Jun 14, 2018 (LBO) – Fitch Ratings says finance companies rated by them are unlikely to face immediate rating action, as they believe all have adequate capital to meet the thresholds that will apply from 1 July 2018.

Even after taking account of potential RWA changes, based on the current asset mix - and most already comply with the 1 July 2021 thresholds, Fitch Ratings said.

“However, future rating action will take into account finance companies' ability to meet the higher minimum requirements over the next few years,” Fitch Ratings said.

“It is possible that some will require external capital to support loan growth and stay in compliance with the higher requirements.”

Fitch Ratings, however, said new capital-adequacy regulations for Sri Lankan finance companies are likely to improve the resilience of the sector to economic shocks, but will add to capitalisation pressures - particularly for the country's numerous small-scale finance companies.

“Smaller finance companies had already been struggling to raise capital to comply with an earlier requirement that each finance company hold a minimum core capital of LKR2.5 billion by 1 January 2021,” Fitch Ratings said.

“The new minimum capital ratios are likely to add to those difficulties, although the lack of regular disclosures compared with banks prevents us from assessing in full the likely impact on individual finance companies.”

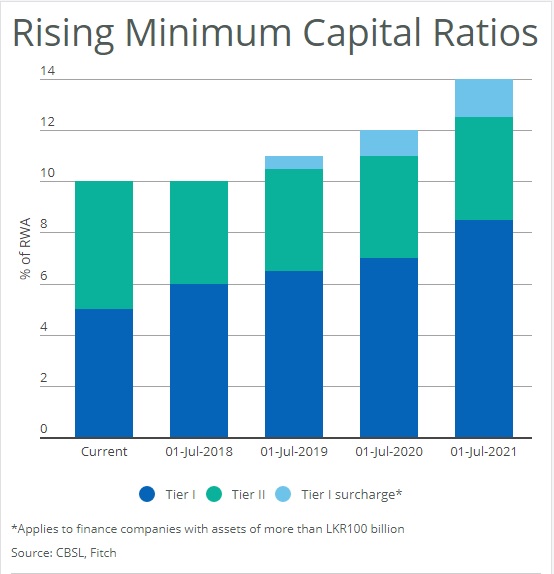

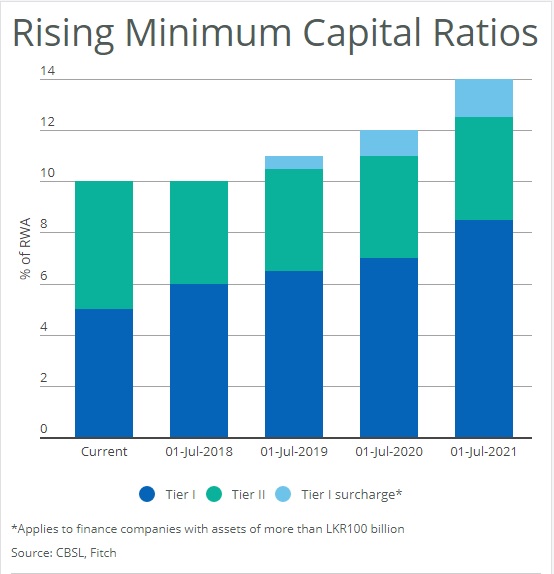

The minimum Tier 1 ratio will increase from 5 percent to 6 percent for all finance companies on 1 July 2018, and then rise to 8.5 percent by 1 July 2021, with incremental increases each year.

The minimum total capital ratio will also increase steadily. Additional capital surcharges for finance companies with assets of more than LKR100 billion will be introduced on a staggered basis from 1 July 2019 and will reach 150bp by 1 July 2021.

Capital ratios will come under downward pressure from changes to the calculation of risk-weighted assets (RWAs) to bring the framework further into line with the recommendations of the Basel committee, Fitch Ratings added.

buy orlistat online

buy orlistat online no prescription

The document setting out the new capital regulations categorises finance companies with more than LKR100 billion - those facing the additional surcharge - as "domestic systemically important licensed finance companies (D-SILFCs)".

“However, we do not believe that this means the authorities consider these companies to have the same systemic importance as "domestic systemically important banks (D-SIBs),”

“Accordingly, we continue to see the propensity for sovereign support for Fitch-rated finance companies as very low.”