Risks and challenges

The new report says the immediate challenge is to improve the external liquidity position and prepare for active liability management.

"Given the significantly large external obligations falling due, especially starting in 2019, potential actions include buying back and re-issuing longer-dated bonds," it said.

"Structural challenges include further progress on revenue-led fiscal consolidation; and narrowing the persistent current account deficit."

It added that the latter is linked to structural competitiveness issues, as indicated by a low level

of exports and a stale export basket.

The country’s transition towards upper middle income status is expected to lead to more commercial borrowing terms, leading to increased fiscal pressures.

Finally, given low national savings rates, more FDI is needed in the manufacturing and export sectors to sustain a high growth path.

Key risks include a growth slowdown, which would lead to fast rising public debt; and delays in key reforms

in a challenging political environment.

While global policy uncertainty could weigh on the external sector performance, the direct impact of a slowdown in China and the Brexit would be limited. Continued economic woes in the Middle East and the EU could adversely affect exports and remittances.

Tightening global financial conditions could elevate capital outflows and make borrowing more expensive.

It is important that fiscal policy is used to promote competitiveness and reduce poverty while pursuing the path of revenue-led fiscal consolidation.

The country has already embarked on bold steps to increase fiscal space, taken measures to reduce fiscal risks from SOEs and make the country more export-oriented.

Additional fiscal space could help minimize the impact of the reforms on vulnerable citizens through reforms, targeted social protection programs and pro-poor investments.

Ongoing efforts to reform the targeting system used by the flagship Samurdhi Social Protection program will help in this regard.

Fiscal buffers could also help counter the impact of frequent natural disasters.

Structural changes to public expenditure are needed to focus on investment in human and productivity-enhancing physical capital to return to a higher growth trajectory and maintain its strong recent record of poverty reduction while preparing to take care of an aging society.

Risks and challenges

The new report says the immediate challenge is to improve the external liquidity position and prepare for active liability management.

"Given the significantly large external obligations falling due, especially starting in 2019, potential actions include buying back and re-issuing longer-dated bonds," it said.

"Structural challenges include further progress on revenue-led fiscal consolidation; and narrowing the persistent current account deficit."

It added that the latter is linked to structural competitiveness issues, as indicated by a low level

of exports and a stale export basket.

The country’s transition towards upper middle income status is expected to lead to more commercial borrowing terms, leading to increased fiscal pressures.

Finally, given low national savings rates, more FDI is needed in the manufacturing and export sectors to sustain a high growth path.

Key risks include a growth slowdown, which would lead to fast rising public debt; and delays in key reforms

in a challenging political environment.

While global policy uncertainty could weigh on the external sector performance, the direct impact of a slowdown in China and the Brexit would be limited. Continued economic woes in the Middle East and the EU could adversely affect exports and remittances.

Tightening global financial conditions could elevate capital outflows and make borrowing more expensive.

It is important that fiscal policy is used to promote competitiveness and reduce poverty while pursuing the path of revenue-led fiscal consolidation.

The country has already embarked on bold steps to increase fiscal space, taken measures to reduce fiscal risks from SOEs and make the country more export-oriented.

Additional fiscal space could help minimize the impact of the reforms on vulnerable citizens through reforms, targeted social protection programs and pro-poor investments.

Ongoing efforts to reform the targeting system used by the flagship Samurdhi Social Protection program will help in this regard.

Fiscal buffers could also help counter the impact of frequent natural disasters.

Structural changes to public expenditure are needed to focus on investment in human and productivity-enhancing physical capital to return to a higher growth trajectory and maintain its strong recent record of poverty reduction while preparing to take care of an aging society. Sri Lanka’s economy projected to grow 4.7 pct in 2017: World Bank

