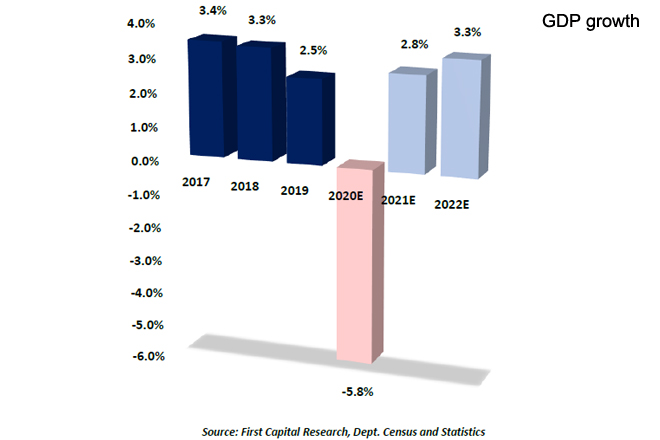

Sep 15, 2020 (LBO) – First Capital Research (FCR) expects the GDP growth to record the steepest contraction at -5.8% for 2020 while the growth may continue to be a struggle at 2.8% in 2021.

Amidst the lack of demand for credit, import restrictions and the slowness in recovery in consumer demand may result in GDP growth turning positive only by 4Q2020 while the unexpected contraction in 1Q2020 further hampered prospects of a lower contraction in GDP.

"GDP growth may continue to be a struggle though at 2.8% in 2021E," First Capital Research said in its mid-year outlook report.

"Considering the heavy CBSL Holding volume and inevitable relaxation of import restrictions, the economy may showcase a currency spike followed by an interest rate spike resulting in another shock to the economy which may prevent a V shaped recovery while inducing a W-shape for the recovery process."

Unprecedented negative growth in 1Q2020 induces a substantial downward revision in GDP growth expectations as GDP takes a grind in 2020 to an all-time low.

Balance of Payments and Foreign Reserves

Overall trade contraction and extended import restrictions to improve the current account to a marginal surplus, but deficit may expand back closer to USD 1Bn in 2021E once restrictions are lifted.

Lack of FDI and limited borrowing options may result in a substantial BOP deficit in 2020E. However, in the wake of 2021E, foreign debt raising becomes critical while at the same time it’s likely to be a major challenge.

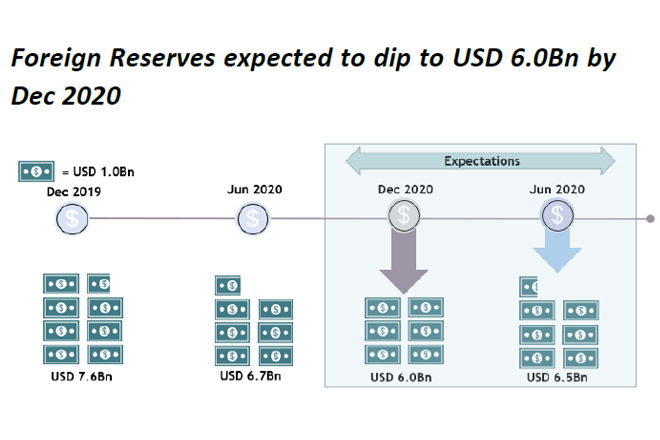

Foreign Reserves under pressure

Sri Lanka’s Financial gap surges while other foreign currency borrowing options are also limited providing significant pressure on Foreign Reserves.

First Capital Research expects the Government to raise about USD 5.0Bn for 2020E compared to USD 6.0Bn foreign currency repayments.

It is estimated that out of the USD 5.0Bn likely to be raised for 2020, the Government has already raised or secured USD 2.4Bn during the first 7 months of 2020.

buy clomiphene online buy clomiphene online no prescription

Foreign Reserves expected to dip to USD 6.0Bn by Dec 2020

Debt repayment for 2021E estimated to surge past LKR 3.0Tn as debt to GDP is expected to exceed 100%. Debt to GDP for 2020E is expected to reach 96% amidst larger budget deficit.

Bond Repayments are a sizable portion of the overall debt with local and foreign maturities on the rise

Dollar maturities are on an upward trajectory from 4Q2020 onwards amidst the Sovereign Bond maturity. Difficulty in raising external long-term funding is likely to cause some stress to the system.

The rise in Rupee Bond maturities coupled with large budget deficit funding requirements adds on to the pressure.