buy lasix online buy lasix online no prescription

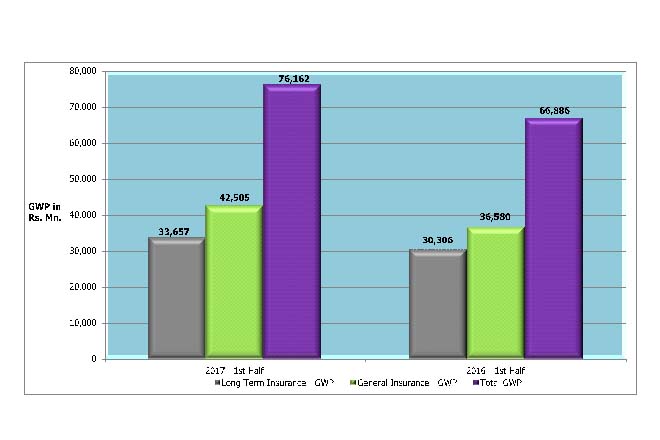

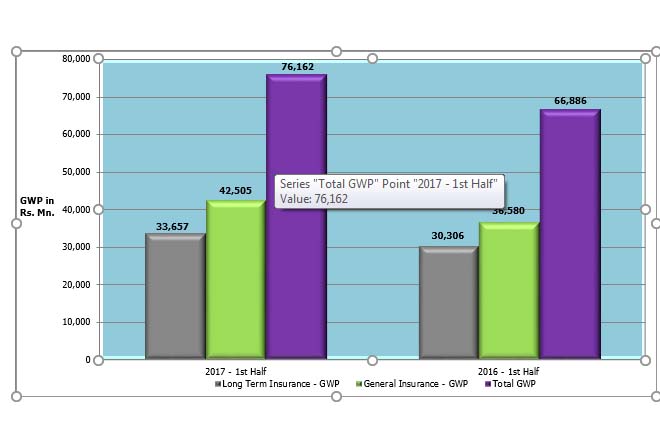

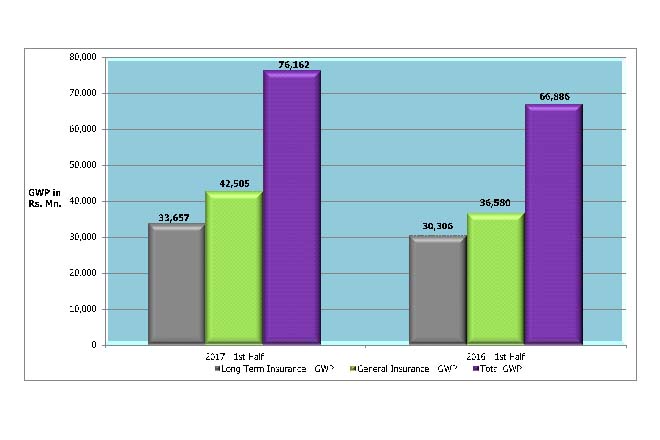

06% and 16.20% respectively when compared to the corresponding period of year 2016.

Total Assets

Total Assets of insurance companies have increased to Rs. 533,075 million as at 30th June 2017 when compared to Rs. 478,427 million recorded as at 30th June 2016, reflecting a growth of 11.42%. The assets of Long Term Insurance Business amounted to Rs. 375,159 million (1st Half 2016: Rs. 323,604 million) indicating a growth rate of 15.93% year-on-year. The assets of General Insurance Business amounted to Rs. 157,915 million (1st Half 2016: Rs. 154,823 million) depicting a growth rate of 2.00%, at the end of first six months of 2017.

Total Assets

Total Assets of insurance companies have increased to Rs. 533,075 million as at 30th June 2017 when compared to Rs. 478,427 million recorded as at 30th June 2016, reflecting a growth of 11.42%. The assets of Long Term Insurance Business amounted to Rs. 375,159 million (1st Half 2016: Rs. 323,604 million) indicating a growth rate of 15.93% year-on-year. The assets of General Insurance Business amounted to Rs. 157,915 million (1st Half 2016: Rs. 154,823 million) depicting a growth rate of 2.00%, at the end of first six months of 2017.

Investment in Government Securities

At the end of first six months of 2017, investment in Government Debt Securities amounted to Rs. 175,627 million representing 46.81% (1st Half 2016: Rs. 158,239; 48.90%) of the total assets of Long Term Insurance Business, while such investment compared to the total assets of General Insurance Business amounted to Rs. 30,933 million representing 19.59% (1st Half 2016: Rs. 31,986; 20.66%). Accordingly, the total investment of assets of both Technical Reserve of General Insurance Business and Long Term Insurance Fund of the Life Insurance Business amounted to Rs. 206,560 million representing 38.75% (1st Half 2016: Rs. 190,224; 39.76%) of the total assets as at 30th June 2017.

