Based on IMF staff analysis, fiscal consolidation necessary to bring debt down to safe levels would require excessive adjustment over the coming years, pointing to a clear solvency problem.

Releasing the Country Report No. 2022/091: Sri Lanka: 2021 Article IV Consultation, the IMF staff said that a more ambitious adjustment, required to significantly reduce debt, would put Sri Lanka even further into the upper tail.

STAFF REPORT FOR THE 2021 ARTICLE IV CONSULTATION

Outlook. Sri Lanka started experiencing a combined balance of payments and sovereign debt crisis. In staff’s view, public debt has become unsustainable, and gross reserves are critically low and insufficient to cover near-term debt service needs. While the authorities’ efforts to raise new FX financing could provide breathing space in the short term, it remains unclear how the large FX debt service obligations beyond 2022 can be met. A successful vaccination campaign has led to improved prospects for tourism, but the near and medium-term growth outlook is clouded by heightened macroeconomic imbalances, FX shortages, and suspension of non-priority imports. The large public debt burden has subordinated monetary and exchange rate policies to fiscal needs and continues to hinder the CBSL from pursuing its price stability objective.

Recommendations. To restore macroeconomic stability and debt sustainability, implementing a credible and coherent strategy covering both the near and medium term is needed. Staff recommends a comprehensive set of policies with specific measures:

• Substantial revenue-based fiscal consolidation. Reforms should focus onstrengthening VAT and income taxes, through rate increases and base broadeningmeasures. Fiscal adjustment should be accompanied by energy pricing reforms toreduce fiscal risks from lossmaking public enterprises. Institution building reforms,such as revamping the fiscal rule, would help ensure the credibility of the strategy.

• Developing a comprehensive strategy to restore debt sustainability.

• Near-term monetary policy tightening to ensure that the recent breach of the inflation target band is only temporary. Recent welcome steps to gradually unwind the CBSL’s large treasury bill holdings should continue through close coordination with the Ministry of Finance.

• Gradually restoring a market-determined and flexible exchange rate. To avoid disorderly movements in the exchange rate, the transition should be carefully sequenced and implemented as part of a comprehensive macroeconomic adjustment package.

• Social safety nets should be strengthened, by increasing spending, widening coverage, and improving targeting, to mitigate the adverse impacts of macroeconomic adjustment on vulnerable groups.

Excerpts from IMF Debt Sustainability Assessment

In staff’s view, Sri Lanka’s debt is unsustainable

Based on staff analysis, fiscal consolidation necessary to bring debt down to safe levels would require excessive adjustment over the coming years, pointing to a clear solvency problem. The DSA realism tools (see Figure 3) also indicate that the primary balance adjustment projected under the baseline already falls into the top 10th percentile of historically observed consolidations across countries. A more ambitious adjustment, required to significantly reduce debt, would put Sri Lanka even further into the upper tail. Rollover risk is very high. FX debt service needs of US$7 billion each year will require access to very large amounts of external financing at concessional rates and long maturities, sustained over many years.

Sri Lanka currently cannot refinance its debt in an orderly manner

With the outbreak of the global pandemic in 2020Q1, Sri Lanka lost access to international capital markets. Spreads increased and have since then hovered between 1,000 and 2,700 basis points, and all three international ratings agencies have downgraded Sri Lanka to CCC and lower. The authorities temporarily imposed strict ceilings on interest rates in treasury security auctions, resulting in substantial auction shortfalls and primary T-bill purchases by the CBSL. To help finance the government, the CBSL provided 3.5 percent of GDP in direct financing in 2020 and around 5 percent of GDP in the first 3 quarters of 2021.

In staff’s view, current fiscal policies are not sustainable

Under the baseline, public debt would keep increasing throughout the projection horizon, reaching 125.3 percent of GDP in 2026, despite relatively favorable interest rate assumptions (Figure 1). And interest payments will remain above 70 percent of tax revenues throughout the projection horizon. The deficit generates financing needs that exceed the domestic financial system’s capacity. And continued reliance on central bank financing would eventually lead to a de-anchoring of inflation expectations. Despite improvements in commitment control, the size of the fiscal financing challenge suggests that new domestic expenditure arrears could emerge in the years ahead.

Contingent liabilities from the SOE sector could materialize soon

CEB and CPC’s balance sheets remain highly exposed to currency fluctuations. Moreover, unless international fuel prices and energy generation costs are passed through to consumers, CPC and CEB are likely to incur further operational losses. Sri Lankan Airlines, already in distress before the pandemic, was hit hard by the pandemic and is in need of regular transfers from the government. It will most likely also need support to service its Eurobond (US$175 million) maturing in 2024.

The debt trajectory is subject to large macroeconomic risks

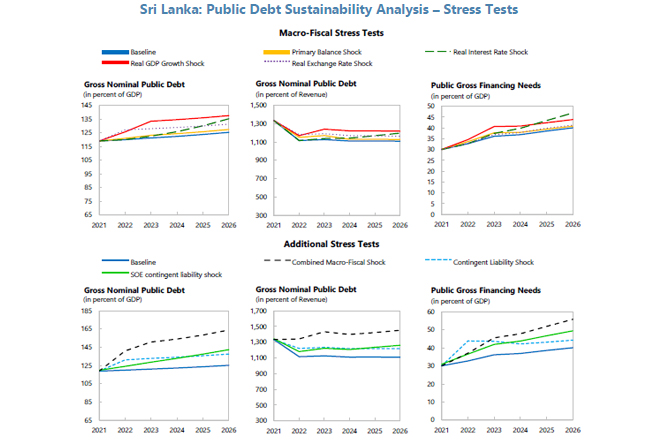

The prospect of the pandemic remains highly uncertain, and the debt trajectory is sensitive to exchange rate shocks. Inflationary pressures from the recent monetary expansion would lead to a lower real interest rate in the short term but could eventually cause the CBSL to raise its policy rates. And while banks appear well capitalized, asset quality in the financial sector remains uncertain. Shock scenarios (Figure 4) indicate the high sensitivity of the outlook to shocks, including the materialization of SOE contingent liabilities (10 percent of outstanding guaranteed debt per year) and the materialization of a one-time financial sector contingent liability shock in 2022. And most vulnerability indicators in the heatmap (Figure 5) signal high risk.

CBSL’s Comments on the IMF Article IV Report

Sri Lanka's Central Bank releasing a statement said that they stand ready to cooperate with the IMF as the Government indicated that it is seeking a closer engagement with the IMF.

According to the Central Bank, several policy adjustments have already been made by the MoF and the CBSL.

These include monetary policy tightening since August 2021, allowing exchange rate flexibility, removing restrictions on foreign exchange market transactions, implementing envisaged revenue enhancing measures, and allowing market-based price adjustments to key commodities.