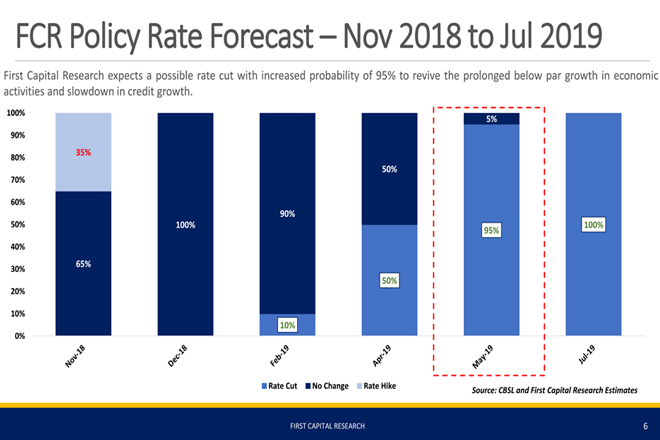

May 27, 2019 (LBO) – First Capital Research has allocated a 95 percent probability for a policy rate cut in May 2019 as they are of the view that policy intervention is inevitable to revive the overly sluggish economy and credit growth.

“Despite the Road Map towards a single policy rate, we believe a rate cut in both SLFR and SDFR is more appropriate considering the severity of the situation,” a pre-policy analysis of First Capital Research predicted.

“However, in the case of a 75bps or a 100bps rate cut consideration, though remote, CBSL may consider a lower cut for SDFR.”

The Central Bank maintaining foreign reserve position above 7 billion US dollars (USD 7.2Bn by end Apr 2019) is noteworthy considering the major outflows in April 2019.

“Easter Sunday attack is expected to have a detrimental impact on the economy possibly further slowing down the sluggish economy,” the research note said.

“We expect the recovery would require at least 1-Yr period forcing a downward revision to our 2019 GDP growth projection to below 3.0% from previous 4.3%.”

IMF, however, approved the 6th tranche of 164.1 million dollars while granting a one year extension until June 2020 providing a cushion to country’s economy to recover from the recent attacks.

online pharmacy https://azimsolutions.com/wp-content/themes/twentytwenty/inc/php/bactroban.html no prescription drugstore

Falling below the Central Bank credit growth projection of 13.5 percent, private sector credit growth decelerated at an alarming rate to record a year-to-date growth of 0.5 percent during the first quarter leading to a contraction in financial sector asset base.

buy cymbalta online buy cymbalta online no prescription

USD:LKR continued to strengthen to close at 176.24 on 22 May 2019 supported by foreign remittance conversions and foreign inflows during the festive seasons.

online pharmacy https://azimsolutions.com/wp-content/themes/twentytwenty/inc/php/desyrel.html no prescription drugstore

However, REER continued to remain undervalued at 94.74 in March 2019.

A sustained positive liquidity position was created after lapse of 6 months resulting from multiple SRR cuts and government making the long delayed payments providing the ability for CBSL to discontinue daily reverse repo auctions and term reverse repo auctions.