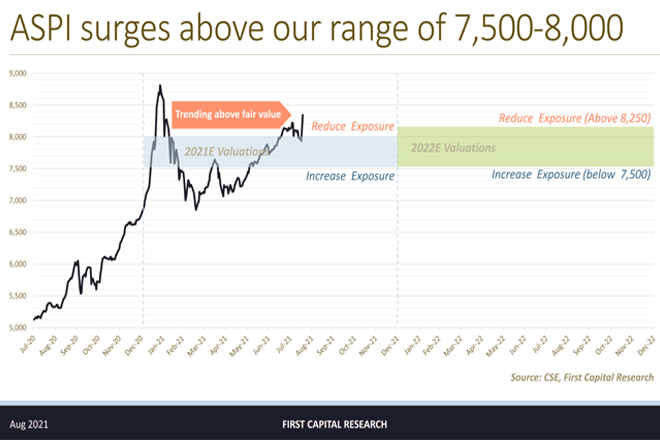

With the ASPI surging past the 8,000 mark for the 2nd time in 2021 and taking into account the economic uncertainties that exist, First Capital Research recommends reducing equity exposure to 65% from the current 90% raising cash allocation to 35% from 10%.

First Capital Research believe that the fair value for the ASPI stands at 7,500 8,000, considering the earnings that listed companies are generating and the risks in the system due to economic uncertainty. CBSL’s rate hike may also input additional pressure on interest rates adversely impacting equity investments.

Market is expensive! What are your options as an Equity Investor?

One option is; an equity investor could adopt to gradually start reducing equity exposure from ASPI level of 8,200 (200 above 8,000), because from 7,500 7,700 we saw a number of illiquid counters driving the market. But remember to reduce exposure to 65% and continue to reduce further, as the market climbs to higher levels which may provide the investor an opportunity to BUY if the market goes through a correction

Second Option is; switch your portfolio into more defensive and high dividend yielding counters. If you are an investor who would want to continue your exposure, then the ideal way to protect your capital would be to move into value counters such as Banking and Dollar Income companies (Eg: TJL, HAYL, EXPO, HAYC, WIND, LVEF) while high dividend yielding companies mostly in Food, Beverage and Tobacco sector and Material sector are preferred (Eg: CTC, NEST, LLUB). Life Insurance sector could also be highlighted, as the sector benefits from rising interest rates.

buy grifulvin online buy grifulvin online no prescription