By Gayan Gunewardana:

The 2019 novel- Coronavirus (covid-19) outbreak, which originated in China has infected nearly 700,000 people globally till date. The impact has left businesses around the globe counting costs and more likely A global-recession would be a definite norm as per IMF’s projections. It’s a challenging task to gage the potential economic or the monitory impact at this moment on each industry, without clear understanding about the severity of this pandemic, extend or length of next phase etc. Even The International Monitory Fund drew the same conclusion in a 2017-study saying “There is no widely accepted, consistent methodology for estimating the economic impacts of pandemics”.

As most extensive indications include, a huge fall in stock market indexes, developing of low interest environment with Fed cut down the rates steeply and a number of governments have already announced the stimulus packages to overcome the economic and social mastery. Banks as prime lenders have a tough role to play to mitigate the economic impacts and particularly to support vital segments and SMEs. Bank of America Chairman/ CEO Brian Moynihan emphasized the role that banks are playing in the global “war” on coronavirus.

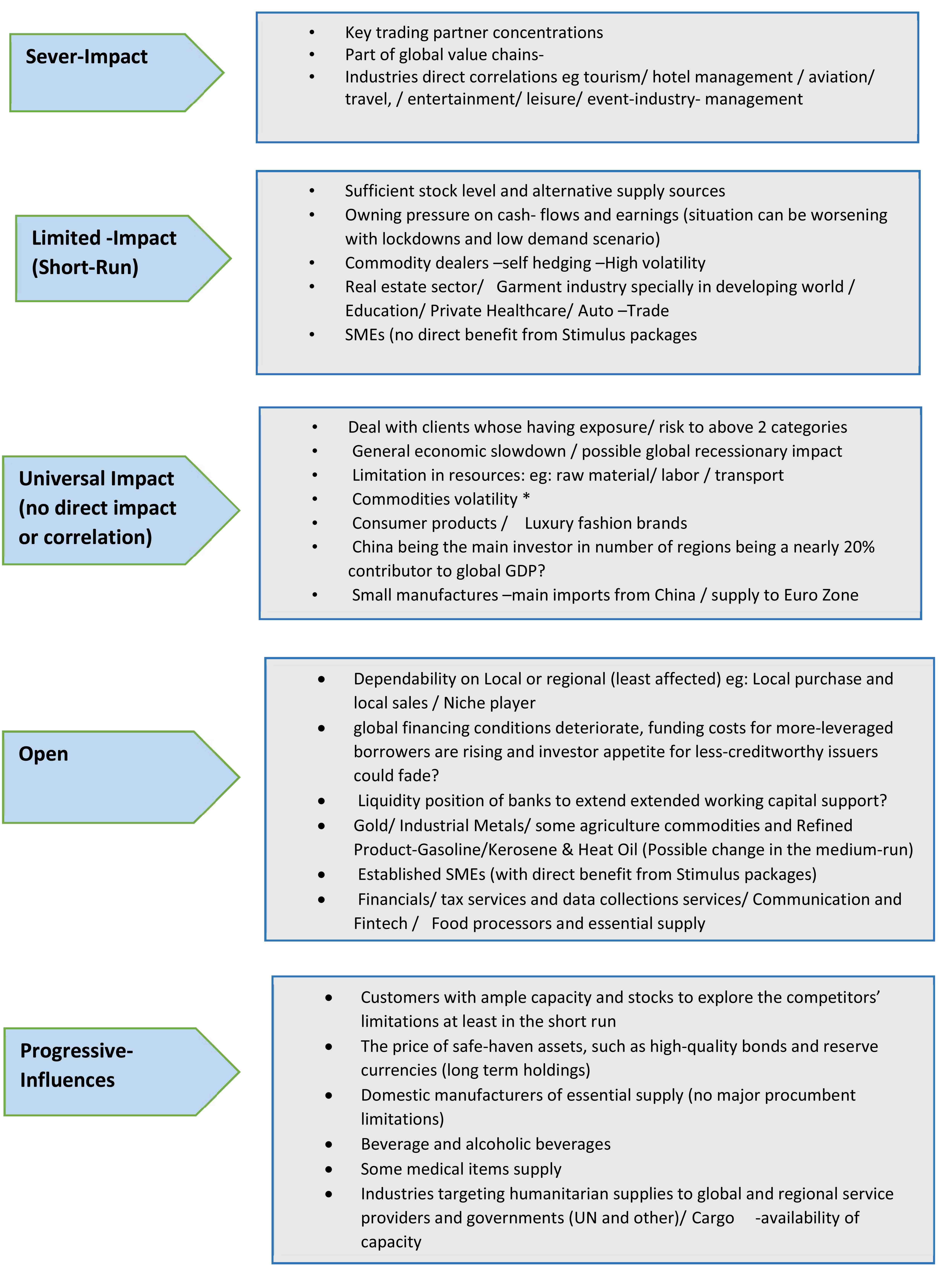

The modern bankers evaluate the (economic) viability of current risk appetite statements (RAS) and risk tolerance frameworks (RTF) through number of established techniques. Stressed-test based on scenarios defining around the potential virus spread and human reaction is a key modification. This predominantly appraise the capacity of maintaining the future exposure within risk tolerance levels. Analyzing the interaction between supply/ demand and associated impacts on macroeconomic factors would be particularly complex as there is no direct historical precedent in the modern times. A Business Impact -Analysis (BIA) is a process and tool that can be utilized to accomplish the organizational alignment of business priorities and to define responses towards critical issues. RAS changes can be recommend based on the outcome as the level of influences to the