buy dapoxetine online buy dapoxetine online no prescription

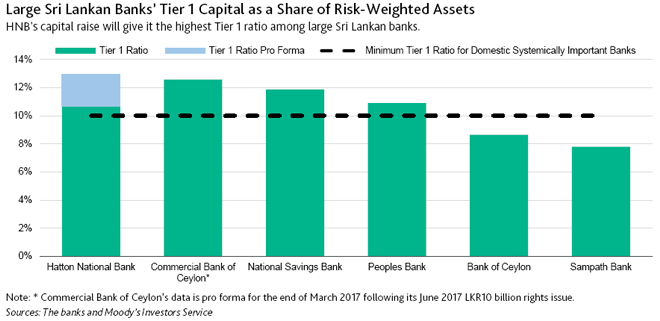

Last week, the bank received shareholder approval for a 15 billion rupees right issue and the bank is to complete the rights issuance by the end of this month. Moody’s investor service estimates that the issue will add 230 basis points to HNB’s Tier 1 ratio, bringing it to 12.9 percent well above Sri Lankan banks’ new 10 percent regulatory minimum, with which banks must comply by January 2019. “The rights issuance will position HNB’s Tier 1 ratio above the ratios of its domestic peers,” Moody’s said.

Sri Lankan banks have been dealing with shrinking capital buffers as loan growth exceeds the growth of banks’ retained earnings.

“System loan growth was 17.5% in 2016, while retained earnings – particularly at state-owned banks – were negatively pressured by high cash dividend payouts that averaged 75% for that year.”

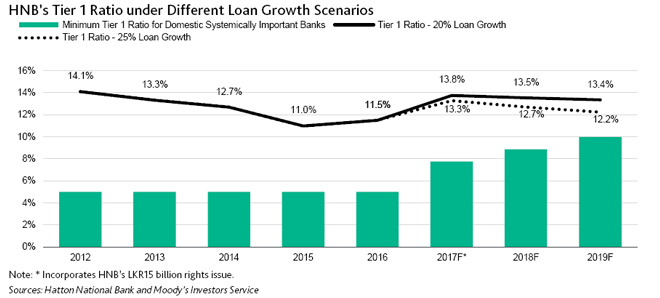

Moody’s expects HNB’s higher capital buffer will support its loan growth over the next 12-18 months.

“We expect HNB’s loan volume to grow by 20% annually during 2017-19, in line with its year-on-year growth rate at the end of March,”

“In this scenario, where we also assume 20% cash dividends every year, HNB’s Tier 1 ratio would be around 13% at the end of 2019,”

Sri Lankan banks have been dealing with shrinking capital buffers as loan growth exceeds the growth of banks’ retained earnings.

“System loan growth was 17.5% in 2016, while retained earnings – particularly at state-owned banks – were negatively pressured by high cash dividend payouts that averaged 75% for that year.”

Moody’s expects HNB’s higher capital buffer will support its loan growth over the next 12-18 months.

“We expect HNB’s loan volume to grow by 20% annually during 2017-19, in line with its year-on-year growth rate at the end of March,”

“In this scenario, where we also assume 20% cash dividends every year, HNB’s Tier 1 ratio would be around 13% at the end of 2019,”

“In a different scenario, where annual loan growth is 25%, we estimate the capital buffer would be around 12% at the end of 2019.”

The shareholders’ approval of the rights issue is a positive step following HNB’s previously stalled plan to raise capital.

HNB had planned to raise capital in 2016 from the Asian Development Bank, but some shareholders blocked the transaction.

“In a different scenario, where annual loan growth is 25%, we estimate the capital buffer would be around 12% at the end of 2019.”

The shareholders’ approval of the rights issue is a positive step following HNB’s previously stalled plan to raise capital.

HNB had planned to raise capital in 2016 from the Asian Development Bank, but some shareholders blocked the transaction.