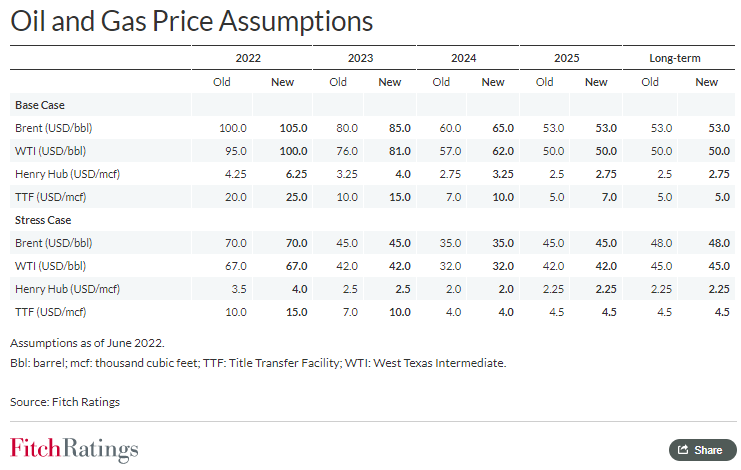

Fitch Ratings has increased its oil and gas price assumptions due to trade flows disruptions and redirection and higher post-pandemic demand.

Fitch Ratings Content:

Our raised oil price assumptions reflect disruptions of established supply channels and growing oil demand. The EU has banned seaborn imports from Russia, so it will have to replace about a third of all oil imports with supplies from other regions, while larger volumes of Russian oil will go to India and China. However, the use of spare capacity and trade flows redirection will eventually reduce the pressure on global oil supply, so we expect the prices to moderate. Our long-term oil price assumptions are unchanged.

We have also increased our European TTF gas price assumptions for 2022-2025. The EU aims to reduce its dependency on Russian gas supplies mainly by increasing the supplies of liquefied natural gas (LNG) in the short term. Prices will be further underpinned by physical gas supply disruptions and Russia’s demand for payments in Russian roubles, where a refusal could halt supplies. However, the Russian supply crisis has accelerated the energy transition in Europe, so we have kept our long-term European gas price assumptions unchanged.

We have increased all assumptions for the US Henry Hub benchmark, reflecting higher demand, primarily driven by the growing LNG export capacity. US natural gas production growth has been modest so far, despite significantly increased spot prices, as producers have been focusing on maximising free cash flow.

buy lasix online buy lasix online no prescription

There are many large LNG facilities in the US that are close to final investment decisions, which, once obtained, will drive long-term demand for natural gas.