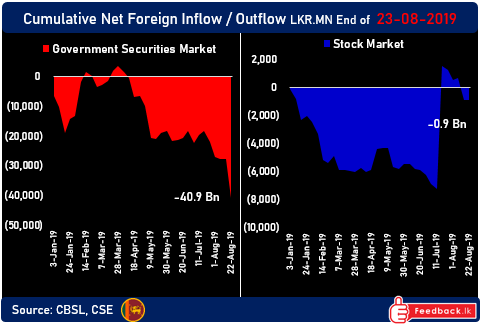

August 24, 2019 (LBO) - The 2018-2019 foreign exodus from Sri Lanka's government bond markets has picked up speed in recent weeks with total net outflows for the 2018-2019 period now totalling over Rs200bn (US$1.1bn).

In the last week alone foreign institutions withdrew a net US$72mn from Sri Lanka's treasury bond markets amid a second significant rate cut by Sri Lanka's Central Bank. Rate cuts from the CBSL lead to reductions of interest rates on government securities making them less attractive to foreign investors.

With a mere Rs123bn (US$700mn) of foreign institutional investor holdings in Sri Lanka's government bond market, there is not much left to flow out. The Governor of the CBSL Indrajit Coomaraswamy has been on record saying that even if all remaining foreign funds flow out, the CBSL is prepared to handle it.

The foreign outflows have caused pressure on the Sri Lanka Rupee (LKR) with the currency sitting close to Rs180/US$. The LKR's all time low is approximately Rs183/US$. The CBSL has disclosed that they have been intervening in the currency markets in recent days to stabilise the currency.

buy diflucan online buy diflucan online no prescription

The outflows from the Sri Lankan bond markets have come as a surprise to policy makers as the budget had forecast over a billion dollars of inflows for 2019. Despite inflows not materialising, Sri Lanka has been able to prop up their foreign reserves with sovereign bond offerings. Reserves stood at US$8.3bn as of the end of July.

United States president Donald Trump's trade war and a US Federal Reserve policy shift have caused unexpected distortions in markets worldwide. With Sri Lanka having its own internal political and terrorist issues, 2019 has been a year of tumult. Despite all these issues, the CBSL is still forecasting positive growth for the year and a recovery in 2020.