By Gayan Gunewardana

Once a flourishing island, Sri Lanka now faces its worst economic crisis since gaining independence in 1948. The article covers the prospect of buildup, current status, and preferred loan term strategies to overcome the issues.

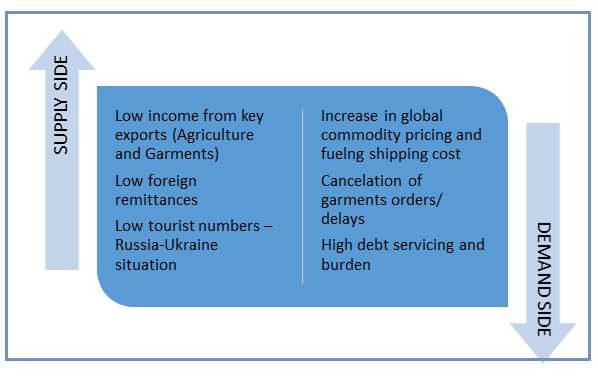

The fundamental challenge is that the country relies heavily on importing essential items, including petrol, food items, medicines, and many principal foreign currency receipts from volatile and non-essential supplies. Some supply has been hampered due to the Covid -19 situation and some poor strategies taken by the current government. As expected, the revenue from tourism evaporated in the wake of the global pandemic, which resulted in appx $ 1 B per year. More recently, the war escalation in Ukraine- Russia zone has further hampered the situation, as the region reported the highest number of visitors to the country. To note that the Tourist arrivals surge in Jan-Feb.

Contemporary challenges and historical buildup

A successful Covid-19 vaccination campaign has led to improved prospects for tourism. Still, the near and medium-term growth outlook is clouded by heightened macroeconomic imbalances, foreign exchange shortages, and halting of non-priority imports.

The agriculture economy generated appx 20% of GDP, generating substantial export revenue mainly through Tea, Rubber, and Coconut. The government has taken an uncompromising stand to convert the entire agriculture to carbonic fertilizer within a short period, resulting in a rapid decline in production. In the past, the country was self-sufficient in producing all staple food items like rice and coconut. This decision has negatively impacted the situation and led to a problem where they had to import rice for the first time from the neighboring courtiers.

On top of it, the rising global commodity prices, fuel bills, and reduction in demand for garments/ appeals from the US and EURO zone due to pandemic situation and value/ distribution chain challenges have widened the current account gap further. This has resulted in using the available reserve funds for financing.

The remittances from the foreign employees have been reduced to an all-time low. Further, the development of the USD-black market for exchange rates attracted these limited foreign remittances to unofficial channels and Hawala. The foreign direct remittances volumes too have reduced significantly owning the global economic situation.

Some of the key factors resulting in the current situation are:

Poor planning and wrong government strategies

The poor planning coupled with rapid expansion in hi-ways and ports, Port city (in Colombo), airports, conference halls, and other infrastructure projects has increased the debt levels rapidly. Sri Lanka's outstanding external debt was $36 billion as of February-22 (some say above $ 50B with institutional obligations). The most significant portion of that included international sovereign bonds, at about $12.5 billion, with other lenders including the Asian Development Bank, China, and Japan. With a recent credit line, India increases its contribution to 5%. JP Morgan analysts estimate Sri Lanka's gross debt servicing would amount to $7bn in 2022 and a current account deficit of approximately $3bn. Many economists define the situation as a "Strategic Debt Trap" (Though I am not fully agreed with

the definition).

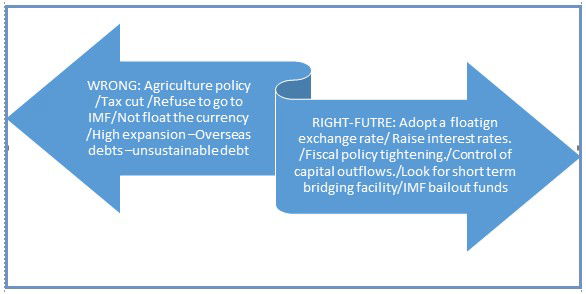

Despite all these challenges, the current government refuses to seek refuge initially from IMF due to a different ideology. This was also against over six decades of partnership with World Bank Group and never defaulted any single loan commitment in the past. WTO actively supported Sri Lanka's transition to a more competitive, inclusive, and resilient country in history. Unfortunately, another wrong strategy of excessive printing of extra notes has rapidly increased the amount of money in circulation in a couple of months.

On a positive note, the government has handled the covid-19 crisis and administered the related vaccine drive strongly by achieving nearly 100%, much before many Asian peers. This is absorbed a sizable amount of USD.

