Jun 22, 2020 (LBO) – PricewaterhouseCoopers (PwC) Sri Lanka recently hosted a webinar on Colombo Port City and its potential impact on the Sri Lankan economy.

The event speakers included Thulci Aluvihare, Head of Strategy and Business Development – CHEC Port City Colombo (the “Project Company”), Aruna Perera, Director – Corporate Finance & Valuation Consulting and Dr. Wignaraja Ganeshan, Executive Director – Lakshman Kadiragamar Institute of International Relations and Strategic Studies (LKI).

The Port City SEZ was launched in 2014 with the intention of being a world-class smart city in South Asia Sri Lanka. It's particularly significant because it's the single largest foreign investment in Sri Lanka’s history. Plans are underway to accelerate the timelines of the project and a committee of experts was appointed to study the project and its policy regime. Unfortunately, with the emergence of COVID-19 crisis, the Government of Sri Lanka (GoSL) has shifted its focus to look at the pandemic and the resulting economic impact.

Key takeaways from the discussion

Can Port City be positioned as a modern services hub?

Dr. Wignaraja spoke about the published research study conducted by LKI which looked at the state of play of the services industry globally and Sri Lanka role in modern services development. The study also looked scenarios on how the Port City Colombo could evolve over the next 20 years given alternative assumptions about domestic and international factors. Finally, the study benchmarked national policies and SEZ conditions in Sri Lanka against those in Asia and the Middle East including Malaysia, India, South Korea and United Arab Emirates.

He said that findings suggested that while traditional services (such as public administration, education, trade, investment, retail and construction) are a foundation for many economies looking at modern services (such as IT, finance, insurance and professional services) to drive economic growth and structural transformation. Modern services are important because they're associated with better productivity, growth and exports which are critical for a country like Sri Lanka which has a foreign exchange constraint and needs to provide high value jobs for its people.

Based on the analysis of successful SEZs in Asia and the Middle East, Dr. Wignaraja argued that factors like a business-friendly regime, strong diplomatic relations with neighboring countries, comprehensive trade and investment agreements provided the confidence for investors to make these SEZs successful. Another important factor is the access to a pool of talented graduates trained in science, technology, engineering and mathematics (STEM) subjects as well as business studies and economics. Finally, he said that the formulation and the implementation of a coherent policy framework was essential to realize the full potential of the Port City Colombo.

What is the economic impact from the Port City to Sri Lanka?

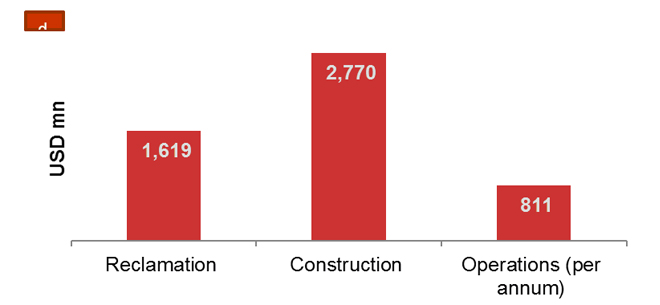

Aruna Perera explained the basis of which PwC Sri Lanka evaluated the economic impact of the Port City to the Sri Lankan economy. The project was divided into three distinct stages; 1) Reclamation, Infrastructure Development and land lease 2) Construction 3) Operation. The impact was analyzed using the parameters; 1) of Employment 2) Foreign direct investments 3) Balance of payments 4) Value addition and 5) Government revenue.

According to the Project Company, the reclamation of land has already completed, and the construction stage is to start in 2021 and complete by 2041.

The Reclamation and Infrastructure Development and Construction stages have a one-off impact during the project period. But more importantly, Operational stage has a recurring impact every year. To measure the impact of the Operational stage, PwC looked at the impact that would have been there in a mature year of operation of the businesses to be located within the Port City. For the impact assessment, data collection was conducted at micro, meso and macro levels.

