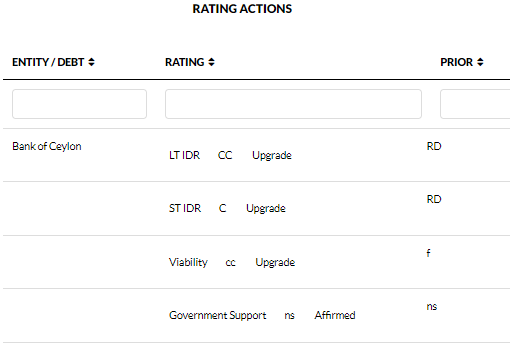

Fitch Ratings has upgraded Bank of Ceylon's (BOC) Long-Term Foreign-Currency Issuer Default Rating (IDR) to 'CC' from 'RD' (Restricted Default). The rating does not carry an Outlook because of the high volatility at this rating level, in line with Fitch's rating definitions.

At the same time, Fitch has also upgraded BOC's Viability Rating (VR) to 'cc' from 'f' and its Short-Term IDR to 'C' from 'RD' and affirmed BOC's Government Support Rating of 'no support' (ns).

BOC's Long-Term Local-Currency IDR of 'CCC-'/Rating Watch Negative (RWN) and National Long-Term Rating of 'A(lka)'/RWN was not considered in this review.

A full list of rating actions is below.

KEY RATING DRIVERS

Foreign-Currency Overdues Met: The upgrade of BOC's VR and its Foreign-Currency and Short-Term IDRs reflects BOC's improved foreign-currency liquidity position since June 2022, which has enabled the bank to become current on its foreign-currency obligations to non-government creditors. That said, the bank's foreign-currency funding and liquidity profile remain stretched, with inflow of foreign currency being mostly limited to remittances and export proceeds. The bank's access to foreign-currency funding remains constrained by the weakened credit profile of the Sri Lanka sovereign (RD).

The bank's funding and liquidity score of 'cc' also reflects its tight local-currency funding and liquidity position, which is currently more manageable than its foreign-currency position, supported by BOC's strong domestic franchise and its ability to access liquidity from the central bank.

Heightened Risks to OE: The current operating environment (OE) score of 'ccc-'/negative reflects our view that a probable default on the sovereign's domestic debt and ensuing risks to the broader economic environment could exacerbate risks to banks' already stressed credit profiles. This follows the sovereign's default on foreign-currency instruments, and would further hinder banks' operational flexibility. The negative outlook reflects downside risks to OE stemming from a significant deterioration in the macroeconomic environment.

Solvency Under Pressure: We have maintained BOC's capitalisation and leverage score at 'cc' to reflect our view that a potential restructuring of the sovereign's domestic debt, in addition to a possible haircut on foreign-currency securities, could have a significant effect on the bank's solvency. This takes into account its large holdings of sovereign securities of nearly eight times of its common equity Tier 1 (CET1) capital at end-3Q22. The bank could then require recapitalisation to restore viability in the absence of further regulatory forbearance.

RATING SENSITIVITIES

Factors that could, individually or collectively, lead to negative rating action/downgrade:

Fitch would downgrade BOC's VR and IDRs if it perceives an increased likelihood that the bank would default on or seek a restructure of its senior obligations to non-government creditors. Potential triggers that could lead to a downgrade include:

- funding stress that impedes the bank's repayment ability in foreign currency

- significant banking-sector intervention by authorities that constrain the bank's ability to service its foreign-currency obligations

- a temporary negotiated waiver or standstill agreement following a payment default on a large foreign-currency financial obligation

- Fitch's belief that the bank has entered into a grace or cure period following non-payment of a large foreign-currency financial obligation

- a reduction in CET1 below the regulatory minimum (4.5% without any buffers), even if there is regulatory forbearance regarding such a shortfall.

Factors that could, individually or collectively, lead to positive rating action/upgrade:

Fitch believes positive rating action is unlikely in the near term, given the sovereign's weak credit profile, the bank's strong linkage to the sovereign, and the broader challenging economic conditions.

State Support Unlikely: The Government Support Rating of 'ns' reflects our assessment that there is no reasonable assumption of government support being forthcoming.

Factors that could, individually or collectively, lead to negative rating action/downgrade:

The rating is already at its lowest level and thus has no downside risk.

Factors that could, individually or collectively, lead to positive rating action/upgrade:

The Government Support Rating is constrained by the sovereign rating. An upward revision is possible, provided the sovereign's ability to provide support significantly improves. However, this appears unlikely in the near to medium term.

VR ADJUSTMENTS

The operating environment score of 'ccc-' is below the 'b' category implied score due to the following adjustment reason: sovereign rating (negative).

The business profile score of 'ccc-' is below the 'b' category implied score due to the following adjustment reason: business model (negative).

BOC has a 1.78% equity stake in Fitch Ratings Lanka Ltd. No shareholder other than Fitch, Inc. is involved in the day-to-day rating operations of, or credit reviews undertaken by, Fitch Ratings Lanka Ltd.

BEST/WORST CASE RATING SCENARIO

International scale credit ratings of Financial Institutions and Covered Bond issuers have a best-case rating upgrade scenario (defined as the 99th percentile of rating transitions, measured in a positive direction) of three notches over a three-year rating horizon; and a worst-case rating downgrade scenario (defined as the 99th percentile of rating transitions, measured in a negative direction) of four notches over three years. The complete span of best- and worst-case scenario credit ratings for all rating categories ranges from 'AAA' to 'D'.