Highlights below are the wrong strategies by the government: and some of the strategies to be taken to rectify the issue:

**Timing of floating

These reasons have contributed to Sri Lanka's foreign exchange (forex) reserves having depleted by 70%to USD 2.3 billion as of February 2022. A currency crisis is brought on by a sharp decline in the value of a country's currency, resulting in massive domestic inflation. Headline inflation has breached the 4% to 6% target band of the CBSL and rose to 14.2 % in January 2022.

Rating agencies have identified the situation much earlier with gradual downgrading. For example, today, Standard & Poor's (S&P) lowered its long-term sovereign credit rating from 'CCC+' to 'CCC' t (now CC) to increasing external financing risks despite the government having honored a matured $ 500 m Sovereign debt during the period.

Domestically, fuel is scarce, essential medicine, and hours-long power cuts, though there is currently no significant shortage in available food items. Protesters have taken to the streets across the country against the severe economic crisis, leading President to declare a state of emergency and impose a nationwide curfew. The government is negotiating with India, Japan, and WTO to get approval for short-term credit lines to import essential items. India has responded positively with a USD 500M line.

Robust (economic) liberalization

The above suggestions and the IMF process can be viewed as short to medium-term strategies. At the same time, the country needs to look for more sustainable longstanding planning to combat current financial challenges. The role of the government, policymakers, entrepreneurs, and the employment sector is critical to come out of this economic disaster.

This broadly includes the economic reforms with the aim of deregulation or reducing the burden on maintaining a massive government sector as a priority. The choices for the government are limited here, namely contracting out of government services, private-public partnerships, and privatization on a selective basis. We can draw comfort from the successful economic reforms carried out by India in 1991, targeting rapid economic growth and a plan for robust liberalization. All planning was targeted at predominantly rebuilding internal and external faith in the economy.

Privatization is one of the strategies used with a never-ending debate of pros and cons. However, the government can look for cherry pickings with expert knowledge to reduce the burden and loss situation and improve services. The less bureaucratic work style, acceleration of technology, and possible attraction of high-quality employees will enhance productivity and service quality. The technological progress or enhancement with modern global know-how is critical for overall economic growth and stability and addressing the other elements like environment protection, value addition to global value chains, and improving the ecological footprint. The essential service suppliers like electricity, water, and cleaning service can be front runners to the concept of a modern change. In the recent past, Dubai has sold some of the shares of its monopolistic water and electricity supply arm (DEWA) through the share market listing to the general public.

Political stability and transparency

The intention is not to discuss extensively the much-needed political reforms that should address the recent unrest of the general public. The constitutional reforms should be wellthought off and aim for an enhanced governance framework, more transference, and accountability. The constitution reforms should be more modern and not only limited to governance and political right but critical issues like international policy, food safety, debt process, and restructuring. The constitutional changes should coincide with serious economic targets like GDP growth, inflation, unemployment rate and balance of payment, globalization %, etc.; the need for a medium to long term framework for the country irrespective of who is in power. The benchmarks relating to the money supply (limits) and budgetary deficit financing are critical discussion points to avoid similar economic crises.

The pressure group can become the spearheads in the long-term reform movements to purify and modernize the governances. These changes can also become the cornerstone of the new society. More transparency and comprehensiveness to be added for selection, tender process, evaluation, and post review in all government projects. For this purpose, all modern enterprise resource planning and audit techniques need to be implemented with the project benchmarking process. A robust institutional framework to be introduced to oversight and control these projects with the participation of industrial experts. Globally, many established bilateral donors and international organizations are available to support strengthening the public finance system.

The Tax policy should be used progressive and simplified. The improvement in fiscal capacity and collection revenue efficiency is paramount. In a modern economy, a sound tax system helps to spur growth, which has a ripple effect on the economy, standard of living, and job creation. For example, the Estonian corporate tax system has helped protect Estonian businesses immensely and improve their global competitiveness. Extensive reliefs are given for tech and digital-based entities. Excellent and consistent tax base and avoiding corruption are essential to upgrade the country from the 99th position on ease of doing business. All attempts improve investor confidence, which can reflect domestic entrepreneurship and foreign investments.