customers and business segments with the COVID-19 epidemic can be different/ dynamic and sever or really progressive. The influences however can be difficult to predict as the core capital and liquidity impacts have rapidly changed since the previous financial crisis situations. From a liquidity perspective, the simultaneous supply and demand shocks have stressed companies across industries, pushing them to draw on credit lines to support working capital and stockpile cash. Positively, most of the financial authorities have understood the situation well and reacted timely. Number of fiscal-stimulus steps/ Target –Economic- Support-System (TESS), low interest rate regimes, liquidity measures like payment holidays, extensions, and relaxation of capital rules were such positive answers. However, the bankers’ potential reaction shall be extremely critical for most of these segments to navigate through the associated modern market slowdown. As restraining credit or safety-first approach by lenders can easily lead to serious economic slowdown and stagnation further. Thus, from a credit perspective, banks should rapidly identify the most affected business sectors and customers to understand how they can be most supportive and to evaluate the dynamic risk environment. This will help to distribute the privileged economic benefits under TESS schemes more appropriately.

Banks have to identify critical modern challenges currently associated with COVID-ECONOMY swiftly. They have to offer a decent podium to the clients to operates by leveraging bank’s infrastructure and workforce, promote digital / virtual platforms and thirdly to control the frauds and information security risk on these actions. Continuous information sharing and customer engagements are paramount. In order to maintain a healthy loan book, banks should reevaluate the individual clients and related industries based on suitable framework. These findings can be unique. The BIA also shall help to modify RAS and also to estimate the level of future delinquencies, potential risk mitigating actions/ responses and even the long-term non-performing advances.

