Fitch Ratings’ ‘deteriorating’ 2023 sector outlook for global sovereigns reflects weaker global economic growth, rising funding costs and pressures from high inflation. The overall balance of sovereign rating outlooks is near to its long-term average, but further monetary policy tightening and elevated geopolitical tensions represent key challenges this year.

Five of eight sovereign regions have ‘deteriorating’ sector outlooks – North America, western Europe, emerging Europe, sub-Saharan Africa (SSA) and APAC. These indicate that underlying sovereign credit conditions will be less supportive over the coming year than in 2022. The fiscal benefit of inflation on government revenues and nominal growth will fade as spending pressures mount, with higher interest rates pushing up debt service costs and dragging on growth. Weaker growth in the US and the eurozone will weigh on other regions.

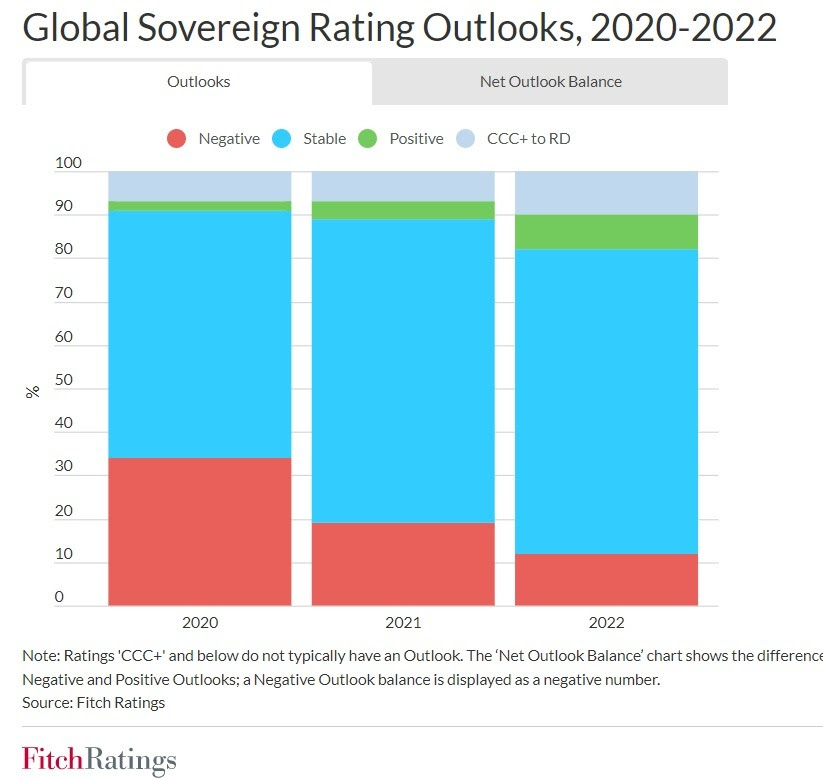

Nevertheless, the shares of our global sovereign portfolio on Negative and Positive Outlook are near their long-term averages of 15% and 10%, respectively. The net Outlook balance is negative at minus four, but has recovered since the onset of the Covid-19 pandemic triggered widespread sovereign rating pressures in 1H20.

This is partly because several Outlooks have been stabilised following the pandemic, often but not always below their pre-pandemic levels, and because the share of sovereigns rated ‘CCC+’ to ‘RD’, where Outlooks are not typically assigned, has risen. The strong post-Covid rebound in economic growth and tax revenues persisted well into 2H22, creating additional fiscal space for some policy measures to offset spillovers from Russia’s invasion of Ukraine.

Sovereigns will have to navigate challenging conditions in 2023. Still-high geopolitical risks mean policy decisions might be guided by non-economic considerations, leading to sub-optimal trade and investment outcomes. Tighter global monetary policy could expose risks that were hidden while central banks kept borrowing costs low.

Accessing international bond markets will remain challenging for some smaller emerging markets (EMs), but this is reflected in already low sovereign ratings (2022 saw the second-highest number of EM downgrades in a single year behind 2020).

Higher ratings are generally more resilient to shocks and policy-induced deviations in their credit profiles, but investment-grade sovereigns account for about two-thirds of Negative Outlooks, and the global net Outlook balance was stronger for EMs than for developed market (DM) sovereigns at end-2022. This is because discretionary policy responses to higher energy prices are more prevalent among DM and higher-rated sovereigns.

Regionally, net Outlook balances range from minus four in emerging Europe to plus one in both the Middle East and North Africa and SSA. Emerging Europe is the only region where the balance became more negative in 2022. This region is highly exposed to Russia-Ukraine spillovers, and although prospects for gas rationing have receded, the energy crisis and a weaker eurozone economy will feed into slower growth, pressuring public finances alongside higher local-currency funding costs. Weaker growth and fiscal prospects stemming from the energy crisis are important factors in western Europe’s minus two Outlook balance.

SSA’s positive net balance follows Kenya’s downgrade to ‘B’/Stable from ‘B+’/Negative last month, but the region has the highest proportion of sovereigns rated ‘CCC+’ to ‘RD’ (26%).

MENA is the only other region with a positive net Outlook balance and is one of three with ‘neutral’ sector outlooks, as hydrocarbon exporters should mostly benefit from another year of fiscal and external surpluses.

Greater China and Latin America also have ‘neutral’ sovereign sector outlooks, and both have net balances of zero. Sino-US tensions are a risk factors to watch in Greater China, and domestic political uncertainty is a risk for several Latin American sovereigns, although proactive monetary tightening, steady external buffers and flexible exchange rates should generally support sovereign creditworthiness in the region.