Regulated by Sri Lanka's Securities and Exchange Commission, investors get the benefit of diversification and liquidity to extract funds.

The tax free returns, when grossed up, compare well against bank fixed deposits, said Asanka Jayasekara, a fund manager at Guardian Fund Management.

If the corporate tax rate is 28 percent, a 10 percent yield when grossed up increases to around 13.8 percent.

A good pedigree is important too, and the parent companies of Guardian Acuity are blue-chip Carson Cumberbatch, HNB and DFCC Bank.

Guardian Acuity discloses its top five stock allocations monthly, which are currently Distilleries, Sampath Bank, Seylan Bank, Dialog Axiata and Aitken Spence Hotel Holdings.

Fernando said they disclose a lot more information such as fund allocations and credit quality of investments than required to by Sri Lanka's SEC. Some of the better managed Unit Trusts follow the same practice, she said.

For investors who want predictable returns over a short-term horizon, Guardian Acuity has a Money Market Gilt Fund, with 410 million rupees under management, and a Money Market Fund with 4.5 billion rupees under management.

The Money Market Gilt fund sticks to treasury bills and repurchase agreements, and the Money Market Fund diversifies into fixed deposits, government securities and commercial paper.

"We have an emphasis on quality. We make sure all investments are investment grade and above. We don't rely on the ratings alone, but have an internal research team dedicated to analyzing companies, cash flows and balance sheets," Sumith Perera, senior fund manager at Guardian Acuity Asset Management, said.

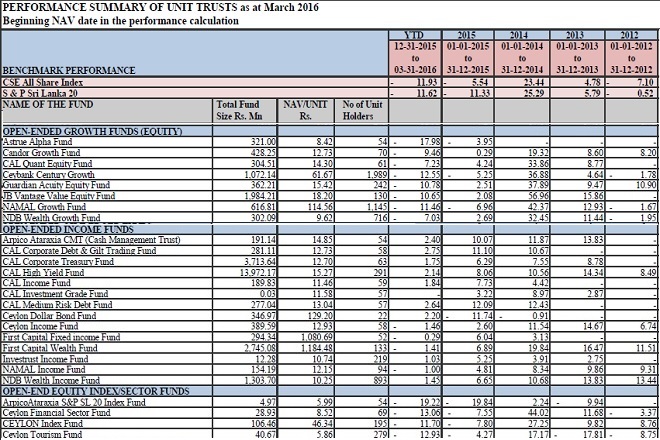

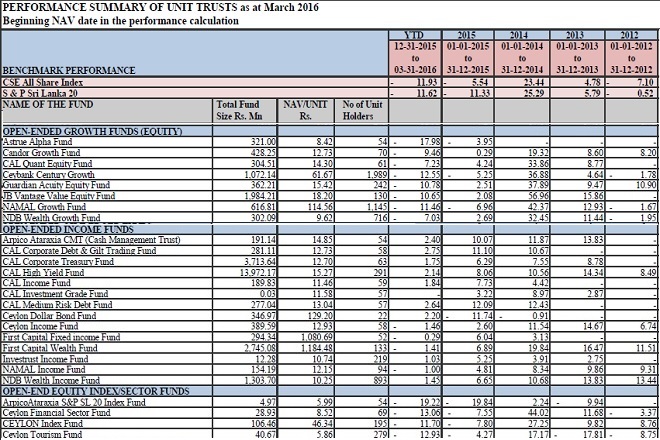

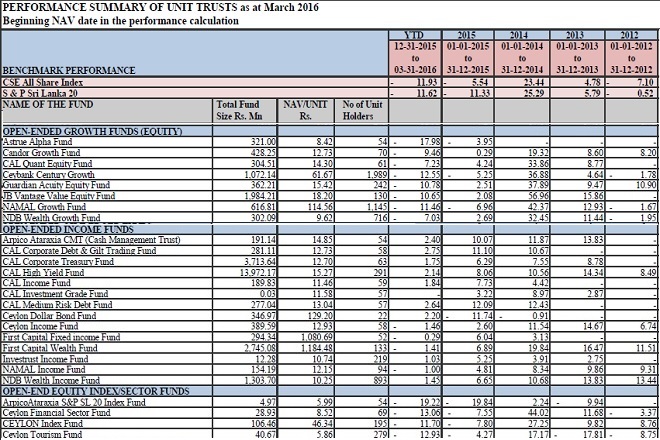

Over 70 unit trusts are regulated in Sri Lanka and registered with the Unit Trust Association of Sri Lanka (utasl.lk) under categories such as open-ended income funds, index funds, balanced funds, shariah funds, IPO funds and gilt and money market funds. Analysts say closer public scrutiny is needed to highlight the strong performers as well as the under-performers in the industry.

