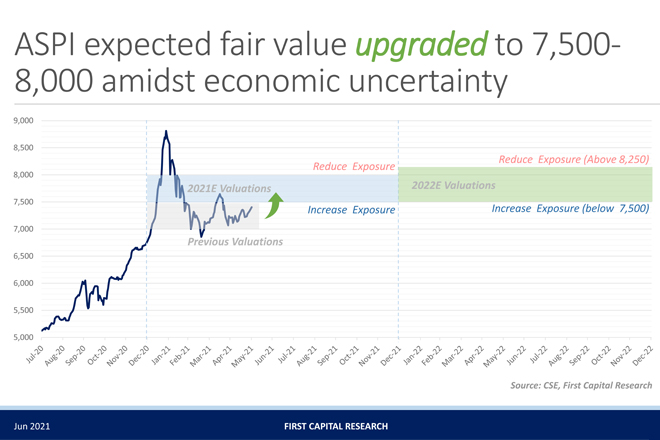

Considering the fact that the market has already reached the 7,500 range, First Capital Research (FCR) recommends investors hold on to the equity allocation and begin exiting beyond 8,000.

“Despite the significant risk in the system due to the uncertain economic environment, the higher liquidity in the system, and cheaper valuations due to healthy earnings, we are upgrading the ASPI fair value for 2021E to a range of 7,500-8,000 from our previous range of 7,000-7,500,” First Capital Research said in its latest equity strategy.

“It amounts to a market return of +18% for 2021E, despite valuations been downgraded to a PER of 12.0x 12.5x (previous 14.0x 14.5x) considering the risks to the economy.”

First Capital Research is maintaining an expanded range for 2022E of 7,500-8,250 with a note of caution.

Is rising interest rates a risk for equity?

First Capital Research: YES. Rising interest rates could be considered as a significant risk for the equity market. However, though we have already witnessed an uptrend in yields, the uptrend has been slow, due to the continuous maintenance of the liquidity position in the money market fueled by the rise in CBSL Holdings.

This trend is likely to continue as the government continuously falls short of the revenue targets leading to money printing measures. Government further revised its already high budget deficit upwards to 9.5% of GDP but is most likely to reach a double digit deficit similar to 2020 amidst the continued infrastructure spending and additional unplanned spending required due to the 3rd Covid Wave.

Therefore, due to the risk in the system the rise in interest rates are likely to continue but at a much slower pace which is unlikely to impact the equity market.

However, investors should be mindful of the economic uncertainty and high foreign debt repayment which could lead to a sudden shock/black swan event in the medium term.