Research Intelligence Unit, a consultancy firm specializing in real-estate says the sector will continue to be a good long-term investment while the current socio-economic crisis has impacted the industry adversely.

"What we have witnessed in 2022 is that real estate continues to offer a long-term refuge for many investors while the ‘buy-to-live’ market continues to spur domestic demand. However, the supply side of the industry has felt the impact of the current crises in multiple ways and may take longer to recover," the Research agency said.

The full Press Release is as follows ...

REAL ESTATE: RIU Annual Report 2022/23

This year has no doubt been the most challenging period for several decades for many industries, investors and the people as a whole. Despite these challenges, which are both home-grown and global in nature, the country is holding on to the hope of ending 2022 on a more positive note than it began. The construction and real estate sector is no different as the impact of vulnerability, uncertainly and chaos has hit most segments of this industry. However, on closer inspection, there are plenty of reasons to remain optimistic in the medium term and beyond.

Apartment absorption at record levels

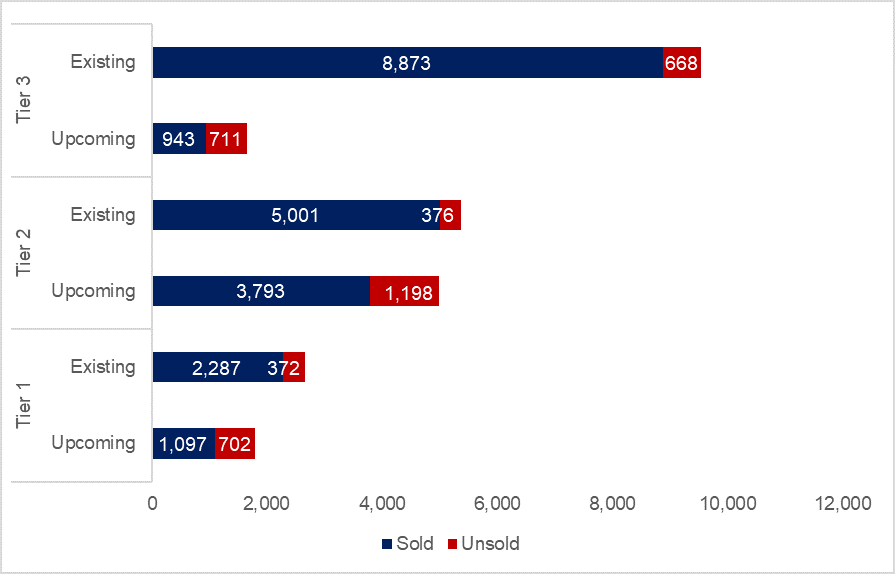

Sri Lanka is set to close out the year 2022 with approximately 26,718 Tier 1, 2 and 3 apartment units in total in the market. Among them, 17,390 units have been completed and despite the challenges posed by the macro environment, another 9,328 units are expected to be complete construction before 2024. Of the completed units, the highest absorption is to be found in tier 2 and tier 3 (93%) followed by tier 1 (86%). By contrast, of the inventory that is currently under construction, tier 2 has the highest absorption (76%), followed by tier 1 (61%) and tier 3 (57%). Across all completed and ongoing projects, Tier 2 has the highest absorption rate as 91% followed by 89% in Tier 3 and 81% in Tier 1. The Colombo city area has a higher absorption rate of 93% as compared with 87% in the suburbs.

