buy singulair online https://naturalhealthcareservices.com/wp-includes/sitemaps/providers/php/singulair.html no prescription

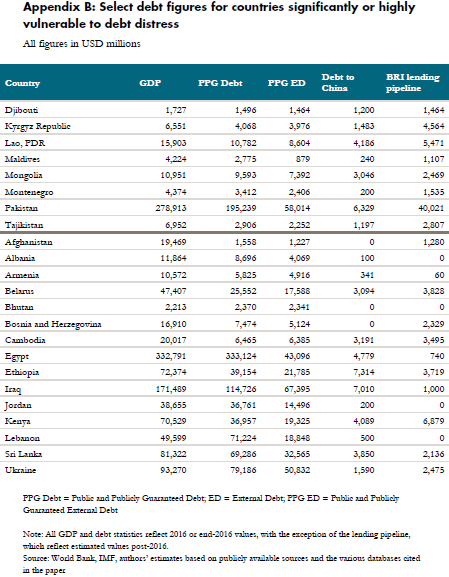

The policy paper has identified 68 countries that fall under the scope of BRI based on reports from Chinese quasi-official organizations and BRI’s geographical representation. The paper said the annual economic output of these 68 countries is roughly 25 trillion US dollars, with China itself accounting for some 45 percent of the total. Sri Lanka, however, has been classified as a highly vulnerable country in a subset of 23 countries that they have determined to be significantly or highly vulnerable to debt distress. Given the current risk ratings, these 23 countries represent those for whom the risk of debt distress due to additional BRI-related financing could be quite high, the study said. The policy paper said China has also demonstrated a willingness to provide additional credit so a borrower can avoid default. “The Sri Lankan government may agree to additional BRI-related financial commitments but their size is likely to be tempered by the Hambantota Port experience,” the study said.

buy amoxicillin online https://naturalhealthcareservices.com/wp-includes/sitemaps/providers/php/amoxicillin.html no prescription

The study also argued that China’s case-by-case approach to debt relief is likely to continue in the absence of a commitment to some multilateral framework. “In countries suffering from debt distress, the Chinese government has provided debt relief in an ad hoc, case-by-case manner,” The policy paper has identified Sri Lanka as one example in which China has managed to respond to problems of debt distress in BRI countries. “With Sri Lanka unwilling to service a $8 billion loan at 6 percent interest that was used to finance the construction of the Hambantota Port, China agreed in July 2017 to a debt-for-equity swap accompanied by a 99-year lease for managing the port.” Despite ad hoc approaches to the treatment of debt problems, the China Banking Regulatory Commission in November 2017 issued its first ever regulations for China's policy banks. It emphasized greater risk controls for the overseas activities of China Development Bank, China Exim Bank, and the Agricultural Development Bank of China.

buy azithromycin online https://naturalhealthcareservices.com/wp-includes/sitemaps/providers/php/azithromycin.html no prescription

Read full study here.