online pharmacy buy strattera with best prices today in the USA

buy valtrex online https://lifepractice.net/wp-content/uploads/2022/08/png/valtrex.html no prescription pharmacy

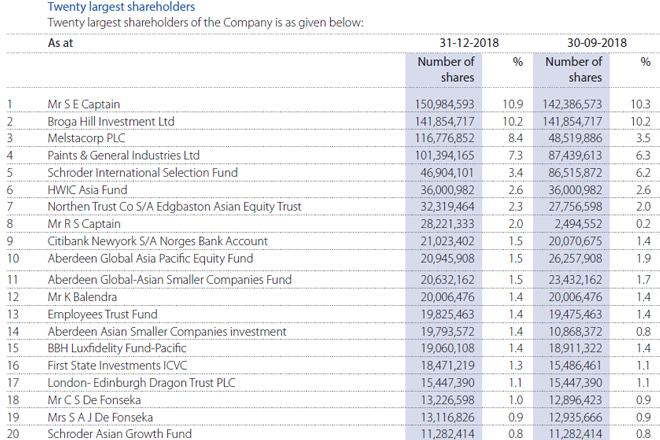

Whether the board of the most important company in Sri Lanka realises it or not, their company and its shareholders are under threat. Sri Lanka's billion dollar stock market bellwether now has 3 shareholders who own in aggregate greater than 40% of the voting shares of the company.

buy antabuse online https://www.indcheminternational.com/wp-content/uploads/2022/08/png/antabuse.html no prescription pharmacy

online pharmacy buy cenforce with best prices today in the USA

These three shareholders, if they collude or sell to each other, have the ability to control the company. The three shareholders are the Captain family, Harry Jayawardena, and the Malaysian sovereign fund.

buy renova online https://www.indcheminternational.com/wp-content/uploads/2022/08/png/renova.html no prescription pharmacy

buy ciprodex online https://lifepractice.net/wp-content/uploads/2022/08/png/ciprodex.html no prescription pharmacy

The two local shareholders, Captains and Harry Jayawardena, control in excess of 30% of the company, while the Malaysians have in excess of 10%. The two local shareholders do not have a track record of creating value for minority shareholders.

online pharmacy buy ciprodex with best prices today in the USA

online pharmacy buy abilify with best prices today in the USA

Shares of the companies they control have preformed far worse than if minority shareholders would have just kept their money if fixed deposits. As the potential forces that could takeover JKH have not had a history of creating value for minority shareholders, the board of JKH is duty bound to protect the rights of all other existing shareholders by conducting a major evaluation of strategic alternatives.

online pharmacy buy cymbalta with best prices today in the USA

online pharmacy buy spiriva inhaler with best prices today in the USA

buy avodart online https://www.indcheminternational.com/wp-content/uploads/2022/08/png/avodart.html no prescription pharmacy

The board of JKH, through its lackadaisical approach to potential takeover threats, has allowed the company to fall into its current predicament.

online pharmacy buy spiriva with best prices today in the USA

buy lariam online https://lifepractice.net/wp-content/uploads/2022/08/png/lariam.html no prescription pharmacy

If historical precedence is an indicator, an internal analysis of strategic alternatives is unlikely to result in the bold moves necessary for the company to preserve its independence. As time is of the essence, the board should immediately seek outside counsel in order evaluate a course of action that is in the interest of all its existing shareholders.

online pharmacy buy diflucan with best prices today in the USA

International investment banks and legal advisors must be retained in order to assist management in evaluating the available alternatives of restructuring and takeover defence.

online pharmacy buy flexeril with best prices today in the USA

If the board fails to act, they will be violating their duty to maximise shareholder value for all stock holders, and likely add JKH to the list of companies that are controlled by Sri Lanka's oligarchs.