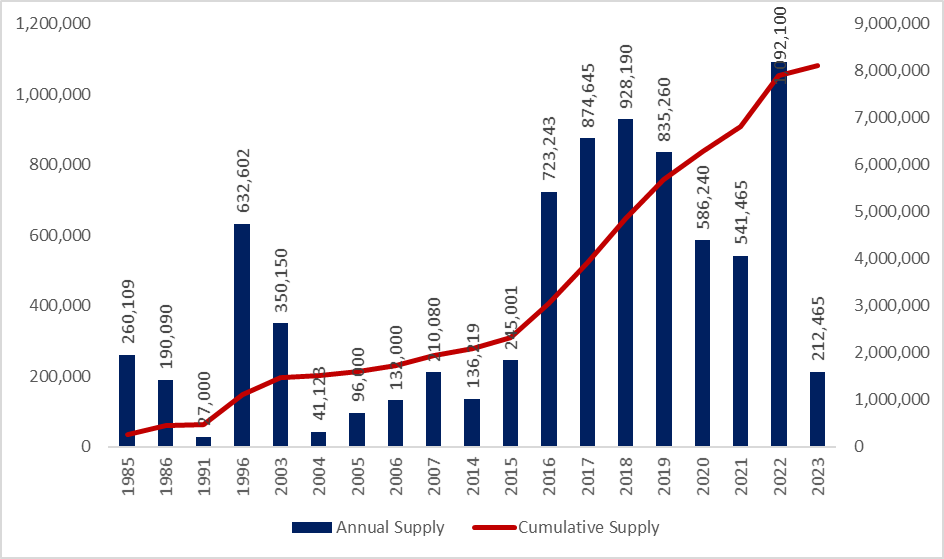

Several factors have resulted in a continued increase in absorption rates for apartments across all tiers. Not least, the fact that very few new projects have been initiated in Sri Lanka in the past three years has resulted in a slowing down of supply additions to the market. Initially the slowdown in supply was a result of market sentiments that were driven by the terror attack followed by covid. Since then, supply constraints have come in the form of domestic import restrictions for many essential construction materials combined with international supply chain issues that have also impacted cost and availability of materials.

Figure 1: Tier 1, 2 and 3 apartment sold vs unsold units

According to the group CEO, Roshan Madawela, ‘apartment rental yields in Colombo have been declining since 2019, mainly as a consequence of the fall in tourist arrivals in the island. The initial drop in visitors was caused by the April 2019 terror attack which was further exasperated by the covid19 lockdowns and airport closures. A partial recovery in 2021 has since been stifled in 2022 with the economic and political crises that triggered several important source markets slapping Sri Lanka with travel warnings. With most of these now being lifted, we expect rental yields to gain some traction in 2023’.

Commercial real estate, the sky has limits

The commercial property market is another key category in the real estate sector of Sri Lanka. This market segment consists of a variety of properties including single-tenant sites, small professional office buildings, mixed use developments and grade A skyscrapers. The commercial office market in Colombo had to endure many bleak months of covid lockdowns similar to other cities when people were forced to work from home. However, even after covid lockdowns had been banished into the dustbin of recent history, the lack of fuel and periodic civil unrest between March – July 2022 resulted in the normal operations of business and commerce being severely disrupted in the short-term.

The economic crises and fuel shortage that peaked during March-July 2022 resulted in sustained daily power cuts of several hours accompanied by acute petrol and diesel shortages to the extent that people were forced to work from home. Nevertheless, developers for the most part are emerging out of the wreckage of 2022 with their critical occupancy levels and lease rates largely intact.

Lessons have also been learned from the economic crises. For instance, at the height of the crises, large commercial buildings that were subjected to nation-wide power-cuts didn’t have fuel to operate their generators. This was of course disastrous for the occupants. The near future will no-doubt witness an increase in investment into solar power for office buildings in order to mitigate future risks.

