online pharmacy buy ciprodex with best prices today in the USA

2 percent year-on-year due to drought.

online pharmacy buy strattera with best prices today in the USA

online pharmacy buy abilify with best prices today in the USA

buy elavil online https://qpharmacorp.com/wp-content/uploads/2023/08/png/elavil.html no prescription pharmacy

"We believe inflation will be under control over the next 2-3 months while there could be some upward pressure towards September and beyond with the floods in May 2017 affecting the supply in the current growing season.

buy antabuse online https://qpharmacorp.com/wp-content/uploads/2023/08/png/antabuse.html no prescription pharmacy

online pharmacy buy celexa with best prices today in the USA

buy bactrim online https://www.northwestmed.net/wp-content/uploads/2022/08/png/bactrim.html no prescription pharmacy

As a result there could be possible supply side shortages towards September and beyond.

buy stromectol online https://www.northwestmed.net/wp-content/uploads/2022/08/png/stromectol.html no prescription pharmacy

" CCPI based headline inflation, decelerated on a YOY basis to 6.0% in May 2017 from 6.9% in April 2017, and CCPI based core inflation also decelerated to 5.

online pharmacy buy cymbalta with best prices today in the USA

online pharmacy buy diflucan with best prices today in the USA

buy keflex online https://www.northwestmed.net/wp-content/uploads/2022/08/png/keflex.html no prescription pharmacy

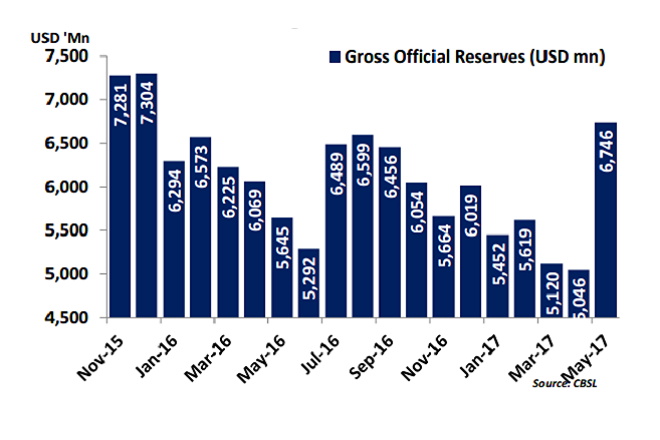

2% in May 2017 from 6.8% in April 2017. Sri Lanka's forex reserves rose to USD 6.8Bn in May 2017 from USD 5.0Bn in April, helped by a 1.5 billion dollar sovereign bond sale, 450 million dollar syndicated loan and dollar purchases by the central bank. "Foreign Reserves are now at comfortable levels," the note said.

buy vibramycin online https://qpharmacorp.com/wp-content/uploads/2023/08/png/vibramycin.html no prescription pharmacy

online pharmacy buy chloroquine with best prices today in the USA

Commenting on private sector credit growth, FC Research expects that the growth in private credit to descend towards around 18% to 20% from the current level of over 20%.

online pharmacy buy ivermectin with best prices today in the USA

"In spite of a high private sector credit figure in March 2017 we believe the usual credit slowness in the month of April will keep overall credit under check." During the last one-and half months the central bank also bought down its holding in Government Securities from LKR 300Bn to below LKR200Bn as at 19th June 2017. First Capital Research said there was a 85 percent probability rates would remain unchanged, and a 15 percent probability of a 25 basis point rate hike.

online pharmacy buy spiriva inhaler with best prices today in the USA

The Press Release on Monetary Policy Review is expected on Friday, 23 June at 7.30 am.