Three types of impacts were measured, namely 1) Direct 2) Indirect and 3) Induced. For an example, assume that there's a hotel in the Port City that adds value to the economy, generates revenues and employment. Such contribution is the direct impact to the economy. The indirect impact is something slightly beyond. Assume the same hotel in the Port City buys vegetables from farmers in Kandy. The Farmers will get an income and will grow to supply to the hotel in the Port City. It is called the indirect impact. The induced impact goes even beyond that. Let's say that a Farmer in Kandy employs five labourers in his field. The farmer will pay money to the employees who in turn will go on to create a demand for goods and services (e.g. buy a shirt).

There are multiple sectors planned to be operated in the Port City such as an international school, a hospital, a convention center, an integrated resort and a theme park. In addition, there are retail shops, supermarkets, office space, residential apartments as well as well as various other business centers. These are all specified in the Development Control Regulations (“DCR”). The above information was extracted from the DCR when building our models to estimate the economic impact.

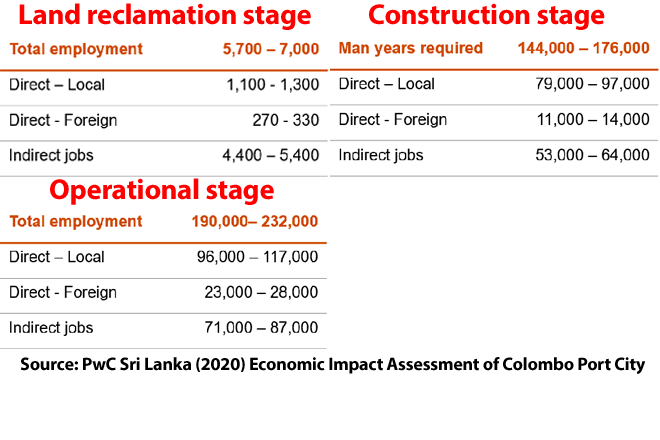

Employment

PwC evaluated potential employment, foreign indirect investments, balance of payment impact, value addition and finally government revenue at different stages of the project. Based on our estimations, during the Construction and Operational stages, the Port City will generate 175,000 and 200,000 jobs respectively.

Another important aspect that has to understood is the knowledge transfers. As the foreign employees that are expected to be employed in the Port City might have been exposed to state of art technology and knowledge, such knowledge may get shared with local employees. This will improve productivity and increase the income generating capability of local employees.

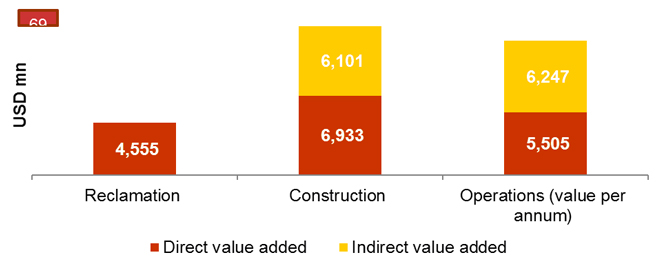

Value addition

In terms of Value addition during the Reclamation and Infrastructure Development stage, PwC considered the excess of leased value of land (approximately 178 hectares) over various input costs to reclaim such land. Similarly, during the Construction stage, when the apartments are sold, excess of sales proceeds over the material cost contributed mainly to the value addition. For the Operational stage, PwC looked at the difference between the revenues generated and various intermediate expenses to arrive at the value addition. The value addition in the first two stages (USD 4.6 billion in reclamation stage and USD 13 billion in the construction stage) are one-off impacts. During the Operational stage, USD 12 billion of value addition is estimated to occur annually as companies produce as services, export and trade. For the estimation, PwC looked at both direct and indirect impact when computing the value addition.

