June 21, 2018 (LBO) – Sri Lanka’s significant credit growth for more than two consecutive years warrants attention, an International Monetary Fund (IMF) staff report released yesterday said.

While a portion of this credit growth can be associated with financial deepening, loan concentration, notably in the real estate sector, raises concerns, the report added.

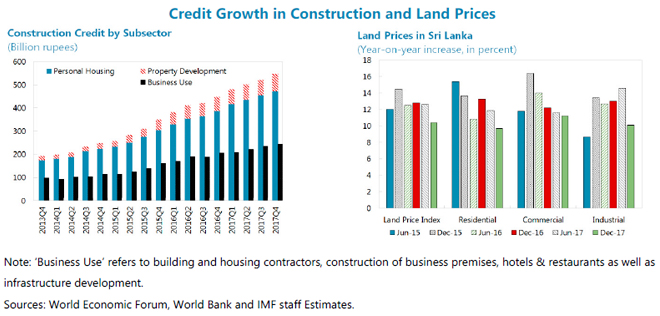

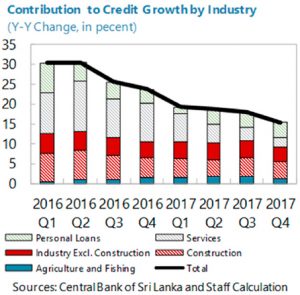

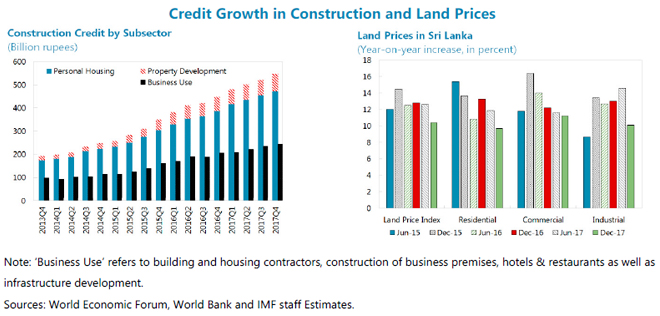

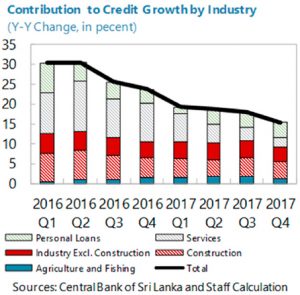

The IMF said notwithstanding the recent deceleration, credit growth remains elevated, particularly in the construction sector.

“Real estate market (personal housing and property development) expansion has continued unabated, and credit to construction is currently the highest contributor to overall credit growth,” the report said.

“Currently, the real estate market makes up of 11.2 percent of total outstanding loans.”

The IMF said decomposed analysis of construction credit indicates that most of this credit has been utilized for personal housing, but credit to property development has also increased since 2014.

“Although the bulk of purchases of luxury condominiums, and some of the construction of office and hotel buildings, may reportedly rely on foreign financing, the increasing credit concentration in the real estate sector can lead to rising financial risks,” IMF said.

“If rapid construction leads to an oversupply in the real estate market, lower prices and a slowdown in construction activity would likely follow and trigger stress among the often-leveraged builders.

buy premarin online

buy premarin online no prescription

”

The IMF said lower prices for luxury condominiums, even with few secondary market transactions, will depress the values of existing housing, entailing a negative wealth effect.

Overbuilding would, through these channels, adversely impact the banking sector and economic activity, the report highlighted.

The IMF said over the last two years, Sri Lanka has experienced fast overall credit growth, beyond what its financial deepening needs would warrant.

While credit growth has moderated since mid-2016, further deceleration would help mitigate financial stability concerns, the IMF staff report further said.