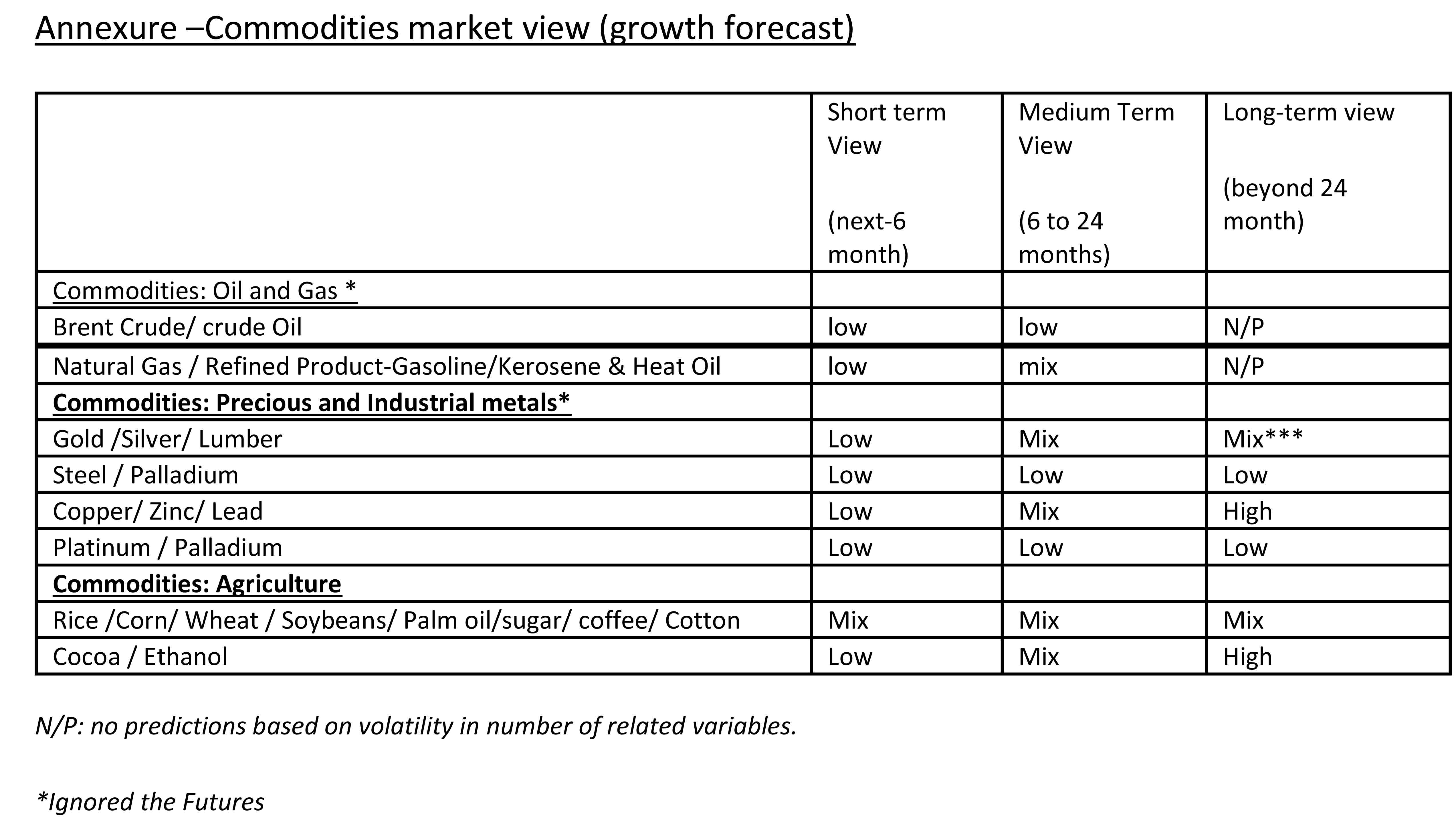

The framework can be used as a preliminary point for more specific Business Impact Analysis, which can be modified based on regional dynamic, government stimulus and responsive bank’s individual financial strength. The framework can incorporate three views based on time framework, short term view. Medium Term and Longer Short term view which is theoretically beyond 18/24 months and beyond Short term, is a spot combination of both demand/ supply and price (market outlook). Responses can be low, mix or High. The selected definitions for responses are, low (lower market demand and price/ oversupply) Mix (similes price/ steady or marginally low or high demand) High (Improved market demand/ possible signs of undersupply/ upward price pressure).

