June 05, 2018 (LBO) – Fitch Ratings expects the exposure of Sri Lanka’s non-life insurers to extreme weather-related events to be manageable due to extensive use of reinsurance.

However, reinsurers are seen to be reducing ceding commissions to reflect the increased risk of catastrophes, Fitch Ratings said.

"Sri Lanka has seen a recurrence of extreme weather-related events – back-to-back floods in May 2018 and over the past two years, and a prolonged drought in several parts of the country, which we believe may raise long-term risks for insurers’ capital," Fitch Ratings said.

"We expect the insurance sector to continue its growth momentum, driven primarily by the rising per capita income, growing awareness on insurance, and considerably lower insurance penetration supporting the growth potential."

Gross written premiums for life and non-life businesses grew by 13 percent and 22 percent, respectively, in 2017 (2016: 18%, 14%).

Sri Lanka Insurance Dashboard 2H18 by Fitch Ratings - What to Watch

New Tax Act Weighs on Life Profits: Fitch expects changes in the Inland Revenue Act, which came into effect on 1 April 2018, to lower the net profits of life insurers as surplus distributions to shareholders from policyholder funds and investment income of shareholder funds (less allowable expenses) are taxed at 28%. Earlier, most of the life insurers paid lower taxes under the ‘investment income minus management fees’ method, which resulted in a lower tax base. In addition, distributions to participating life policyholders, which were not taxed previously, are now taxed at 14% and will be increased to 28% from 2021.

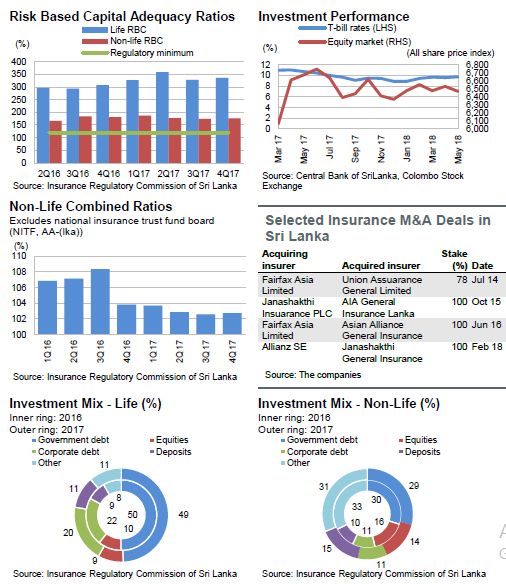

Industry Consolidation Likely: Further industry consolidation is likely, given the competitive nature of the non-life insurance market where some players are incurring underwriting losses.

In addition, recent regulatory developments including higher capital requirements and split of composites have also hastened consolidation. There have been four merger or acquisition deals since 2014, including Allianz SE’s (Insurer Financial Strength: AA/Stable) acquisition of 100% of Janashakthi General Insurance Limited in early 2018.

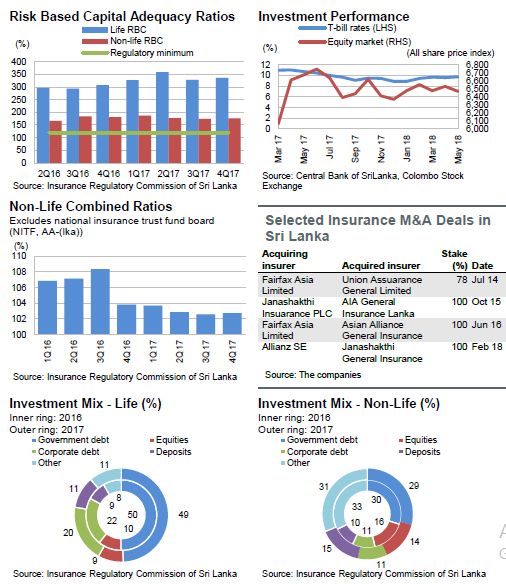

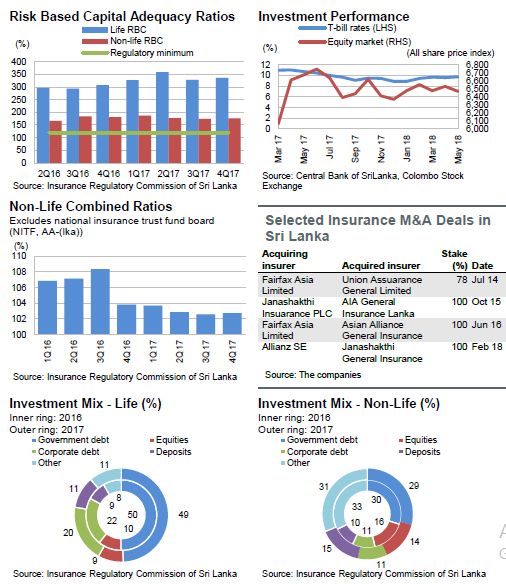

Steady Investment Income: We expect insurers’ investment income to remain stable owing to their large allocation to fixed-income investments whose returns are likely to remain mostly steady in 2H18. We expect insurers to maintain a considerable exposure to government and corporate debt securities while limiting allocations to the volatile equity market.

buy avanafil online

buy avanafil online no prescription

Ratings Impact: Neutral

Fitch expects the credit metrics of rated insurers to remain intact in 2H18, following satisfactory capitalisation and sustained market share.