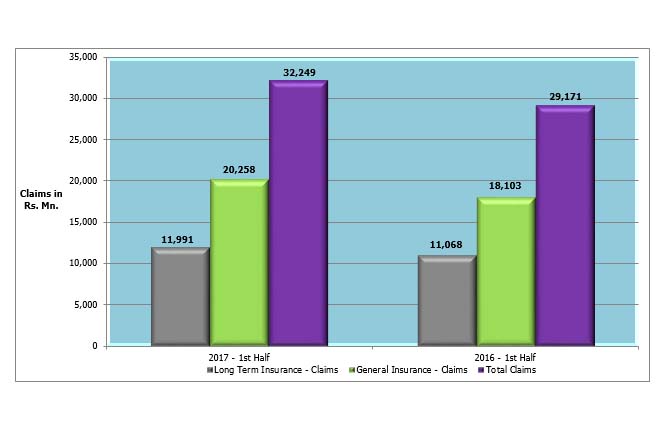

Claims incurred by Insurance Companies

The claims incurred by insurance companies in both Long Term Insurance Business and General Insurance Business was Rs. 32,249 million (1st Half 2016: Rs. 29,171 million) showing an increase in total claims amount by 10.55% year-on-year. The Long Term Insurance claims, including maturity and death benefits, amounted to Rs. 11,991 million (1st Half 2016: Rs. 11,068 million). The claims incurred in General Insurance Business, including Motor, Fire, Marine and other categories, amounted to Rs. 20,258 million (1st Half 2016: Rs. 18,103 million). Hence, during the first half 2017, there is an increase in claims incurred by 8.34% and 11.91% for Long Term Insurance and General Insurance Businesses respectively, when compared to the corresponding period of year 2016.

Investment in Government Securities

At the end of first six months of 2017, investment in Government Debt Securities amounted to Rs. 175,627 million representing 46.81% (1st Half 2016: Rs. 158,239; 48.90%) of the total assets of Long Term Insurance Business, while such investment compared to the total assets of General Insurance Business amounted to Rs. 30,933 million representing 19.59% (1st Half 2016: Rs. 31,986; 20.66%). Accordingly, the total investment of assets of both Technical Reserve of General Insurance Business and Long Term Insurance Fund of the Life Insurance Business amounted to Rs. 206,560 million representing 38.75% (1st Half 2016: Rs. 190,224; 39.76%) of the total assets as at 30th June 2017.

Claims incurred by Insurance Companies

The claims incurred by insurance companies in both Long Term Insurance Business and General Insurance Business was Rs. 32,249 million (1st Half 2016: Rs. 29,171 million) showing an increase in total claims amount by 10.55% year-on-year. The Long Term Insurance claims, including maturity and death benefits, amounted to Rs. 11,991 million (1st Half 2016: Rs. 11,068 million). The claims incurred in General Insurance Business, including Motor, Fire, Marine and other categories, amounted to Rs. 20,258 million (1st Half 2016: Rs. 18,103 million). Hence, during the first half 2017, there is an increase in claims incurred by 8.34% and 11.91% for Long Term Insurance and General Insurance Businesses respectively, when compared to the corresponding period of year 2016.

Profit (Before Tax) of Insurance Companies

The profit (before tax) of insurance companies in both Long Term Insurance Business and General Insurance Business has decreased to Rs. 4,660 million (1st Half 2016: Rs. 5,259 million) showing a negative growth rate of 11.38%. The profit (before tax) of Long Term Insurance Business amounted to Rs. 738 million (1st Half 2016: Rs. 3,434 million) while the profit (before tax) of General Insurance Business amounted to Rs. 3,922 million (1st Half 2016: Rs. 1,825 million) during the first half of 2017. Thus, profit (before tax) of Long Term Insurance Business witnessed a negative growth rate of 78.5% whereas the General Insurance Business witnessed a positive growth of 114.9%, when compared to the corresponding period of year 2016. The main reason for negative growth rate of profit (before tax) of Long Term Insurance Business was the loss of Rs.2,260 million recorded by Sri Lanka Insurance Corporation (SLIC) for the quarter ended 30th June 2017.

Profit (Before Tax) of Insurance Companies

The profit (before tax) of insurance companies in both Long Term Insurance Business and General Insurance Business has decreased to Rs. 4,660 million (1st Half 2016: Rs. 5,259 million) showing a negative growth rate of 11.38%. The profit (before tax) of Long Term Insurance Business amounted to Rs. 738 million (1st Half 2016: Rs. 3,434 million) while the profit (before tax) of General Insurance Business amounted to Rs. 3,922 million (1st Half 2016: Rs. 1,825 million) during the first half of 2017. Thus, profit (before tax) of Long Term Insurance Business witnessed a negative growth rate of 78.5% whereas the General Insurance Business witnessed a positive growth of 114.9%, when compared to the corresponding period of year 2016. The main reason for negative growth rate of profit (before tax) of Long Term Insurance Business was the loss of Rs.2,260 million recorded by Sri Lanka Insurance Corporation (SLIC) for the quarter ended 30th June 2017.