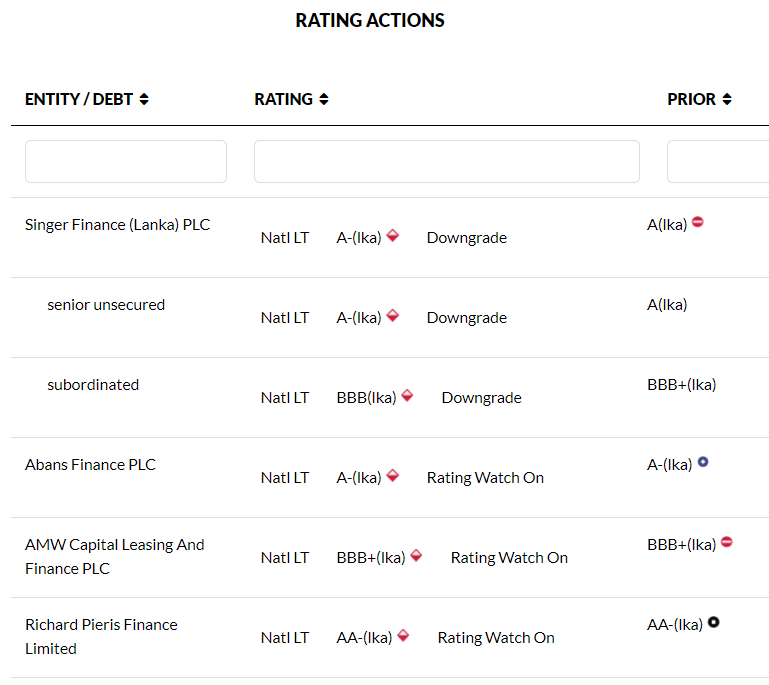

Fitch Ratings has downgraded Singer Finance (Lanka) PLC's (SFL) National Long-Term Rating to 'A-(lka)' from 'A(lka)' and placed the rating on Rating Watch Negative (RWN). We have also placed the National Long-Term Ratings of three other Fitch-rated Sri Lankan finance and leasing companies (FLCs) - Abans Finance PLC (AF), AMW Capital Leasing and Finance PLC (AMWCL) and Richard Pieris Finance Limited (RPF) - on RWN.

Fitch thinks some rated Sri Lankan corporates are more affected by the challenging macroeconomic environment stemming from the sovereign's distressed credit profile. We believe there is significant downside risk to our assessment of the corporate parents' ability to extend timely support to their Fitch-rated finance and leasing subsidiaries amid the additional pressure on the economy.

KEY RATING DRIVERS

SFL's downgrade follows the downgrade of the National Long-Term Rating of its parent, Singer (Sri Lanka) PLC, to 'A+(lka)', from 'AA-(lka)', on 29 April 2022; see our commentary, Fitch Downgrades Singer (Sri Lanka) to 'A+(lka)'; Outlook Negative. Singer's ability to support SFL has weakened due to its deteriorating credit profile, which is based on its standalone strength.

The RWN on AF, AMWCL, RPF and SFL reflects heightened downside risks to these financial institutions' ratings from the potentially weaker ability of their parents to provide timely liquidity support to these subsidiaries should there be a liquidity crunch in the financial system.

We believe these entities, similar to other peers in the sector, are prone to the risk of a change in creditor and market sentiment due to their high deposit concentration and significant reliance on wholesale funding. This, in turn, could put pressure on their parents to provide timely liquidity support, which is likely to be challenging in the weak operating environment and the stresses building up in the banking system.

This risk is exacerbated by the deteriorating sovereign credit profile (Long-Term Foreign-Currency Issuer Default Rating (IDR): RD, Long-Term Local-Currency IDR: CCC) and the ensuing risks to the stability of the financial system.

We aim to resolve the RWN in the next six months, depending on developments in the operating environment and the evolution of the FLCs' funding and liquidity positions, which could result in multiple notch downgrades.

These four entities' National Long-Term Ratings are driven by Fitch's expectation of support from their parents, underpinned by the parents' stake in the finance subsidiaries, sharing of brand names and the degree of integration and role in the group.