buy chloroquine online https://qpharmacorp.com/wp-content/uploads/2023/08/png/chloroquine.html no prescription pharmacy

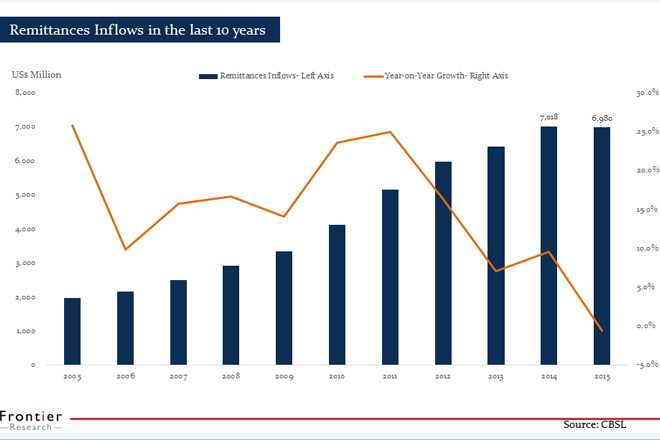

2015 remittance inflows have contracted 0.

buy abilify online https://qpharmacorp.com/wp-content/uploads/2023/08/png/abilify.html no prescription pharmacy

online pharmacy buy flexeril with best prices today in the USA

5 percent against the previous year, Frontier Research said.

online pharmacy buy diflucan with best prices today in the USA

In 2014 remittances grew around 9.5 percent, which followed 7 percent growth in 2013.

online pharmacy buy cipro with best prices today in the USA

In 2011 inward remittances grew 25 percent.

buy symbicort online https://www.scottsdaleweightloss.com/wp-content/uploads/2022/08/png/symbicort.html no prescription pharmacy

“But remittances is still one of the biggest foreign income earners because it is about 7 billion inflows that we get,” analyst at Frontier Research Shiran Fernando said. The research firm said falling oil prices and its impact on Gulf nations could be one reason behind this contraction of remittances. “We are seeing probably less hiring from Gulf nations, so growth from that base is not improving,” Fernando said.

online pharmacy buy spiriva with best prices today in the USA

Frontier Research also said the next reason for the reduction of remittances could be the weakend euro against the dollar.

Frontier Research also said the next reason for the reduction of remittances could be the weakend euro against the dollar. buy lexapro online https://www.scottsdaleweightloss.com/wp-content/uploads/2022/08/png/lexapro.html no prescription pharmacy

“Sri Lanka also has people working in European nations as well.

buy champix online https://www.scottsdaleweightloss.com/wp-content/uploads/2022/08/png/champix.html no prescription pharmacy

buy symbicort online https://greendalept.com/wp-content/uploads/2023/08/png/symbicort.html no prescription pharmacy

Since the euro has weakend against the dollar; they are sending in less than what they would have in 2014.” Fernando said the high growth eventually has to subside and this could be the start of it. “But it’s too early to call that the growth has actually reached a saturation level,” Fernando said.

online pharmacy buy cenforce with best prices today in the USA

online pharmacy buy champix with best prices today in the USA

buy ventolin online https://greendalept.com/wp-content/uploads/2023/08/png/ventolin.html no prescription pharmacy

“With oil falling to 30 dollars a barrel, it’s positive for us in terms of our fuel bill but remittances could hurt even more in 2016 if this trend continues.

buy amoxil online https://greendalept.com/wp-content/uploads/2023/08/png/amoxil.html no prescription pharmacy

” Fernando further said Gulf nations are looking to cut down expenditure because earlier they were planning there government budgets based on a dollar of about 135 though it is about 30 now. “So cutting down on public expenditure, things like infrastructure would mean fewer opportunities for Sri Lankan workers trying to get jobs there.

buy ivermectin online https://qpharmacorp.com/wp-content/uploads/2023/08/png/ivermectin.html no prescription pharmacy

” “I think 2016 is a number that we certainly need to keep an eye on,” Fernando added.

forget the new jobs, gcc countries are planning to send home some of the expats already here.

kuwait i believe has put a ceiling on the age of 50 and will retrench all above.

saudi , qatar , oman , will send home those over 60 years.

also new visa regulations coming in. expats who leave cannot return for 2 years unless its the same employer, so job switching is stopped.

uae that previously allowed visa on arrival for expats living in gcc , now require e-visa prior to travel.

gcc will implement vat (most probably @ 5%) from 2017. already fuel subsidy done away with.

so in time to come these countries will not pay as much as they used to pre oil price collapse !!!

We need to get used to these and plan ahead, Oil prices will not bounce back soon and most probably some gulf states may bankrupt. We need to improve our exports and tourist income.