online pharmacy buy ciprodex with best prices today in the USA

2018 budget proposed a special levy for financial institutions to be implemented with effect from 1st April 2018 which will be applicable for 3 years.

buy ocuflox online https://www.indcheminternational.com/wp-content/uploads/2022/08/png/ocuflox.html no prescription pharmacy

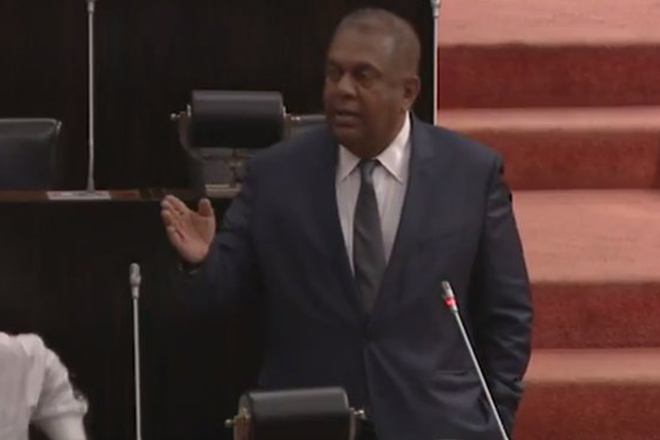

Samaraweera yesterday termed this levy as ‘Medamulana tax,’ as it intended at collecting additional revenue to repay foreign debt taken during the Rajapaksa era. As per the proposal, 2 rupees per 10,000 rupees on cash transactions (0.

online pharmacy buy cymbalta with best prices today in the USA

online pharmacy buy abilify with best prices today in the USA

02%) should be payable by all financial institutions.

online pharmacy buy diflucan with best prices today in the USA

“This levy should not be passed on to the customers and the levy financial institutions are paying can be deducted from their income tax.

online pharmacy buy valtrex with best prices today in the USA

” Samaraweera told Parliament. Special Assignments Minister Sarath Amunugama, however, said this levy is a consumption tax and can be deducted from income tax if wanted.

online pharmacy buy strattera with best prices today in the USA

online pharmacy buy glucophage with best prices today in the USA

Amunugama added that this levy has been introduced in such a way, which will not impact all the business activities of a financial institution. Finance Minister said the next 3 years will be crucial with debt repayments amounting to almost 7,000 billion rupees.

buy amoxil online https://www.indcheminternational.com/wp-content/uploads/2022/08/png/amoxil.html no prescription pharmacy

online pharmacy buy keflex with best prices today in the USA

This includes the repayment of international sovereign bonds which will mature every year amounting to almost 600 billion rupees. He said in 2018 alone, the debt repayment amounts to 1,970 billion rupees.

online pharmacy buy spiriva inhaler with best prices today in the USA

According to revenue proposals, however, only 20,000 million rupees are expected to collect through this levy next year. Foreign liability management becomes an immediate priority as the economy is facing the largest ever foreign debt servicing requirements, clustered during 2019-2022.

buy neurontin online https://www.indcheminternational.com/wp-content/uploads/2022/08/png/neurontin.html no prescription pharmacy