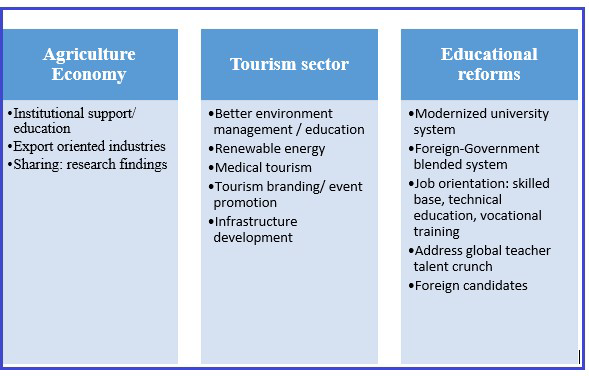

Agriculture economy and tourism

Historically, the agricultural economy is one of the critical elements in society, owing to the geographical location and cultural elements. Agriculture provides the highest employment opportunity, livelihood, and, more critically, the ancient culture is linked to these societies. Given the rapid global food inflation forecast, domestic products are essential to feed the local population and earn many dollars. The domestic agriculture society needs solid governmental support and social welfare scheme. The key is an institution targeting advisory services, modern technology, and investment in human resources. These institutes should conduct regular research aiming at core issues like land reforms, interplant, intelligent water management, advanced plants (with many crops), environment protection, etc. The aim is to support more resilient agriculture sectors with continued growth. One such technique used in modern agriculture societies to increase crop yield is field productivity zoning. This will help identify the different soil and region for various crops; the government can provide incentives accordingly. Agriculture is one of the significant parts of export-oriented industrialization, especially in front of the global food shortage. More directives and a high sharing of high-level research findings can help to improve the farming community and institutional education. This approach will help make farmers among the wealthiest people in the community, like in China and the USA.

Sri Lanka, known as the pearl of the Indian Ocean, is one of the most popular tourist destinations due to its natural beauty, biodiversity, and tangible Buddhist heritage. The critical success factor for long-term sustainability is better environmental management and minimizing ecological damages. Switzerland is the world primer Tourist destination, scoring a perfect 100 on the eighth environmental indicator, including water quality, (protection of) forest coverage, and recycling. They continuously promote renewable energy, eliminate carbon emissions, and promote environmental education. Our primary income is the current

yield from the accommodation, recreation, entertainment, and travel service.

There is an excellent opportunity to look for more avenues like medical tourism targeting ancient and Ayurveda medicine and religious tourism, which can attract a different segment of foreigners. This will also help enhance the related industries like a gem, agriculture, and services. The role of international divisions in Sri Lankan missions can not be undermined in this regard to promote awareness. The tourist board has to select better themes to attract the population; Visit Wales (UK) is one such successful event. The infrastructure development and modernization of the road network is one of the successful planning done in the past. The one-dimensional Maldives has a strong competitive edge through the "my dreamland" promotional campaign.

Educational reforms

Educational and labor market reforms are critical too. The university system needs to be modernized. The government should allow the foreign universities to the country, viz a viz the doors of government universities to be opened on fees. The government shall use the funding received through private candidates to enhance the capabilities and infrastructure. Such funds can also provide funded scholarships based on merits in foreign universities operating in the country. The same system is followed in many Asia and Western countries successfully. Individual states administrate the decentralized American university system as a part of the state university system. For example, the entrance to Colombo university can be based on merits and the private application process. Admission to the (branch) of Oxford University is based on personal applications. Still, the government pays for a fully-funded scholarship for selected candidates purely based on merits, as per the proposed blended system.

Retaining quality academic personnel will not be a challenge as government universities will also become competent in offering better perks thanks to the new revenue stream. The local university can look for more job orientation in their course programs.

The art degree holders face some challenges in securing quality job opportunities, especially in the private sector, and hence the unemployment rate is seriously high. This is an unacceptable situation given the global shortage of teachers as per UNESCO’s "Teachers’ talent crunch" theme. "70% of countries face a lack of meeting the demands of nearly 69m teachers by 2030. Changing course structure in the art stream can provide a competitive advantage to local candidates without any significant long-term reforms. The mixed method not only improves academic excellence through healthy competition but will promote these universities, especially in the regional markets, to attract international students. Another objective is the professional and skill-based education system to tag the gaps in job markets.

The intuitions are to be promoted not to displace the people having little or limited marketable skills but to get their maximum contribution to the economy. Vocational and technical education has a substantial role in meeting non-academic, specific trade, and occupational demands. This is one of the areas which can find instant demand in the global skilled job market. The countries like Finland promote and give value to this intellectual property sector more than academic education, given these merits. In neighboring Kerala and Tamil Nadu, nearly 30 high educational institutes covering agriculture and fisheries upgraded to university status. And now they offer reputed BSC degrees. Candidates hold BFSC or BASc on fishing or agriculture and enjoy good demand from public and private sectors, research institutes, ministries, and even internal markets.