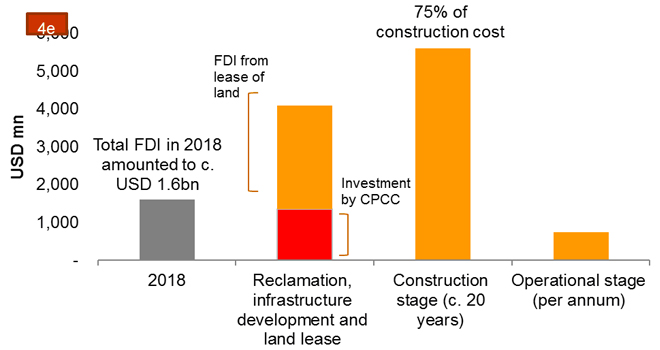

Foreign direct investments

During the land reclamation foreign direct investments will come from two specific sources; 1) Port City’s investment of USD 1.4 bn 2) FDIs from leasing the land. During the construction stage, developers will invest in developing the building infrastructure to boost FDIs. Finally, in the Operational stage, there will be recurring FDIs due to reinvestment of profits.

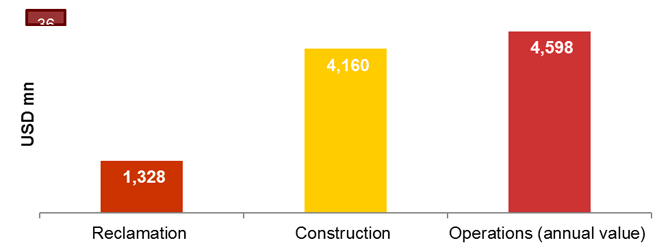

Balance of payment

Balance of payment will be benefited by the FDIs and few other sources of revenue. For example, during the construction stage, PwC expect the apartments and houses to be sold to foreigners. During the operation stage a lot of companies will generate export revenues. Meanwhile, boost in tourism from the Port City and the related receipts will further improve Balance of Payments.

Government revenue

In terms of Government Revenue, the two main sources will be tax and non-tax revenue. If you look at the non-tax revenue, the GoSL is going to get 62 hectares of land which they can lease out on a 99-year basis lease. Hence, GoSL will receive a major part of non-tax revenue from this source. There will also be revenue from charges on approvals and licenses to be given by the Government. Tax revenue will be generated through Stamp Duty, Income Tax, VAT and Tax on Employment Income.

What are the challenges for the Port City especially amidst the uncertainty and volatility of current markets? How has investor interest been so far? What incentives are offered to make it an attractive proposition?

Thulci stated that the reclamation work was completed during 2019 and now the Project Company have commenced the construction of infrastructure such as utilities, road network and the landscaping of public spaces. He further stated that due to the COVID-19 pandemic there has been some slowdown in activity but with the country getting back to normalcy, the project can also commence construction activities to get back on schedule.

He further mentioned that the Project has floated 10 Requests for Proposals (RFPs) for 10 land slots. The Memorandum of Understanding (MoU) was signed on the Marina with a local party as a temporary arrangement for two years to create the footfall that is required until Port City signs with an international marina operator. Another RFP is for the investment in a mixed-use development project which consists of office, residential and retail space on a three-hectare land extent. However, he further mentioned that during these challenging times it is important to instill investor confidence. The project company who had already invested USD 1.4 billion on the reclamation works, have come forward to invest another a billion dollars on the vertical development.

However, based on their market sounding exercise, he further stated that the investor reactions have been mixed. This was mainly due to Easter Sunday attacks last year and then obviously the recent pandemic. Some investors are adopting a wait and see approach on how the current situation transpires albeit some are quite confident that given the long-term nature of the project, the COVID-19 impact will only be short-term.

He further stated that it is important to recognize that there is intense competition in the region and for the Port City to be positioned as an attractive proposition, the project needs to be competitive to attract foreign capital flow. Thulci also highlighted that the proposed SEZ law is crucial for the Port City to be able to market and position competitively.

Thulci mentioned that Port City was structured in two ways; 1) Hard infrastructure 2) Soft infrastructure. The Port City project is a public private partnership where the Project Company has come forward to make the investment to have the required Hard infrastructure. The GoSL have to make sure that the Soft infrastructure is in place so the Port City can go to market. There has been delays from the GoSL in getting the Soft Infrastructure implemented. He is presently aware that the three-member cabinet committee appointed to review the drat SEZ law has concluded its review and hopes that the Port City Special Economic Zone Law could be implemented before the end of 2020.

What insights might be drawn from more advanced services-based economies and established SEZs for developing of the policy framework for Colombo Port City?

