buy fildena online buy fildena online no prescription

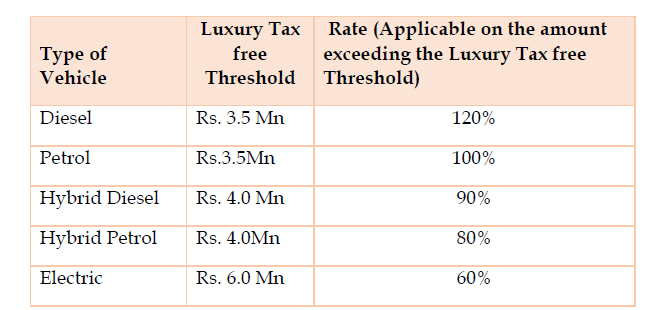

As per the budget proposals, the excise duty on the single cabs and passenger vehicles will also be revised. Proposed luxury tax on motor vehicles will be imposed on the CIF value or the manufacturer’s price as the case may be in excess of the luxury tax free threshold, as follows;

Luxury Tax free threshold will be the Cost Insurance Freight (CIF) value in the case of imported vehicles andex-factory cost (Manufacturer's price), in the case of locally assembled vehicles.

Revision of excise duty on motor vehicles and implementation of luxury tax on luxury motor vehicles is expected to generate a revenue of 48,000 million rupees this year.

Luxury Tax free threshold will be the Cost Insurance Freight (CIF) value in the case of imported vehicles andex-factory cost (Manufacturer's price), in the case of locally assembled vehicles.

Revision of excise duty on motor vehicles and implementation of luxury tax on luxury motor vehicles is expected to generate a revenue of 48,000 million rupees this year.