The industries with Severe- Impacts can be derived through three key parameters. Firstly, businesses/ segments, predominant depend over China/ Eurozone and other affected countries for procurement/ marketing’s eg: Pending shipment or shipment to be sent to these highly affected courtiers like South Korea, Japan, Italy, France, Germany, Spain, USA and Iran--are at risk (this is known as key trading partner concentrations). Secondly, part of global value chains- which has major value additions from these Covid-19 highly impacted nations/ regions (Impact can be reduced possibly with six billion dollars from the International Finance Corporation, the private sector arm of the World Bank to address supply chain issues in the medium run) eg: electronic industry, Indian pharma sector (over 80% ingredients are from China) and Thirdly, Industries which have direct correlations like tourism/ hotel management / aviation/ travel, / entertainment/ leisure/ event-industry- management. The second category represents the Industries which despite present vulnerability, display some level promise of recovery in the long run. Industries earlier had major supply from china & affected countries, though they also have sufficient inventory level/ buffer stock and some level of alternative supply sources eg India, Africa etc (quick revamp of the China supply can mitigate the impact to the moderate level). Others in this category include, clients with ongoing pressure on cash-flows and earnings (situation can be worsening with lockdowns and low demand scenario), Direct dependability on (non- essential) Consumer Spending (some retail could have major impact), Commodity dealers with selfhedging techniques and exposure to High volatility. The Real estate sector too exhibit the same futures. The Garment industry specially in developing world, Asian economies like Bangladesh, Sri lanka, Vietnam would exposure the raw material and other resources including human in the medium run. Private education, healthcare, auto trade and SME with no direct benefit from the stimulus packages make up for the other major segment under the captioned category.

The third category is high in number as these are almost all industries expose to the global slowdown through there is no identifying direct impact or coalitions. Category consist of deal with clients whose having exposure/ risk to above categories (indirect impact), exposure to general/regional economic slowdown and possible global recessionary impact and Limitation in resources: eg: raw material/ labor / transport. The Commodities volatility is interesting and worth discussing in different section. Few other industries in “Global sections” are, Suppler of Consumer products and Luxury fashion brands. On the other hand, China being the main investor in number of regions and being a nearly 20% contributor to global GDP? Any slowdown therein will have multiple impacts in connected economies. Small manufactures –main imports from China / supply to Euro Zone will have to find alternative channels/ regions to sustain. The fourth category where the impact is not yet clear and remain open till date due to number of reasons. The major considerations include, dependability exclusively on local or regional (least affected) eg: Local purchase and local sales / niche player? , As global financing conditions deteriorate, funding costs for more-leveraged borrowers are rising and investor appetite for less-creditworthy issuers could fade.?, Liquidity position of banks to extend extended working capital support?, Established SMEs (with direct benefit from Stimulus packages). Some industries in this category are Financials/ tax services and data collections services, Food processors and essential supply. The final segment represents the “salient economic beneficiaries” due to various reasons. Customers with ample capacity and stocks to explore the competitors’ limitations at least in the short run is a good example. The price of safe-haven assets, such as high-quality bonds and reserve currencies (long term holdings), domestic manufacturers of essential supply (no major procumbent limitations), communication and fintech, Beverage and alcoholic beverages, some medical items supply are few beneficiaries. Industries targeting humanitarian supplies to global and regional service providers and governments (UN and other) and finally inbound and outbound Cargo with adequate capacity are expect to perform all times.

The commodity market projections are extremely challenging and exciting in view of the massive downward pressure since the mid of the crisis. In case of Oil and gas, the predictions beyond medium term is extremely challenging. Both Brent -Crude and Crude -oil expect to perform moderately in the medium run even with the assumption that major Oil producing-nations agree for production cut. Natural- gas and Refined Product-Gasoline/Kerosene & Heat Oil could perform better or mix when major nations are heading toward the winter seasons’ demands. In case of precious and Industrial metals, Gold has the potentiality to improve demand in the medium to long run. Silver and Copper too may follow the same trend through as per long term projections, steel being the core industrial metal expect to perform poorly due to sizable industrialized slowdown. The most promising outlook can be predicted on the agriculture commodities. Rice, corn, wheat, soybeans, Palm-oil, sugar, coffee, cocoa all expect to attract strong market demand and strong pricing both in the medium and long run as globe is heading towards some level of core food-scarcity. Ethanol, however has showed a strong demand in the medium run as a result of raw martial to number of demanding industries.

The key highlights of the proposed BIA summarized below:

By Gayan Gunewardana (BSc/MScC/CGMA/FRM)

Independent Researchers and banking Adviser-Middle East