June 24, 2019 (LBO) - Sri Lanka is set to tap the credit markets for the second time this year. A sovereign bond is to be floated at interest rates that are even more attractive than the recent US$2.5bn issuance in March.

Timing is good. Interest rates in the United States have sharply dropped in recent weeks as the U.

S. Federal Reserve has softened its monetary policy outlook. Bonds throughout the world are rallying as markets adapt to the the new global interest rate backdrop.

If the current prudent management of monetary policy continues, Sri Lanka should be able to get this sovereign bond offering done, and secure its foreign reserve position for the next few years.

It is fascinating how Sri Lanka finds itself in such a stable position after going through an economic downturn, constitutional crisis, political uncertainty ahead of impending elections, racial and religious tensions, and one of the worst global acts of terrorism in recent history.

The Sri Lankan economy has taken all these hits, but after the sovereign bond offering, the country's economy will find itself with one of the most solid foundations in recent memory. Despite much fear mongering, there are no indications of any Sri Lankan debt or currency crises on the horizon. With the upcoming bond offering all but done, those storms have passed. The resilience of the Sri Lankan economy in the face of countless shocks never ceases to amaze.

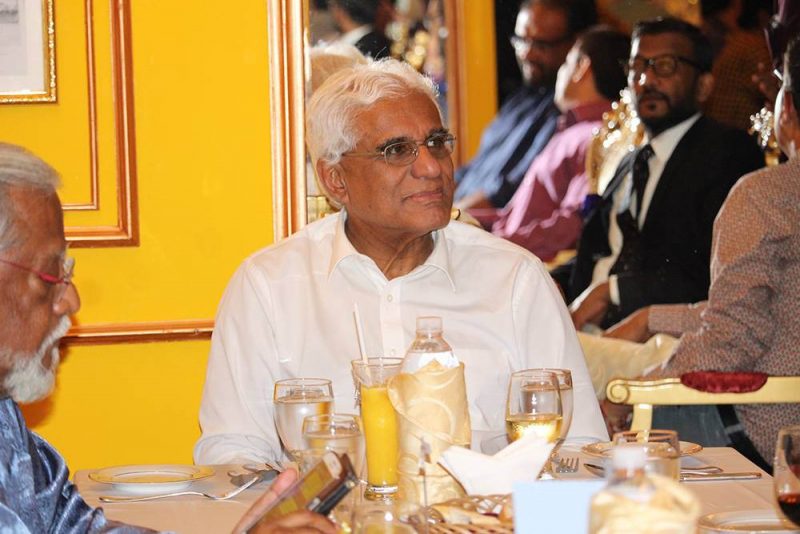

Credit should go to where credit is due. Governor Indrajit Coomaraswamy and the Central Bank of Sri Lanka (CBSL) have done yeoman's service to the nation in keeping her economy on solid footing.

Without a doubt the economy is weak. Growth for 2019 is likely to be the lowest in recent history with estimates of GDP growth at less than 3%. However, considering the backdrop in which the CBSL has had to operate, the performance is not at all that bad.

The CBSL can't control politics. Neither can it control security, or global economic volatility. What the CBSL can manage are interest rates, money supply, currency volatility, debt management, and regulation of financial institutions. They have managed these aspects very well.

The CBSL has done its job. The economy has a strong foundation on which to build. They are now relaxing monetary policy in order to help drive economic growth. Now it's up to the political leadership to get its act together and get the economy going.