online pharmacy buy abilify with best prices today in the USA

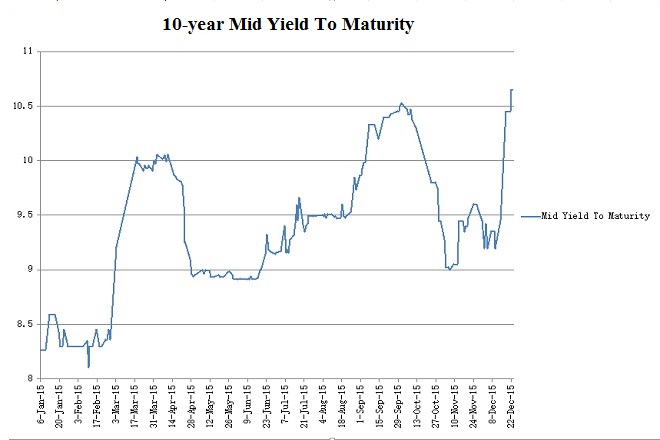

Data shows rupee treasury bonds posting more than 25 turning points last year, a clear sign of volatility in the secondary market.

buy lariam online https://greendalept.com/wp-content/uploads/2023/08/png/lariam.html no prescription pharmacy

Swings of between 25 to 100 basis points during such turns is possible. In October, 10-year bonds offered yields of 10.

online pharmacy buy cymbalta with best prices today in the USA

buy bactrim online https://greendalept.com/wp-content/uploads/2023/08/png/bactrim.html no prescription pharmacy

25 percent, which dropped to 9.50 percent within two weeks. This is a 4.6 percent capital gain, and an annualized return of 129 percent. This month, 10-year yields fell to 10.35 percent from 11 percent within a week.

online pharmacy buy spiriva inhaler with best prices today in the USA

This is a return of 3.5 percent, when annualized works out to 182 percent.

buy clomiphene online https://greendalept.com/wp-content/uploads/2023/08/png/clomiphene.html no prescription pharmacy

"Many of our clients made above average returns last year. Providing an advisory role, we allow customers to leverage and take trading positions," Kasun Palisena, chief executive of Perpetual Treasuries, said.

online pharmacy buy diflucan with best prices today in the USA

Investing in Sri Lanka bonds in the secondary market can be done in multiples of 50 million rupees, with 10 percent of bonds outstanding available to foreign investors. Several foreign funds have taken positions in Sri Lanka bonds in recent years such as emerging market funds of Franklin Templeton and Aberdeen.

buy elavil online https://qpharmacorp.com/wp-content/uploads/2023/08/png/elavil.html no prescription pharmacy

Sri Lanka's Central Bank tightened the Statutory Reserve Ratio last month citing rising inflation, after the US tightened interest rates. It is expected to watch for signs of inflation and international policy direction in coming months.

This week, the chances of the US Fed hiking interest rates in March fell to 40 percent.

Sri Lanka's Central Bank tightened the Statutory Reserve Ratio last month citing rising inflation, after the US tightened interest rates. It is expected to watch for signs of inflation and international policy direction in coming months.

This week, the chances of the US Fed hiking interest rates in March fell to 40 percent. buy antabuse online https://qpharmacorp.com/wp-content/uploads/2023/08/png/antabuse.html no prescription pharmacy

The island's bond yield curve, which may have made an exaggerated move upwards, has begun to correct. Palisena said Sri Lanka 10-year bonds provide some of the highest returns in the Asia Pacific, at 10.35 percent, while Indian treasury bonds, sought after by foreign funds these days, offer 7.

online pharmacy buy ciprodex with best prices today in the USA

online pharmacy buy tamiflu with best prices today in the USA

8 percent. Indonesia 10-year bonds yield 8.5 percent and Pakistan bonds yield 9.

online pharmacy buy strattera with best prices today in the USA

1 percent. US 10-year treasuries, in comparison, offer 2.

online pharmacy buy stendra with best prices today in the USA

04 percent, Japanese counterparts 0.2 percent, China 2.7 percent, Philippines 4 percent and Malaysia 4.

buy vibramycin online https://qpharmacorp.com/wp-content/uploads/2023/08/png/vibramycin.html no prescription pharmacy

1 percent. "Sri Lanka has never defaulted on sovereign debt, and with several foreign and local banks operating in the island, the market is well regulated," he said. Sri Lanka raised 1.5 billion dollars in a sovereign bond issue in October, an issue oversubscribed 2.

online pharmacy buy albenza with best prices today in the USA

2 times, priced at 6.85 percent. The island is expected to go to international markets this year to raise a similar amount. "It was a capital outflow that triggered a balance of payments deficit last year. We expect a flow of capital back to emerging markets this year," Palisena said.