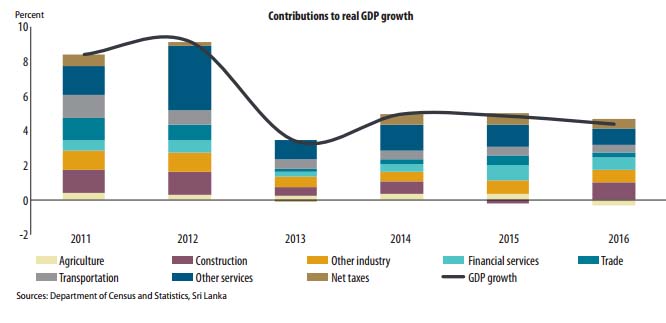

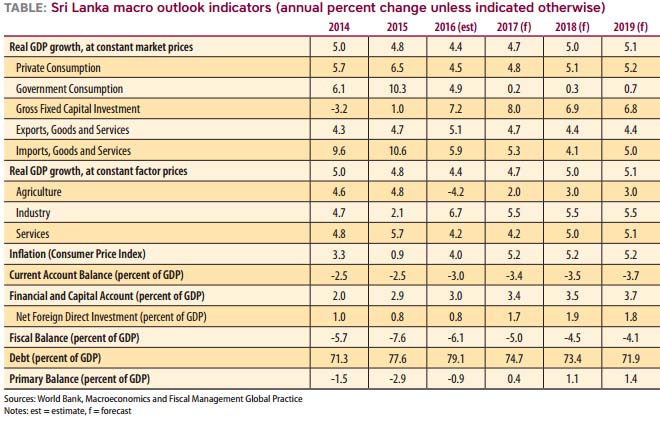

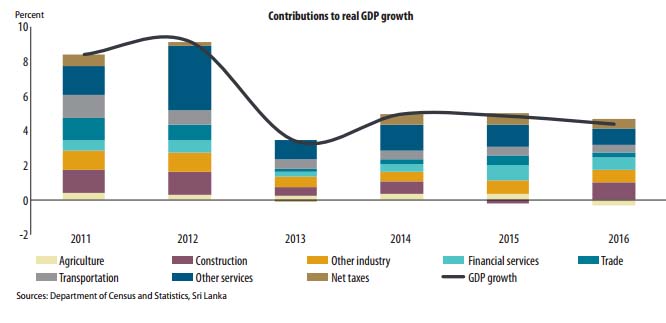

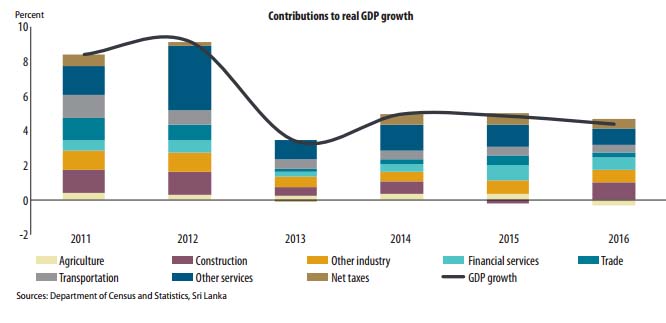

Apr 19, 2017 (LBO) - Recent policy reforms including monetary tightening and revenue-led fiscal consolidation have improved Sri Lanka's outlook, The World Bank's South Asia Economic Focus report says.

"Continuation of the IMF program will add to the confidence and support fiscal sustainability

while structural reforms supported by the World Bank are expected to yield benefits in the medium term," it said.

"The economy is projected to grow by 4.7 percent in 2017 and marginally exceed 5.0 percent growth in the

medium term, driven by private consumption and investment."

However the report adds that the impact of past currency depreciation and the rise in the Value Added Tax rate will increase inflation in 2017 despite downward pressure from low international commodity prices.

The external sector is poised to benefit from the reinstatement of GSP+ preferential access to European Union and rapidly growing tourism, although the drought could adversely impact exports and increase petroleum imports.

External buffers are projected to improve, with emphasis placed on purchasing foreign exchange, maintaining a more market-determined exchange rate, using monetary policy and the sale of selected government assets.

The fiscal deficit is projected to fall to 5.0 percent of GDP for 2017 due to the implementation of revenue

measures.

Risks and challenges

The new report says the immediate challenge is to improve the external liquidity position and prepare for active liability management.

"Given the significantly large external obligations falling due, especially starting in 2019, potential actions include buying back and re-issuing longer-dated bonds," it said.

"Structural challenges include further progress on revenue-led fiscal consolidation; and narrowing the persistent current account deficit."

It added that the latter is linked to structural competitiveness issues, as indicated by a low level

of exports and a stale export basket.

The country’s transition towards upper middle income status is expected to lead to more commercial borrowing terms, leading to increased fiscal pressures.

Finally, given low national savings rates, more FDI is needed in the manufacturing and export sectors to sustain a high growth path.

Key risks include a growth slowdown, which would lead to fast rising public debt; and delays in key reforms

in a challenging political environment.

While global policy uncertainty could weigh on the external sector performance, the direct impact of a slowdown in China and the Brexit would be limited. Continued economic woes in the Middle East and the EU could adversely affect exports and remittances.

Tightening global financial conditions could elevate capital outflows and make borrowing more expensive.

It is important that fiscal policy is used to promote competitiveness and reduce poverty while pursuing the path of revenue-led fiscal consolidation.

The country has already embarked on bold steps to increase fiscal space, taken measures to reduce fiscal risks from SOEs and make the country more export-oriented.

Additional fiscal space could help minimize the impact of the reforms on vulnerable citizens through reforms, targeted social protection programs and pro-poor investments.

Ongoing efforts to reform the targeting system used by the flagship Samurdhi Social Protection program will help in this regard.

Fiscal buffers could also help counter the impact of frequent natural disasters.

Structural changes to public expenditure are needed to focus on investment in human and productivity-enhancing physical capital to return to a higher growth trajectory and maintain its strong recent record of poverty reduction while preparing to take care of an aging society.

Risks and challenges

The new report says the immediate challenge is to improve the external liquidity position and prepare for active liability management.

"Given the significantly large external obligations falling due, especially starting in 2019, potential actions include buying back and re-issuing longer-dated bonds," it said.

"Structural challenges include further progress on revenue-led fiscal consolidation; and narrowing the persistent current account deficit."