Regulated by Sri Lanka's Securities and Exchange Commission, investors get the benefit of diversification and liquidity to extract funds.

The tax free returns, when grossed up, compare well against bank fixed deposits, said Asanka Jayasekara, a fund manager at Guardian Fund Management.

If the corporate tax rate is 28 percent, a 10 percent yield when grossed up increases to around 13.8 percent.

A good pedigree is important too, and the parent companies of Guardian Acuity are blue-chip Carson Cumberbatch, HNB and DFCC Bank.

Guardian Acuity discloses its top five stock allocations monthly, which are currently Distilleries, Sampath Bank, Seylan Bank, Dialog Axiata and Aitken Spence Hotel Holdings.

Fernando said they disclose a lot more information such as fund allocations and credit quality of investments than required to by Sri Lanka's SEC. Some of the better managed Unit Trusts follow the same practice, she said.

For investors who want predictable returns over a short-term horizon, Guardian Acuity has a Money Market Gilt Fund, with 410 million rupees under management, and a Money Market Fund with 4.5 billion rupees under management.

The Money Market Gilt fund sticks to treasury bills and repurchase agreements, and the Money Market Fund diversifies into fixed deposits, government securities and commercial paper.

"We have an emphasis on quality. We make sure all investments are investment grade and above. We don't rely on the ratings alone, but have an internal research team dedicated to analyzing companies, cash flows and balance sheets," Sumith Perera, senior fund manager at Guardian Acuity Asset Management, said.

Over 70 unit trusts are regulated in Sri Lanka and registered with the Unit Trust Association of Sri Lanka (utasl.lk) under categories such as open-ended income funds, index funds, balanced funds, shariah funds, IPO funds and gilt and money market funds. Analysts say closer public scrutiny is needed to highlight the strong performers as well as the under-performers in the industry. SL Funds: Equity Unit Trusts now outperform market, says Guardian Acuity

May 27, 2016 (LBO) - There's good news in fund management. Most of the professionally managed funds that invest in the Colombo market tend to outperform the market.

In 2014, for instance, the Guardian Acuity Equity Fund, gave a return of 37.9 percent, compared with the All Share Price Index (ASPI) which rallied 23.4 percent.

Sri Lankan equity funds, or open-ended growth funds, outdid the market in 2012 and 2013 as well. They gave returns of between 8.2 and 15.86 percent annually, although some didn't do so well.

Even in 2015, which wasn't a good year for stocks, Guardian Acuity gave a return of 2.5 percent, when the S&P Sri Lanka 20 index plunged 11.33 percent.

For investors who want higher returns linked to Sri Lanka's emerging market, equity Unit Trusts offer an attractive proposition. But outperforming the market isn't the only criterion for evaluating a fund.

Lanka Business Online, which plans a series of articles on Sri Lankan Unit Trusts, spoke to the fund managers at Guardian Acuity to get their insights.

Similar to mutual funds in the U.S., the Sri Lankan variety gives investors tax-free returns. Foreign investors can invest as well.

But picking an equity fund is a bit like picking a stock. An investor should have good timing, be willing to ride the waves, and in Sri Lanka, take a three to four year view.

"We encourage investors to take a three to four year view rather than look for short-term returns," said Ruvini Fernando, the joint CEO of Guardian Acuity Asset Management. She highlighted that steady long-term returns is a good option within this asset class.

After the end of a war with Tamil Tiger separatists in 2009, Sri Lanka is showing strong growth, with some sectors such as tourism booming. Many Sri Lankan companies offer attractive ROEs, but it generally takes a fund manager to extract those returns.

