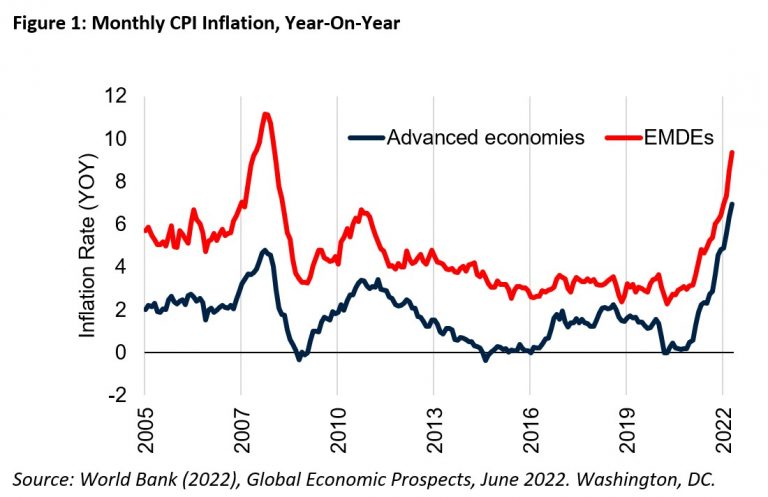

The world economy is showing signs of a serious slowdown due to overlapping crises including the Russia-Ukraine War, the COVID-19 pandemic, China’s real estate crisis and the global tightening of monetary policy. In June, the World Bank revised the 2022 growth prediction downward to 2.9% from its January forecast of 4.1%. The slowdown has come along with a decade-high bout of inflation worldwide with the global median Consumer Price Inflation (CPI) inflation rising to around 7.8% on a year-on-year (YoY) basis, the highest since 2008, according to April 2022 data (Figure 1). The emergence of a low-growth international environment together with a significant rise in inflation has raised concerns of stagflation; a period of low growth combined with high inflation.

The Effects of Stagflation

A global stagflationary environment could further weaken global economic growth while increasing inflation. To combat inflation, many central banks including the US Federal Reserve, the Bank of England and the European Central Bank have resorted to monetary tightening measures. The rise in global interest rates as a direct attempt to anchor inflation expectations will further subdue economic growth thereby increasing borrowing costs globally. This results in a downward economic cycle as rising borrowing costs will reflect in lower investments. The effects for developing countries could be more pronounced as inflation will hit the poorest and the marginalised the most. Weak global growth will decrease export income in these markets while higher global commodity prices will increase import expenditure leading to macroeconomic imbalances.

Risks for Sri Lanka

A global stagflationary environment can worsen Sri Lanka’s current economic crisis restricting growth and increasing inflation. Higher global borrowing costs will be detrimental to Sri Lanka’s future growth when the country resumes international borrowing once an IMF agreement is in place. The rise in commodity prices could further increase the country’s worsening food insecurity, with the World Food Programme reporting that 25% of the population is food insecure. Higher commodity costs will also increase import expenditure while lower global demand could reduce export revenue thus expanding the current account deficit. However, if global inflation is transient, the effects on the current account would be ambiguous. The global economic downturn will spark lower demand for commodities such as oil which could lower import expenditure but also reduce the demand for Sri Lankan exports.

Due to rising inflation and lower growth, the Sri Lankan economy is approaching stagflation. Growth expectations for the country have nosedived after the sovereign default with the economy projected to decline by -7.8% in 2022 and -3.7% in 2023 according to the World Bank. The combination of a myopic “organic” agricultural policy, the inflation pass through from the depreciation of the Sri Lankan Rupee by 80%, an expansionary monetary policy and global market conditions have resulted in inflation surging to 59% in June (YOY) (Figure 2).

The tightening global economic conditions along with domestic supply-side factors such as shortages in food and fuel will continue to drive inflation in the country. Increased policy rates to combat inflation will result in lower investments. These factors, combined with political instability, lower than expected remittances, and lower productivity due to acute shortages of essential items will further constrict the Sri Lankan economy, pushing it into stagflation.

Policy Options

Sri Lankan policymakers are constrained within this economic environment. The country will need to impose austerity measures to receive an extended fund facility from the IMF. These measures will include tax reforms to increase government revenue, curtailing non-essential government spending and reducing subsidies. While a fiscal stimulus package is out of the equation, the country needs to target the most vulnerable groups in providing emergency subsidies, as rising inflation and job losses have led to lower standards of living, especially among the vulnerable segments of the population. Due to financing constraints, Sri Lanka will have to look for further bilateral and multilateral aid in securing funding for short term, targeted “in-kind” transfers such as food stamps. It is also imperative to have a bridge financing arrangement, to import essential commodities like fuel, so that supply shortages reduce. This should help in keeping productivity intact and inflationary pressure in check.

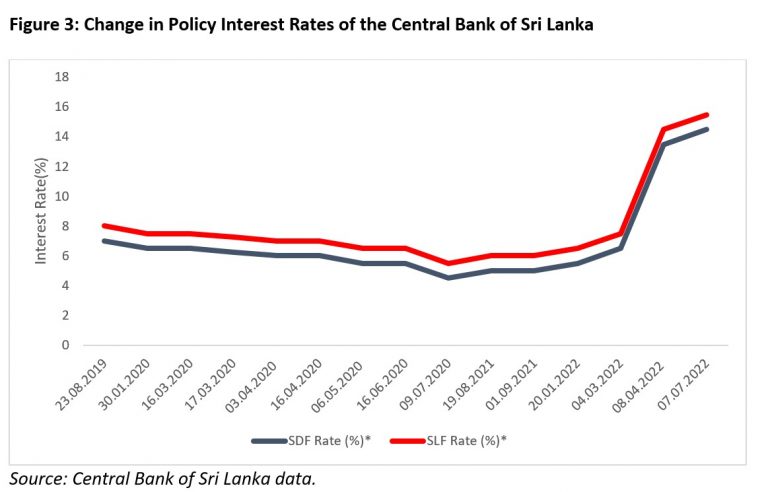

Monetary tightening should also continue. The CBSL hiked interest rates by 700 basis points in April this year. Interest rates were increased by another 100 basis points in July to control the rising inflation (Figure 3). Monetary policy decisions need to be communicated very clearly so that there is a stronger anchoring of inflation expectations. Anchored inflation expectations would limit a wage-price spiral to control inflationary pressure so that production costs do not rise further. Due to a global economic downturn, rising commodity prices and high rates of borrowing, Sri Lanka can expect a challenging external sector environment next year. Policymakers will need to understand these global challenges and make pragmatic economic decisions to minimise further damage to the economy.

About the Author

Binura Seneviratne is a Research Officer working on macroeconomic policy, poverty and social welfare research at IPS. He holds a Master of Economic Policy from the Australian National University and a BSc in Economics and Finance from the University of York. (Talk with Binura: binura@ips.lk)