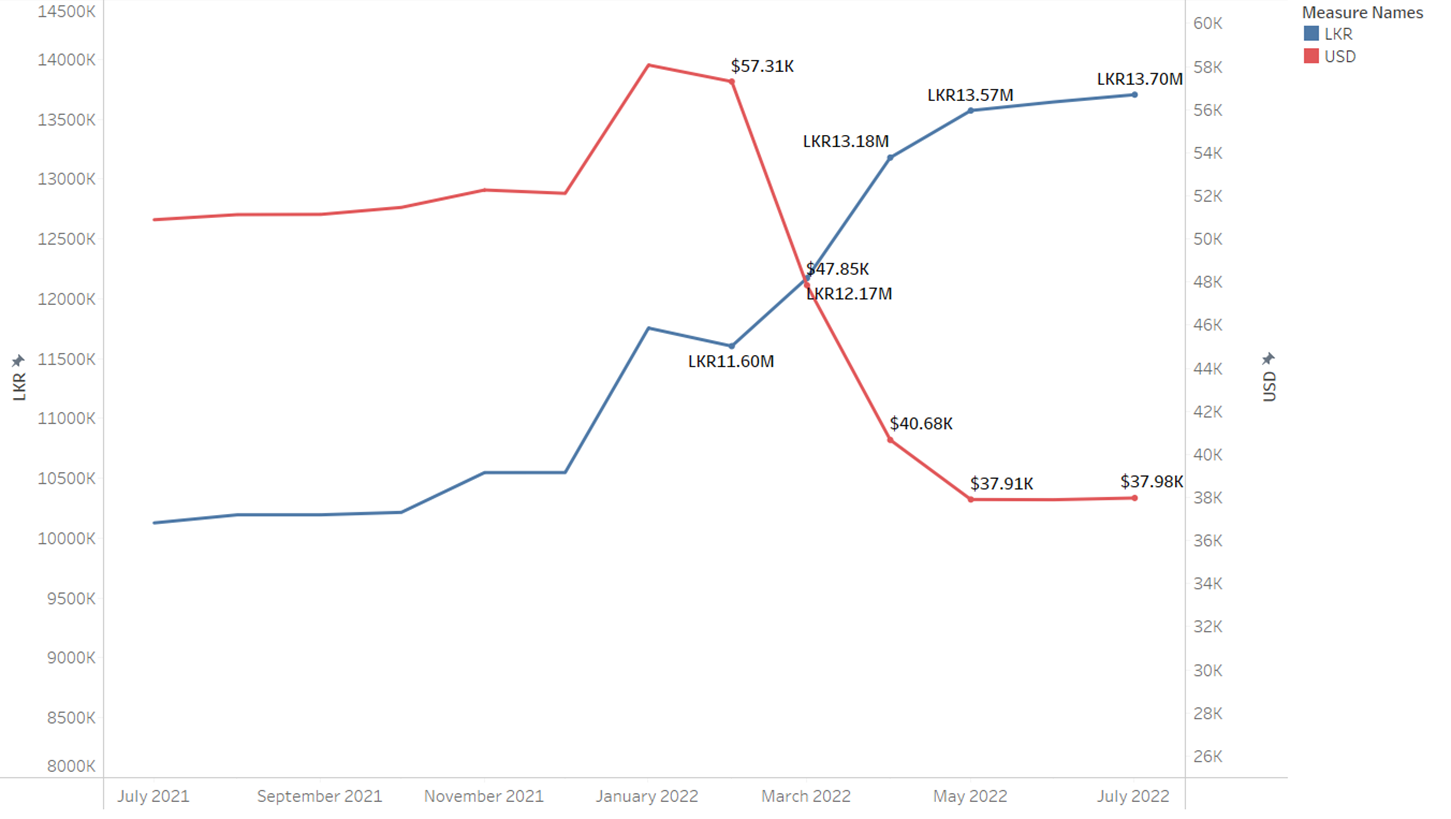

Perhaps the only silver-lining for commercial real estate in 2022 comes in the form of a staggering currency devaluation that has now made Colombo a much more competitive destination for MNC’s seeking grade A office space.