Since the fund launched in 2012, the 410 million rupee Guardian Acuity Equity Fund has given a 65.5 percent absolute return as of April 2016. In comparison, the All Share Price Index has grown by 18.9 percent.

In annualized terms, the fund has given a return of 12.8 percent, compared with a 4.25 percent annualized return on the All Share Price Index during this period.

Equity funds in Sri Lanka have to compete with government securities which often crowd out the private sector. One-year treasury bills at the beginning of 2012 yielded 9.3 percent, which rose to 11.38 percent at the beginning of 2013. They ranged around 6-7 percent for most of 2014 and 2015 and currently yield 10.3 percent.

Risk-free Treasury bills, which are an important benchmark for Unit Trusts in Sri Lanka, should experience a structural adjustment downwards as alternative instruments are better priced.

Share owning democracy

Although the current Sri Lankan government has promoted share ownership to the public, it seems individual investors would be better off investing via an equity fund.

"A share owning democracy is a great idea, but the way people can manage risks and volatility better is by using an instrument like a unit trust," she said.

This is because they often don't have the time to monitor, react to market developments and pour over research.

"If you are a professional and you want to access capital markets, be it securitizations or commercial paper, or stocks and bonds, there are fund managers who will dedicate their time to doing that for you," she said.

Regulated by Sri Lanka's Securities and Exchange Commission, investors get the benefit of diversification and liquidity to extract funds.

The tax free returns, when grossed up, compare well against bank fixed deposits, said Asanka Jayasekara, a fund manager at Guardian Fund Management.

If the corporate tax rate is 28 percent, a 10 percent yield when grossed up increases to around 13.8 percent.

A good pedigree is important too, and the parent companies of Guardian Acuity are blue-chip Carson Cumberbatch, HNB and DFCC Bank.

Guardian Acuity discloses its top five stock allocations monthly, which are currently Distilleries, Sampath Bank, Seylan Bank, Dialog Axiata and Aitken Spence Hotel Holdings.

Fernando said they disclose a lot more information such as fund allocations and credit quality of investments than required to by Sri Lanka's SEC. Some of the better managed Unit Trusts follow the same practice, she said.

For investors who want predictable returns over a short-term horizon, Guardian Acuity has a Money Market Gilt Fund, with 410 million rupees under management, and a Money Market Fund with 4.5 billion rupees under management.

The Money Market Gilt fund sticks to treasury bills and repurchase agreements, and the Money Market Fund diversifies into fixed deposits, government securities and commercial paper.

"We have an emphasis on quality. We make sure all investments are investment grade and above. We don't rely on the ratings alone, but have an internal research team dedicated to analyzing companies, cash flows and balance sheets," Sumith Perera, senior fund manager at Guardian Acuity Asset Management, said.

Over 70 unit trusts are regulated in Sri Lanka and registered with the Unit Trust Association of Sri Lanka (utasl.lk) under categories such as open-ended income funds, index funds, balanced funds, shariah funds, IPO funds and gilt and money market funds. Analysts say closer public scrutiny is needed to highlight the strong performers as well as the under-performers in the industry.

Regulated by Sri Lanka's Securities and Exchange Commission, investors get the benefit of diversification and liquidity to extract funds.

The tax free returns, when grossed up, compare well against bank fixed deposits, said Asanka Jayasekara, a fund manager at Guardian Fund Management.

If the corporate tax rate is 28 percent, a 10 percent yield when grossed up increases to around 13.8 percent.

A good pedigree is important too, and the parent companies of Guardian Acuity are blue-chip Carson Cumberbatch, HNB and DFCC Bank.

Guardian Acuity discloses its top five stock allocations monthly, which are currently Distilleries, Sampath Bank, Seylan Bank, Dialog Axiata and Aitken Spence Hotel Holdings.

Fernando said they disclose a lot more information such as fund allocations and credit quality of investments than required to by Sri Lanka's SEC. Some of the better managed Unit Trusts follow the same practice, she said.

For investors who want predictable returns over a short-term horizon, Guardian Acuity has a Money Market Gilt Fund, with 410 million rupees under management, and a Money Market Fund with 4.5 billion rupees under management.

The Money Market Gilt fund sticks to treasury bills and repurchase agreements, and the Money Market Fund diversifies into fixed deposits, government securities and commercial paper.

