online pharmacy cymbalta no prescription

“The possibility of a rate cut is almost completely eliminated amidst continuous weakening in the currency and continued foreign outflows,” the firm said.

online pharmacy neurontin no prescription

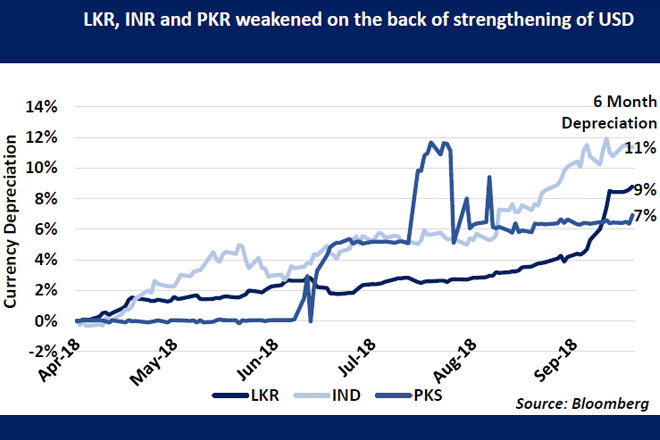

“However, we are of the view that a 20% probability exists for a rate hike, depending on the CBSL expectations of the timing on the debt-driven foreign inflows.” First Capital Research said the expected debt driven inflows have so far delayed by almost 5 weeks and are of paramount importance to boost the reserve position. Heavy foreign outflows considerably lower foreign currency reserve position and lower bond yields resulted in the currency suffering an MTD depreciation of 4.6 percent against the greenback in September. The research arm said over the last 3 weeks the overall yield curve experienced a steep upward movement as the yields of more liquid short to mid-tenure maturities spiked by almost 100bps. “Stabilization of LKR: USD at LKR 169 levels was witnessed subsequent to the upward shift in the overall yield curve, coupled with relatively weaker dollar witnessed over the last couple of days,” the firm said. US Federal Reserve, as expected, increased rates by 25bps to 2.25 percent in Sep 2018 and they expect additional rate hikes to take place predicting 3 hikes for 2019 compared to the previously expected 2 hikes. “Expected debt driven inflows from the USD 1Bn Syndicated loan from the China Development Bank and USD 250Mn from the issuance of Panda Bond is key to improving the reserve position.” Central Bank said the next Monetary Policy Review which was previously scheduled to be issued on Friday, 28 September, has been rescheduled to Tuesday, 02 October 2018.