First Capital maintains the domestic debt restructuring (DDR) probability at 20%, highlighting that the domestic debt restructuring probabilities stand low for Sri Lanka.

Following are the arguments for and against presented by First Capital in terms of DDR.

Arguments Against Local Debt Restructuring

• Rupee investors equivalent to having suffered debt restructuring: With the steep depreciation and high inflation faced by local investors, buying power of the local currency investors have almost halved resulting in a major set back. In such a situation it is unfair to again consider restructuring of local debt.

• Requirement to recapitalize selected banks: Restructuring of domestic debt may cause a detrimental impact to the financial institutions Banks, Finance Companies, Insurance companies and Pension Funds such as EPF which have invested a large portion of their assets in domestic debt and also are struggling amidst the ailing economic conditions. It is likely to cause a significant erosion in capital resulting in a Govt requirement to support to recapitalize some of the financial institutions which may again be a burden to the budget deficit.

• Ghana struggles to finalize DDR: 3 months after announcing domestic debt restructuring Ghana still struggles to implement DDR amidst the major impact to its financial system. The latest amendment to DDR illustrates insufficient impact total debt NPV but a severe impact to the financial system continues to be present.

Arguments for Local Debt Restructuring

• Debt Sustainability and Gross Financing Needs: SL’s debt to GDP is above 120% and Gross financing need to be at 25% while IMF expects both indicators to be at 100% and 15% over the medium term. With China maintaining a tough stance there is a possibility that external debt restructuring may not be sufficient to achieve the expected target, which may lead to domestic debt restructuring.

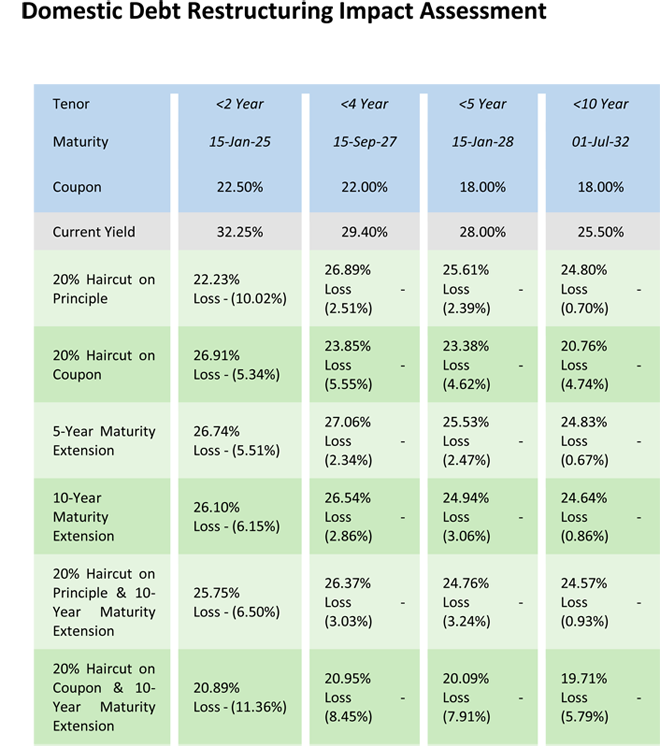

Domestic Debt Restructuring options

• Hair Cut on principle: The capital returned at the end of the period is reduced. The move is expected to reduce the overall debt stock.

• Hair Cut on Coupon: Adjusting the interest rates to be paid or coupon rates commonly known as coupon adjustment.

• Increase in the maturity period: Extending the repayment or maturity period

• Hybrid of above options: A Mix of some or all of the above