Oct 24, 2019 (LBO) – First Capital Research recommends investors to increase overall fixed income portfolio exposure to 50 percent from 45 percent.

The firm also recommends cutting carrying portfolio to 15 percent from 30 percent and to increase trading portfolio to 35 percent from 15 percent.

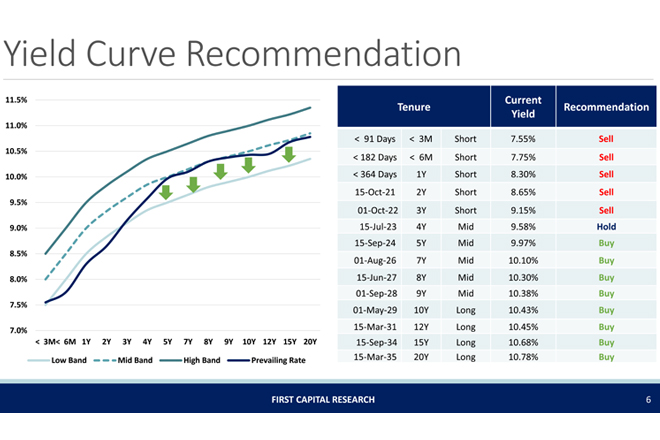

“We recommend cutting short tenor maturities of the carrying portfolio amidst the significant reduction in yields while we recommend an increase in 2023 and 2024 maturities in the trading portfolio due to attractive yields,” FCR said.

“With the present macroeconomic environment, we recommend reducing exposure in the carrying portfolio while increasing trading portfolio Yields of mid to long tenors 5 Y, 7 Y, 8 Y, and 9 Y are trading at attractive price levels to accumulate.

”

FCR expects market liquidity to improve and stay positive with the lower level of private credit growth post-presidential elections, with the possible easing off of political uncertainty and coupled with favourable macro environment, creates a strong case for foreign inflows potentially towards the end of 4 Q 2019.

Sri Lanka has also appointed lead managers for a 500 million dollars equivalent Samurai bond which will have a guarantee from Japan Bank for International Corporation (JBIC).

Sri Lanka’s next international sovereign repayment is only due in Sep 2020 amounting to 1 billion dollars while 1Q and 2Q 2020 constitute 0.9 billion dollars of SLDBs maturing.

“Raising funds well in advance for repayment is expected to significantly strengthen the macroeconomic outlook for Sri Lanka and to reduce unnecessary volatility,” FCR said.

“We expect reserves to be c USD 8.0Bn towards 2019 year-end while maintaining above USD 7.

0Bn by end of 1H 2020.”