Life Insurers are expected to benefit from rising interest rates due to the higher investment returns as asset allocation in Life Insurance is skewed towards fixed income earning assets, First Capital Research said in a report.

According to the Insurance Sector Report 2021, Govt. securities represents the main investment due to the regulatory requirement to invest minimum of 30% of the life fund assets.

Balance of the fund after investing minimum 30% can be invested in other investments, subjected to a particular threshold.

During the last 07 years change in Insurance Contract Liabilities has shown a negative correlation with the 05 Yr Avg. T bond rate.

"Insurance companies which own larger Life Insurance funds are expected to benefit from rising interest rates due to potentially lower transfer to Insurance contract liabilities," First Capital Research said.

"Ceylinco Insurance PLC having the largest Insurance fund among the Listed Life Insurance sector players are expected to benefit from rising interest rates due to possible surplus gains."

Moreover, escalation in interest rates are expected to improve Insurers’ Risk Based Capital ratios through improved earnings.

In the midst of the COVID-19 pandemic, Life Insurers have also seen higher demand as the pandemic caused more people to reconsider Health Insurance needs coupled with Life Insurance.

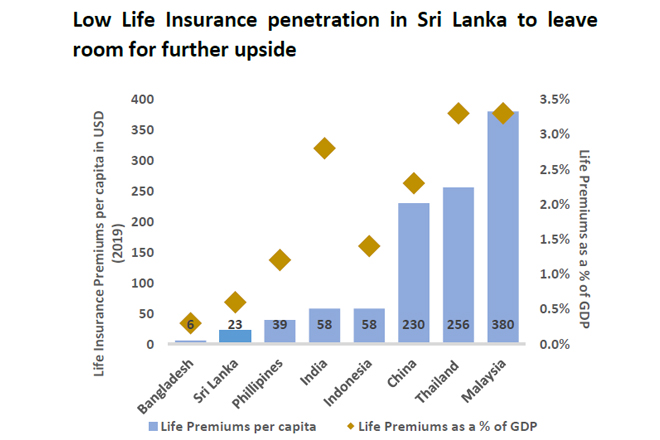

"We believe that increased awareness in post-pandemic to augur well with low penetration in Sri Lanka," the firm said.

buy zithromax online buy zithromax online no prescription

"Being a country largely characterized by the collectivism and dependency where the need for a Life Insurance is yet to realized, industry in Sri Lanka still remains underpenetrated compared to regional peers."

Among Asian countries, Sri Lanka is expected to clock a growth of 20% in 2021 as Sri Lanka’s Insurance market is still one of the least developed in the region.

Insurance industry in Sri Lanka is still at an early stage of the life cycle despite the growth momentum in recent times.

Full Report

Press-Release-Insurance-Sector-Report-2021-Jun-2021