buy penegra online http://www.handrehab.us/images/layout1/php/penegra.html no prescription

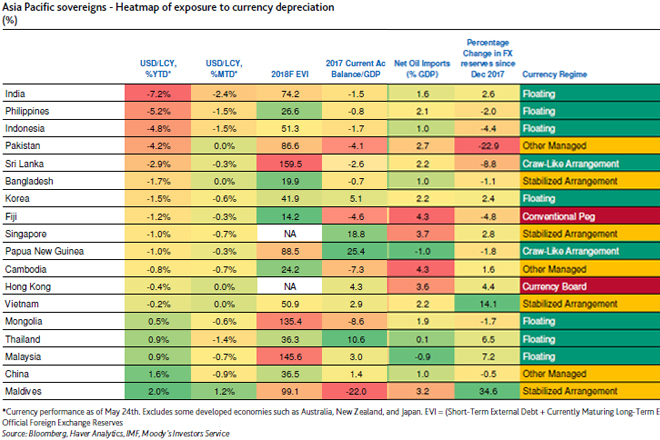

Moody’s said country-specific factors like in Sri Lanka have played a role in tightening financing conditions. Tightening financing conditions reflect various factors, including the appreciation of the US dollar. Moody’s, however, said nearly all economies in the APAC region have seen their currencies depreciate against the US dollar over the course of this year. “Foreign exchange pressures have most pronounced in the key Asian emerging markets of India, Indonesia and the Philippines, but also some frontier markets like Bangladesh and Sri Lanka,” Moody’s said.

buy tadasiva online http://www.handrehab.us/images/layout1/php/tadasiva.html no prescription

“In all cases, however, the extent of depreciation and more generally, tightening in financing conditions, is nowhere similar in magnitude as in the taper tantrum in 2013.” Dollar strength has been driven by solid economic data in the US, leading financial markets to revise their expectations for US interest rates. Another factor has been oil prices; geopolitical developments have contributed to higher oil prices in recent weeks. “Although we expect oil prices to stay in the $45-$65 per barrel range over the medium term, in the near term, higher oil prices are associated with weaker currencies for oil importers,” In a recent analysis by Moody’s, that takes into consideration the tenor, level and affordability of debt, finds that Pakistan, Mongolia, Sri Lanka and the Maldives are most exposed to a higher cost of debt that feeds mostly through weaker debt affordability. “Sovereigns with high external debt obligations relative to their foreign reserves, such as Sri Lanka (B1 negative) and Mongolia, are also particularly at risk,” Moody’s said. “Prolonged currency depreciation also presents fiscal risks to those frontier economies with substantial foreign currency debt by inflating debt servicing needs, namely Sri Lanka, Maldives and Mongolia.” Related: Sri Lanka among most exposed countries to an interest rate shock: Moody’s