It added that the latter is linked to structural competitiveness issues, as indicated by a low level

of exports and a stale export basket.

The country’s transition towards upper middle income status is expected to lead to more commercial borrowing terms, leading to increased fiscal pressures.

Finally, given low national savings rates, more FDI is needed in the manufacturing and export sectors to sustain a high growth path.

Key risks include a growth slowdown, which would lead to fast rising public debt; and delays in key reforms

in a challenging political environment.

While global policy uncertainty could weigh on the external sector performance, the direct impact of a slowdown in China and the Brexit would be limited. Continued economic woes in the Middle East and the EU could adversely affect exports and remittances.

Tightening global financial conditions could elevate capital outflows and make borrowing more expensive.

It is important that fiscal policy is used to promote competitiveness and reduce poverty while pursuing the path of revenue-led fiscal consolidation.

The country has already embarked on bold steps to increase fiscal space, taken measures to reduce fiscal risks from SOEs and make the country more export-oriented.

Additional fiscal space could help minimize the impact of the reforms on vulnerable citizens through reforms, targeted social protection programs and pro-poor investments.

Ongoing efforts to reform the targeting system used by the flagship Samurdhi Social Protection program will help in this regard.

Fiscal buffers could also help counter the impact of frequent natural disasters.

Structural changes to public expenditure are needed to focus on investment in human and productivity-enhancing physical capital to return to a higher growth trajectory and maintain its strong recent record of poverty reduction while preparing to take care of an aging society.

Risks and challenges

The new report says the immediate challenge is to improve the external liquidity position and prepare for active liability management.

"Given the significantly large external obligations falling due, especially starting in 2019, potential actions include buying back and re-issuing longer-dated bonds," it said.

"Structural challenges include further progress on revenue-led fiscal consolidation; and narrowing the persistent current account deficit."

It added that the latter is linked to structural competitiveness issues, as indicated by a low level

of exports and a stale export basket.

The country’s transition towards upper middle income status is expected to lead to more commercial borrowing terms, leading to increased fiscal pressures.

Finally, given low national savings rates, more FDI is needed in the manufacturing and export sectors to sustain a high growth path.

Key risks include a growth slowdown, which would lead to fast rising public debt; and delays in key reforms

in a challenging political environment.

While global policy uncertainty could weigh on the external sector performance, the direct impact of a slowdown in China and the Brexit would be limited. Continued economic woes in the Middle East and the EU could adversely affect exports and remittances.

Tightening global financial conditions could elevate capital outflows and make borrowing more expensive.

It is important that fiscal policy is used to promote competitiveness and reduce poverty while pursuing the path of revenue-led fiscal consolidation.

The country has already embarked on bold steps to increase fiscal space, taken measures to reduce fiscal risks from SOEs and make the country more export-oriented.

Additional fiscal space could help minimize the impact of the reforms on vulnerable citizens through reforms, targeted social protection programs and pro-poor investments.

Ongoing efforts to reform the targeting system used by the flagship Samurdhi Social Protection program will help in this regard.

Fiscal buffers could also help counter the impact of frequent natural disasters.

Structural changes to public expenditure are needed to focus on investment in human and productivity-enhancing physical capital to return to a higher growth trajectory and maintain its strong recent record of poverty reduction while preparing to take care of an aging society.

Risks and challenges

The new report says the immediate challenge is to improve the external liquidity position and prepare for active liability management.

"Given the significantly large external obligations falling due, especially starting in 2019, potential actions include buying back and re-issuing longer-dated bonds," it said.

"Structural challenges include further progress on revenue-led fiscal consolidation; and narrowing the persistent current account deficit."

It added that the latter is linked to structural competitiveness issues, as indicated by a low level

of exports and a stale export basket.

The country’s transition towards upper middle income status is expected to lead to more commercial borrowing terms, leading to increased fiscal pressures.

Finally, given low national savings rates, more FDI is needed in the manufacturing and export sectors to sustain a high growth path.

Key risks include a growth slowdown, which would lead to fast rising public debt; and delays in key reforms

in a challenging political environment.

While global policy uncertainty could weigh on the external sector performance, the direct impact of a slowdown in China and the Brexit would be limited. Continued economic woes in the Middle East and the EU could adversely affect exports and remittances.

Tightening global financial conditions could elevate capital outflows and make borrowing more expensive.

It is important that fiscal policy is used to promote competitiveness and reduce poverty while pursuing the path of revenue-led fiscal consolidation.

The country has already embarked on bold steps to increase fiscal space, taken measures to reduce fiscal risks from SOEs and make the country more export-oriented.

Additional fiscal space could help minimize the impact of the reforms on vulnerable citizens through reforms, targeted social protection programs and pro-poor investments.

Ongoing efforts to reform the targeting system used by the flagship Samurdhi Social Protection program will help in this regard.

Fiscal buffers could also help counter the impact of frequent natural disasters.

Structural changes to public expenditure are needed to focus on investment in human and productivity-enhancing physical capital to return to a higher growth trajectory and maintain its strong recent record of poverty reduction while preparing to take care of an aging society.