Feb 19, 2020 (LBO) – With the recovery in economic activity and company earnings, First Capital Research (FCR) expects an upward trend in the capital market supported by stronger market multiples.

Launching the Strategy Report 2020, Head of Research at the First Capital Holdings, Dimantha Mathew said that the heavy tax cuts and the policy rate cut is likely to be an added boost for company earnings.

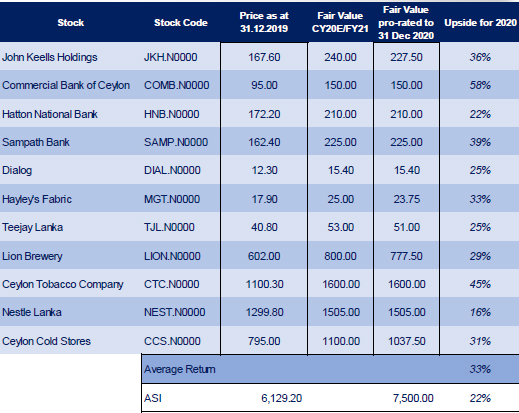

"Considering the mid-term positive impact, we upgrade our equity exposure to 100% while maintaining our ASPI expectations for Jun 2020 at 6,500, assuming Market PER to be in the range of 8.5x – 9.5x," he said.

"However, we upgrade our ASPI target for Dec 2020 to 7,500 from the previous 7,000 amidst the added boost to the economy,"

In previous years, First Capital Research recommended investors only to invest a portion of the funds targeted towards equity investments while maintaining a cash allocation.

"However, considering the attractiveness of the market we recommend investors invest 100% or fully invest the equity allocated funds into the portfolio."

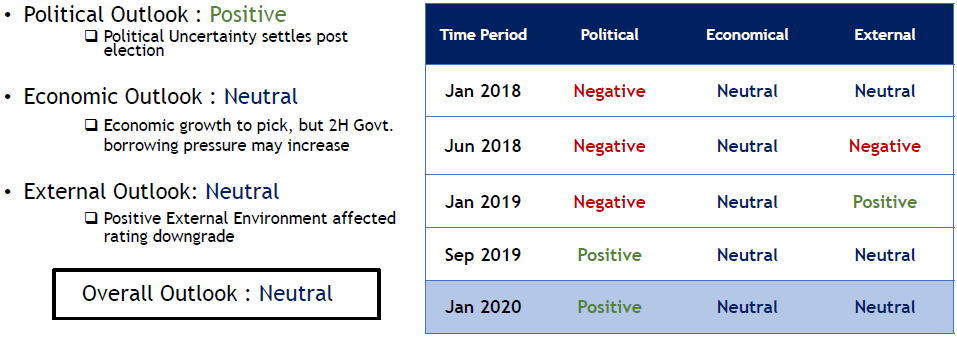

Following the Presidential elections and appointment of the new Cabinet, the Political uncertainty which prevailed for an extended duration has eased providing stability and policy certainty for investors.

It has also given a major boost to business confidence as the LMD-Nielsen business confidence index jumps to a 51-month high of 186 for Dec 2019.

On 27th Nov 2019, Government announced hefty tax reliefs including reducing VAT to 8% (from 15%), abolishing NBT and revising PAYE tax with the expectation of increasing the consumer spending while boosting the economic growth of the country.

As an extension to the stimulus package, Govt. took measures to remove DRL on banks and NBFIs and revise downwards the corporate tax rates across all sectors.

Further, supporting Govt.’s efforts to revive growth CBSL on 30th Jan took to cut policy rates by 50bps despite credit growth accelerating in Nov and Dec 2019.

"With the potentially stable external environment, we expect the USD/LKR rate to remain stable in the 1H2020," he said.

"As consumer demand accelerates towards 2H, we expect to witness a possible weakness in the currency."