"We have an emphasis on quality. We make sure all investments are investment grade and above. We don't rely on the ratings alone, but have an internal research team dedicated to analyzing companies, cash flows and balance sheets," Sumith Perera, senior fund manager at Guardian Acuity Asset Management, said.

Over 70 unit trusts are regulated in Sri Lanka and registered with the Unit Trust Association of Sri Lanka (utasl.lk) under categories such as open-ended income funds, index funds, balanced funds, shariah funds, IPO funds and gilt and money market funds. Analysts say closer public scrutiny is needed to highlight the strong performers as well as the under-performers in the industry.

Regulated by Sri Lanka's Securities and Exchange Commission, investors get the benefit of diversification and liquidity to extract funds.

The tax free returns, when grossed up, compare well against bank fixed deposits, said Asanka Jayasekara, a fund manager at Guardian Fund Management.

If the corporate tax rate is 28 percent, a 10 percent yield when grossed up increases to around 13.8 percent.

A good pedigree is important too, and the parent companies of Guardian Acuity are blue-chip Carson Cumberbatch, HNB and DFCC Bank.

Guardian Acuity discloses its top five stock allocations monthly, which are currently Distilleries, Sampath Bank, Seylan Bank, Dialog Axiata and Aitken Spence Hotel Holdings.

Fernando said they disclose a lot more information such as fund allocations and credit quality of investments than required to by Sri Lanka's SEC. Some of the better managed Unit Trusts follow the same practice, she said.

For investors who want predictable returns over a short-term horizon, Guardian Acuity has a Money Market Gilt Fund, with 410 million rupees under management, and a Money Market Fund with 4.5 billion rupees under management.

The Money Market Gilt fund sticks to treasury bills and repurchase agreements, and the Money Market Fund diversifies into fixed deposits, government securities and commercial paper.

"We have an emphasis on quality. We make sure all investments are investment grade and above. We don't rely on the ratings alone, but have an internal research team dedicated to analyzing companies, cash flows and balance sheets," Sumith Perera, senior fund manager at Guardian Acuity Asset Management, said.

Over 70 unit trusts are regulated in Sri Lanka and registered with the Unit Trust Association of Sri Lanka (utasl.lk) under categories such as open-ended income funds, index funds, balanced funds, shariah funds, IPO funds and gilt and money market funds. Analysts say closer public scrutiny is needed to highlight the strong performers as well as the under-performers in the industry.

Regulated by Sri Lanka's Securities and Exchange Commission, investors get the benefit of diversification and liquidity to extract funds.

The tax free returns, when grossed up, compare well against bank fixed deposits, said Asanka Jayasekara, a fund manager at Guardian Fund Management.

If the corporate tax rate is 28 percent, a 10 percent yield when grossed up increases to around 13.8 percent.

A good pedigree is important too, and the parent companies of Guardian Acuity are blue-chip Carson Cumberbatch, HNB and DFCC Bank.

Guardian Acuity discloses its top five stock allocations monthly, which are currently Distilleries, Sampath Bank, Seylan Bank, Dialog Axiata and Aitken Spence Hotel Holdings.

Fernando said they disclose a lot more information such as fund allocations and credit quality of investments than required to by Sri Lanka's SEC. Some of the better managed Unit Trusts follow the same practice, she said.

For investors who want predictable returns over a short-term horizon, Guardian Acuity has a Money Market Gilt Fund, with 410 million rupees under management, and a Money Market Fund with 4.5 billion rupees under management.

The Money Market Gilt fund sticks to treasury bills and repurchase agreements, and the Money Market Fund diversifies into fixed deposits, government securities and commercial paper.

"We have an emphasis on quality. We make sure all investments are investment grade and above. We don't rely on the ratings alone, but have an internal research team dedicated to analyzing companies, cash flows and balance sheets," Sumith Perera, senior fund manager at Guardian Acuity Asset Management, said.

Over 70 unit trusts are regulated in Sri Lanka and registered with the Unit Trust Association of Sri Lanka (utasl.lk) under categories such as open-ended income funds, index funds, balanced funds, shariah funds, IPO funds and gilt and money market funds. Analysts say closer public scrutiny is needed to highlight the strong performers as well as the under-performers in the industry.