Not losing the plot

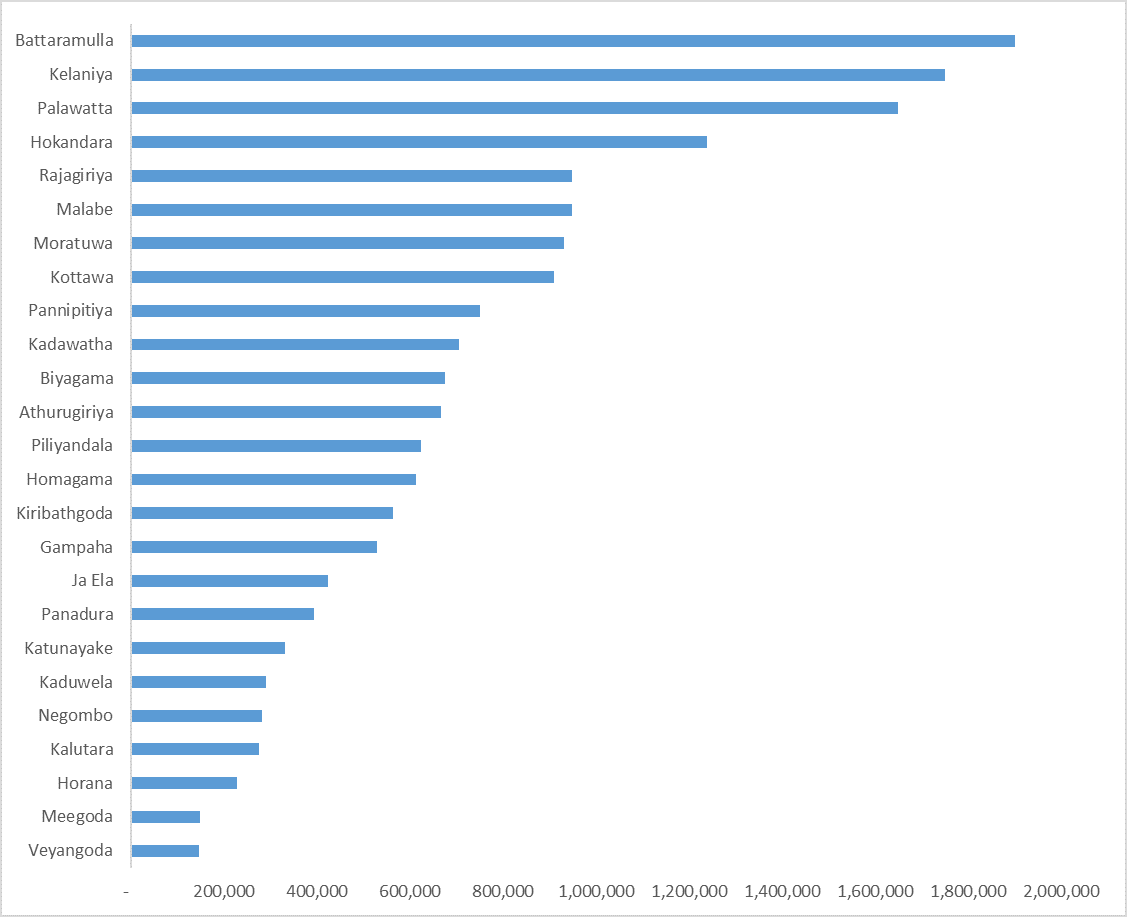

Plotted land projects are the most popular real estate option for the majority of people in Sri Lanka, especially at the mid-income levels. Typically, a developer will purchase a large land, clear the land, install basic infrastructure like water, electricity and drainage and undertake landscaping and beautification of the property before selling out small blocks of land. Some of the more expensive projects also have several features that are found in gated community projects like 24-hour security and a clubhouse.

However, plotted land projects are almost exclusively only to be found in the outer suburbs of Colombo and the Western province. The cost of land and the lack of availability of large plots in Colombo make these projects feasible only in more remote parts of Colombo as well as in the Western province and beyond into the other provinces of the island

Figure 3: Location wise average plotted land prices (LKR/Perch) according to the major plotted land projects within the area.

Source: Research Intelligence Unit (2022)

Outlook remains optimistic

What we have witnessed in 2022 is that this industry continues to be undeterred from a domestic demand perspective, with many investors finding refuge in real estate during difficult times. However, the supply side of the industry has felt the impact of the current crises in multiple ways. For starters, it was noted that construction inflation is currently estimated at over 200% and this is for materials that are available. For the most part, much of what is needed by the contractors cannot be sourced due to the import restrictions. It can also be noted that the situation with the supply of labour at all levels is rapidly becoming a concern as outward migration gathers pace. According to the government data, 587,979 passports have been issued by 24th August 2022. By comparison, only 382, 506 had been issued for the whole of last year.

A fundamental lesson from 2022 is a call to address the root causes of the problem that the island is facing now. The current political movement is unprecedented in Sri Lanka and is a good sign that the future will have cleaner and more responsible leaders. A cultural shift is needed and it appears to be taking place. Economically, the nation needs to remain resilient in the short term and focus on key fundamentals, including an export drive.

Overall, this is the right time to develop a new vision for Sri Lanka. Devaluation has made it attractive for diaspora and foreigners to now invest in that dream property on the beach or hills.

Source: Research Intelligence Unit (2022)