Dr Wignaraja said that the LKI Research showed that investors require a law that’s clear and transparent with regard to property rights of investors, tax concessions and also market access to large economies in India and East Asia. The negotiations with India on the upgraded trade agreement will be crucial for attracting investments from Indian investors. Likewise, he further stated that Sri Lanka needs to have a trade agreement with China and make the Sri Lanka-Singapore trade agreement active to bolster investor confidence from wealthy Southeast Asian economies including Singapore, Malaysia, Thailand and Indonesia. Furthermore, he underlined that Sri Lanka needs to tackle long-term bottlenecks in human capital, infrastructure and financial markets.

The signal that Sri Lanka is “open for business” needs to be clearly articulated not just by statements made but also by concrete actions on the ground such as laws, infrastructure, and education. Dr. Wignaraja argued that potential investors pay careful attention to Sri Lanka’s annual ranking in cross-country benchmarking exercises of investment climates like the World Bank’s Doing Business Index and the World Economic Forum’s Competitiveness Index.

Is there any impact from Port

City to the environment?

Thulci mentioned that the Port City project had completed three Environmental Impact Assessments (EIA) - two were done on the reclamation stage, which was made available for public scrutiny because protocols need to be followed.

The Port City was issued an EIA license to proceed with conditions. For an example, the first EIA for reclamation stipulated over 70 conditions which were addressed based on the Environment Management Plan. The Third EIA was done for vertical development where the same procedure was followed. The license was issued based on 53 conditions stipulated in the license. He further stated that there are 26 government agencies currently monitoring the Port City project and he can assure that all environmental protocols and international standards have been met.

DCR is an international standard guideline where each developer needs to adhere to when developing the land plots of the Port City. It’s an extensive document which includes the guidelines and framework for urban design, utility, landscaping and more importantly sustainability.

The impact from the rise of the sea level due to climate change and other environmental factors, have been studied using analytical models and necessary steps are taken to address them.

Why is the development of the Port City spanning over 20 years?

Thulci highlighted that the Port City could be actually built within 10 years but only if there is adequate demand. Depending on the demand, the project can take 10 years, 20 years or if the demand is subdued it can even take 30 years because investors need to have confidence to come and build on it.

In terms of development, first phase (first 10 years) will cover predominantly commercial office. The second phase is more driven by residential requirements. The rationale is that Trade and Commerce has to commence for the Port City to generate demand for the residential space.

What economic measures should Sri Lanka take to overcome the COVID-19 pandemic economic shock and to what extent can Port City be a catalyst for the recovery?

Dr. Wignaraja highlighted that 2020 is likely to see negative growth globally in the wake of the COVID-19 crisis. He said Sri Lanka had handled the public health emergency well but the economic fallout from the pandemic would be significant. Sri Lanka’s growth could be less than the 2.3% recorded in 2019 and possibly the worst rate in its recent development history. Much will depend on the US-China dynamics and supply chains getting relocated from a manufacturing point of view. However, it is important to note that the Port City is a services hub not an industrial one. To be competitive Sri Lanka needs to have a tax and policy regime to position itself as a business-friendly nation. He further stated that a ranking of 99th position on the World Bank’s Doing Business Index is low by the standards of other upper-middle income economies in Asia and that Sri Lanka should ideally target being in the top 35 or 40 in the world by 2025, which requires a major effort in cutting red tape affecting business and digitizing all government services.

Dr. Wignaraja expressed concerns about the future employability of local graduates in the Port City. Despite a possible reversal of the brain drain, there are urgent issues to be addressed in the university system including a skill mismatch. The President has recognized this problem and underlined the need to move towards a curricula that suits the Port City (that includes STEM subjects, IT skills and foreign languages). Raging has been outlawed but better enforcement is needed.

Dr. Wignaraja that it is critical that the Port City should be seen not as an enclave but as a vehicle to drive modern services sector developed which is linked to the rest of the Sri Lankan economy. Since the GoSL needs the support of businesses including the port city to achieve a high growth trajectory it needs to create an overall environment that is conductive to do business and foster economic growth in the future.

