut would be a sweetener to sustain the yields at current low levels and to enhance the activities of the secondary bond market.