Sri Lanka Budget 2019: Overview of key taxation proposals

Mar 06, 2019 (LBO) – Sri Lanka’s budget 2019 estimates total revenue and grants of 2,464 billion rupees against a total estimated expenditure of 3,149 billion rupees.

The resulting budget deficit of 685 billion rupees is expected to be financed by foreign financing of 55 billion rupees and domestic financing of 630 billion rupees.

All income tax proposals will be effective from 01 April 2019 while VAT, NBT, and ESC will be effective from 01 June 2019. Duties and fiscal levies on imports, however, will be effective from today.

Income tax proposals include new exemptions introduced on sovereign bonds, including Sri Lanka Development Bonds.

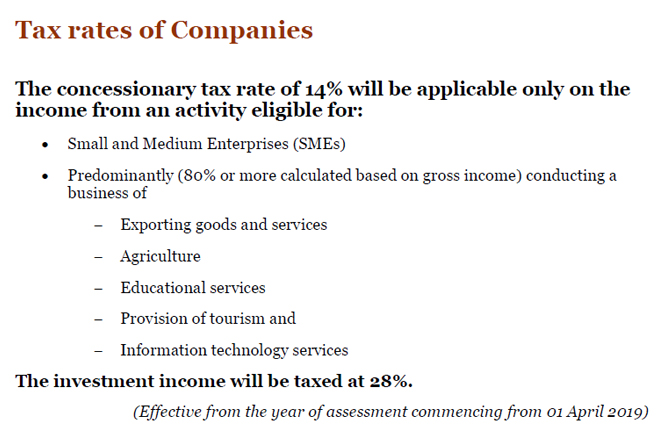

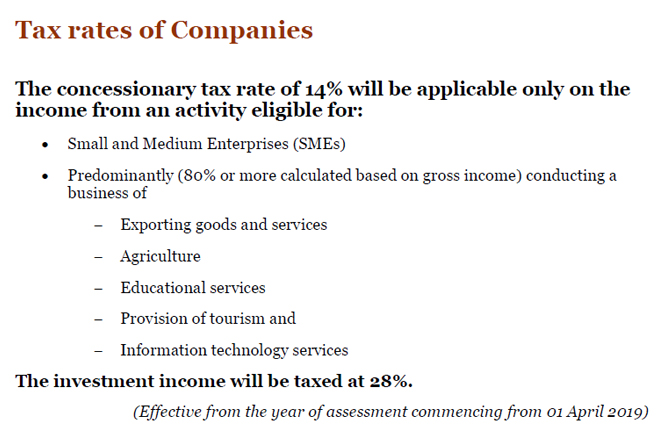

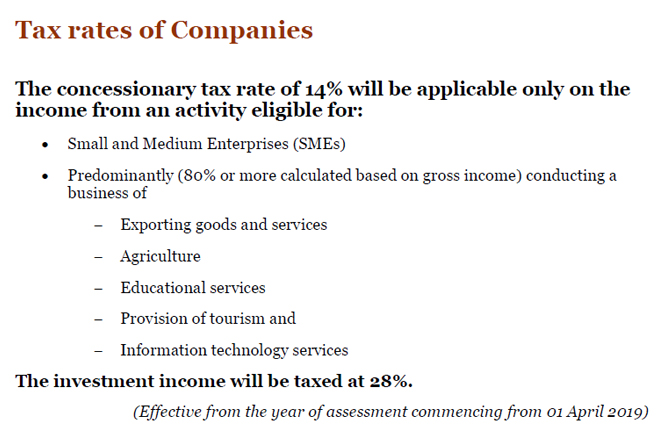

Investment income of a company eligible for a concessionary rate of 14 percent is to be taxed at 28 percent.

The concessionary rate of 14 percent is granted under the IR Act for companies predominantly conducting specified businesses.

Predominantly means 80 percent or more calculated based on gross income and the gross income to be defined as the total income excluding the investment income.

The concessionary tax rate of 14 percent is to be applied only on the income from an activity eligible for the concessionary tax rate. The investment income, however, is to be liable for tax at 28 percent.

VAT imposed on condominium housing units to be implemented with effect from 1 April 2019.

Accordingly, exemptions will be removed for the supply of condominium housing units where the deed of agreement relating to such supply is not executed prior to 01 April 2019.

Main construction contractor is to be exempt from NBT on infrastructure projects. NBT exemption on manufacturing cigarettes is to be removed.

The current exemption from NBT on the importation of rough unprocessed gemstones for re-export after cutting and polishing would be restricted to the lapidary service providers registered under the Gem & Jewellery Authority.

Sri Lanka Tourism Development Authority (SLTDA) registered tourist hotels would be exempt from NBT on foreign currency receipts.

Turnover from the export of goods or services is to be eligible for a concessionary rate of 0.25 percent Economic Service Charge.

PAL on the tourism sector and local manufacturing industry (specified HS codes) reduced to 2.5 percent. International Telecommunication Operators Levy is to be removed.

Betting and Gaming Levy rate will be increased to 15 percent. Passport fee will also be revised. Tax Incentives have been proposed for IT firms, other existing businesses and for large scale projects.

Luxury tax on motor vehicles will be imposed on the CIF value or the manufacturer’s price.

Click here for the detailed taxation proposals provided by the PwC Sri Lanka.

Download Full Budget Speech