Can local contractors bid for projects in the Port City?

Thulci mentioned that there are no restrictions on local contractors bidding for port city projects. Out of the total workforce of 1,600 on site, approximately 80% are Sri Lankans. Although, the EPC contractor is China Habour Engineering Corporation, there are over 30 local subcontractors already working on the reclamation and internal infrastructure development stage. For instance, during COVID-19 lockdowns, the construction came almost to a stop because all the operators of machines, cranes and excavators are locals.

However, when the investors lease these plots, they have the right to hire their own contractors but typically if there is scale locally, because of the cost factors, they would tend to hire local contractors. However, productivity may be of concern.

A flat rate of LKR 13 mn per perch was used for the economic impact assessment, how will this be different from reality?

Thulci mentioned that the value of land again depends on the purpose and use of the plot. The value will differ from a mixed-use development to a hotel. He further stated that that it will not be too different to the prevailing market rates in Colombo 01.

Aruna stated that when estimating land values there were various factors to be considered. He stated that PwC had looked at the recent transactions that took place and the fact that Port City land transactions will not be outright sales but 99-year leases. The value of land will vary from one plot to the other based on the use and the restrictions specified in the DCR (e.g. No of stories allowed)

Another aspect that needs to be considered is that whether the release of port city land will create an oversupply condition in the market. Also, the fact that the land is within the port city may demand a premium due to its location. Considering all these, a conservative value of approximately 13 million a perch was decided, but it could vary from one plot to another.

On the supply of land, Thulci mentioned that Port City has access to a large pool of prime land plots and will ensure that market will not be flooded so that the prices will not really bottom out. He further mentioned that they will be strategically releasing those lands parcels into the market and therefore there will not be a slump in prices or an unusual increase.

In terms of recent sales volumes, it is evident that post Easter Sunday attacks and the COVID-19 pandemic, it has significantly slowed. However, once the situation reaches some normalcy average velocity of apartments per month will be around 50 to 60 a month and it may take five years from now for the existing unsold inventory to be sold. By the time, Port City comes to the market it will take another four to five years. Hence, Port City is confident that it will not be flooding the existing market. Furthermore, he mentioned that historical demand patterns indicate that 90 to 95 percent of the demand has been from Sri Lankans and Sri Lankan Expats. He further highlighted that Sri Lanka has not really even scratched the surface of attracting foreigners to invest in apartments. He further mentioned that Port City does not therefore foresee an oversupply condition.

What is the impact to Electricity, Water and other utilities from Port City? What kind of administration will Port City fall under? What kind of law will be applicable?

Thulci mentioned that they have modeled the energy and water usage of the port city. He further mentioned that development of all internal utility infrastructure is the responsibility of the Project Company and it is the responsibility of the GoSL to bring the required connectivity to the periphery of the Port City. However, if there are short falls on the generation plan from the GoSL, the Port City will have an impact. As a contingency, the Project Company are also evaluating alternative plans.

On the administration front, Port City was declared as a part of Colombo. Very importantly, there are two things to be noted. Firstly, an estate management company will be set up as a joint venture between the GoSL and the Project Company. This joint venture company will administer and manage the common areas within Port City which includes parks, waterways, roads and other common areas to ensure of an efficient service and quality. There will be a Port City Authority or a Commission which would be a government body incorporated by an Act of Parliament to administer any business and investment activity within port city and required a license to be obtained through this Authority or Commission. The proposed government authority or commission will operate within Port City so that it will be the administrative arrangement for managing the hard and soft infrastructure. These licenses will be reviewed and renewed to ensure compliance.

Finally, he further stressed that the landlord of the port city is GoSL, and the Project Company has been given a certain amount of land parcels on a 99-year lease to monetize for the investment already made.

On a different note, similar to the Industrial Zones of the Board of Investment, which is more manufacturing oriented, the Port City is going to be service-oriented Special Economic Zone.

He further stated that the Port City can be a tool to reform some laws and regulations in a controlled environment. It can also act as a solution for the GoSL to test some of these policies such as Smart Taxing. They can then selectively roll it out to the rest of Colombo and Sri Lanka.