buy azithromycin online https://fromaddictiontorecovery.com/NAV2/_notes/mno/azithromycin.html no prescription pharmacy

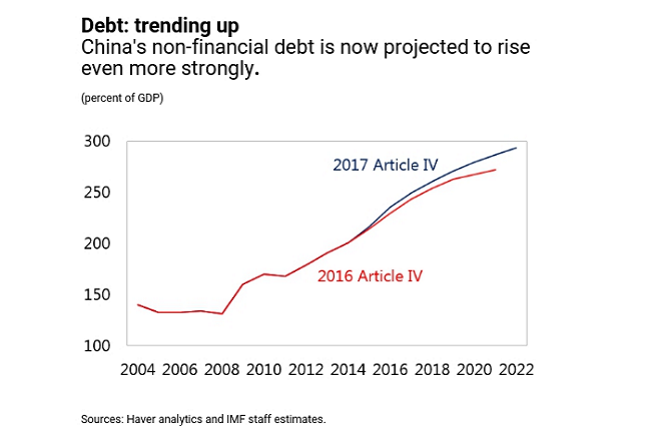

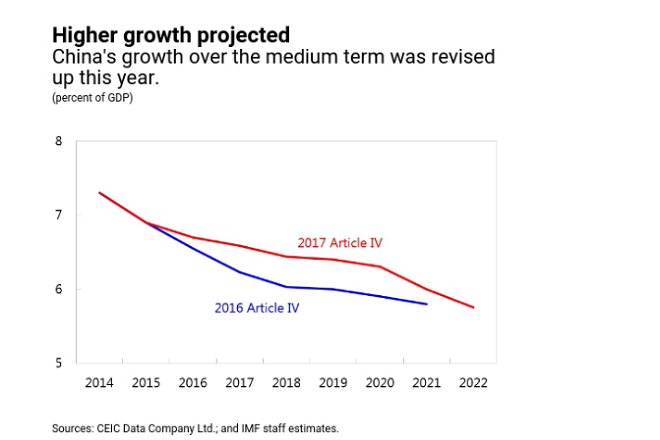

4 percent between 2017 and 2021, up from 6.0 percent last year, but has also flagged problems of debt rising to 300 percent of GDP.

online pharmacy buy abilify with best prices today in the USA

buy abilify online https://fromaddictiontorecovery.com/NAV2/_notes/mno/abilify.html no prescription pharmacy

China's total non-financial sector debt, which includes household, corporate and government debt, is expected to reach almost 300 percent of GDP by 2022, up from 242 percent in 2016. "This raises concerns for a possible sharp decline in growth in the medium term," the IMF said this week.

online pharmacy buy spiriva inhaler with best prices today in the USA

buy albenza online https://www.indcheminternational.com/wp-content/uploads/2022/08/png/albenza.html no prescription pharmacy

buy tamiflu online https://fromaddictiontorecovery.com/NAV2/_notes/mno/tamiflu.html no prescription pharmacy

buy priligy online https://fromaddictiontorecovery.com/NAV2/_notes/mno/priligy.html no prescription pharmacy

"The Chinese government has started to take important initial steps to facilitate private sector deleveraging ... These efforts should intensify, with the overarching priority being to focus more on the quality and sustainability of growth, and less on quantitative targets.

online pharmacy buy diflucan with best prices today in the USA

buy vibramycin online https://fromaddictiontorecovery.com/NAV2/_notes/mno/vibramycin.html no prescription pharmacy

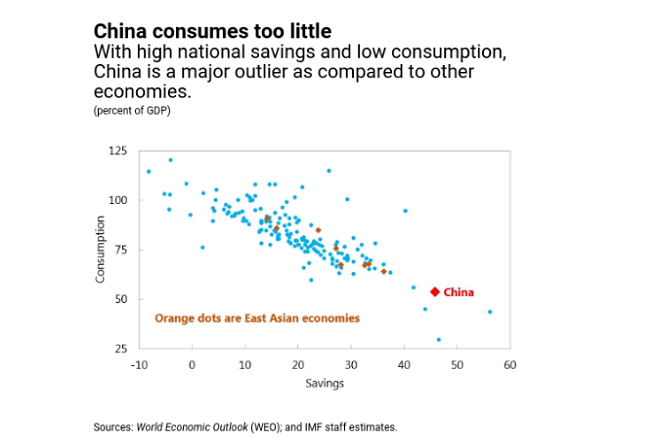

" At 46 percent of GDP, China’s national savings are 26 percentage points higher than the global average, largely due to the household sector, with consumption correspondingly low. To grow sustainably, China needs to boost consumption, the IMF said.

buy nolvadex online https://qpharmacorp.com/wp-content/uploads/2023/08/png/nolvadex.html no prescription pharmacy

"This (high savings) reduces the current welfare of Chinese citizens, fosters high levels of investment which are unlikely to be absorbed efficiently, and, were investment to fall, would lead to even larger current account surpluses, worsening global imbalances.

buy zofran online https://fromaddictiontorecovery.com/NAV2/_notes/mno/zofran.html no prescription pharmacy

" "China also needs to increase productivity. This can be done by making better use of resources that are currently going to loss-making (“zombie”) companies, overcapacity industries, and State-Owned Enterprises (SOEs)." This month, China reclaimed the title of being the largest foreign owner of U.S. government debt at $1.15 trillion, taking China above Japan, which offloaded billion in U.

buy doxycycline online https://qpharmacorp.com/wp-content/uploads/2023/08/png/doxycycline.html no prescription pharmacy

S. bonds during the month. China and Japan together own more than one-third of foreign-owned treasuries, according to the Financial Times.