Rural economy and institutional support

The two critical sectors that can be useful for economic progress are cooperative societies and SMEs (including Micro entities). There are multiple advantages from these sectors to small economies like Sri Lanka. Corporative associations can identify the local resources and an economical business model. And see some collectivity elements and voluntary services.

Connecting these societies directly into local or regional value chains by eliminating the middleman can improve the efficacy. These societies can be linked at the country level to select the respective synergies under the government patronage.

On the other hand, the direct revenue streams will enhance the village economy and purchasing power of the rural community. These small societies with more robust institutional support at the country or regional level can find the ability to compete with the more established corporate sector. The cooperative view related to agriculture can also provide long-term solutions for the small and fragmented landholding issues, agriculture marketing and export orientation, technical knowledge, etc.

SMEs already have a pivotal role in socio-economic development and contribute over 50% to GDP. Despite providing the lion's share of employment, most of these small players operate in niches or silos without a significant support system from the institutional sector. Most of them are rural-based, though they have a solid potentiality for integrating into export value chains. This is a vital tool for the country and the policymakers to improve their export volumes. The robust institution framework and sponsored banking sector should support this sector to achieve financial stability, marketing network, and technology. Especially after the Covid -19 pandemic, CB-SL has introduced concessions targeting the captioned sector and ADB refinancing scheme. Banks need to provide dedicated bank financing with or without a credit guarantee scheme.

A reliable institution can offer strong infrastructure support to these players for storage, transport, production, and marketing. Crowd-funding and peer-to-peer financing techniques can promote Angel financing or debt/ quasi-debt to start-ups. After a recent financial crisis in Lebanon, the Authority has formed an organization with a project value of USD 30M to grant funding window for seed-stage firms. This holistic support includes digital marketing platforms, e-lending platforms, knowledge management, and better export planning. Sri Lanka export development board currently plays some valuable role in this regard, though more investment is made to support these small ventures to reach their full potential. This will bring substantial value to the entire business ecosystem and strong support in achieving sustainable development goals. The much-needed innovation will come from these small entrepreneurs, who have a remarkable ability to fuel rural economic growth particularly.

Export Orientation and Institutional Industrialization

The drop in foreign reserves is considered the tip of the iceberg, as many variable factors have contributed. The import restrictions are only a short-term strategy as many economists have highlighted the long-term impacts of protectionist policies. This will hurt the country's position or competitiveness in the export market. And which leads to lower economic output and economic efficiency in the long run. The import restriction can be selected only to protect the infant (domestic) industries against unfair competition. The primary strategy that needs to be followed is strongly prompting export-oriented businesses. The limited variety of agriculture and garments/ textile items needs to be enhanced with a more extensive list. The new territorial diversification and adding new market places, especially in the vast African region, can be a solution to support these demands. Continental perspective, over 65% of exports by value are delivered to Euro and Asia. Africa is considered a rapidly growing market and supplies only 3% of export volumes.

The second strategy in the planning is to look for rapid import substitution industrialization. Domestic products need to be invented and developed to meet the challenges of imports. As a classic example, dairy farmers currently face a lack of profitability and adapt to a low-cost production system or exit from the business. This becomes counter-cyclic and leads to lowmilk yield. The government should provide financial and technical support to rescue the industry, as this can easily compete with the milk power imports. As per experts, the country has reached only up to 30% of its capacity; hence there is vast potential.

Future

IMF has provided a draft before starting the severe discussion or the roadmap. These include "substantial" revenue-based fiscal consolidation with reforms focused on strengthening VAT and income taxes. The need of the hour is to develop a comprehensive strategy to restore debt sustainability, near-term monetary policy tightening, fixing a market-determined and flexible exchange rate, and stronger social safety nets. On the backdrop of a weak global GDP growth forecast for 2022, which has recently been cut down to 3.6% by WTO, the macro challenge remains a concern.

As reviewed, the pushing up oil prices, and threatening food supply, could create unrest, particularly in vulnerable developing courtiers like Sri Lank. Overall, inflation is higher for longer," clear and present danger, "even for some developed courtiers. Overall, spillover from high energy prices, a loss of confidence, and financial market turmoil can primarily affect vulnerable economics. Therefore, it's essential to navigate the current challenges and keep an eye on potential challenges when making all the financial planning and strategies with openness to make rapid changes based on the environmental forces.

Gayan is a veteran banker, and researcher in corporate & commercial lending for over two decades in the Middle East, Asia, and European markets. He holds FRM(GARP), AIB, and CGMA apart from two university degrees from Sri Jayewardenepura and Leicester-UK. currently reading for PhD. under the supervision of Prof Ariyarathna Jayamaha (University of Kelaniya)