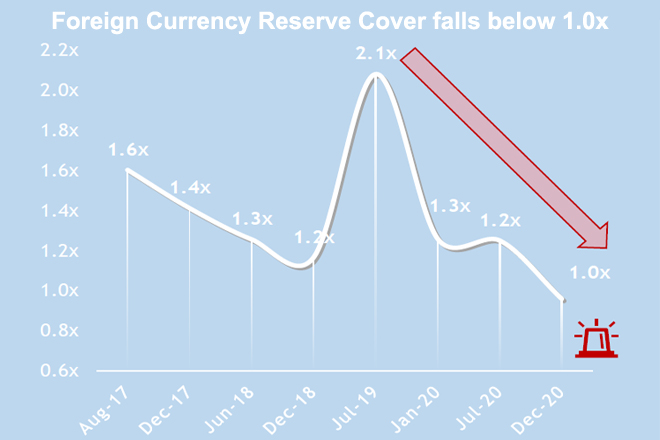

Sri Lanka's foreign currency reserves which were at USD 5.7Bn as of December 2020, have now marginally fallen below the foreign debt obligations for the first time in the recent past as foreign currency reserve cover falls below 1.0x.

Official reserve assets of the country stood at USD 5,665Mn as of 31 December 2020 while the foreign currency repayment schedule for 1-year stands at USD 5,797Mn.

According to the Strategy Report 2021 of First Capital Research, total rupee and USD bond obligations are high closing in on LKR 1Tn in 2021E with total debt obligations including project loans rising to 2.7Tn 2021E from 2.4Tn in 2020.

During 2021E, Rupee debt maturity spikes in 4Q while foreign debt maturity is high in 2Q & 3Q with an ISB maturity of USD 1.0Bn in Jul 2021.

"Even in the Government Securities market, it is important to note that the treasury bill stock has spiked to 24% of the Government Securities portfolio, one of the highest levels in the recent past which clearly illustrates the risk in the system as most investors prefer to invest in the shorter tenors identifying the possibility of a spike in rates in the future," the First Capital Research said.

"With a balance of payment likely to reach a deficit of USD 1.6Bn, we expect foreign reserves to gradually decline over the next 12 months. Foreign Reserves are likely to fall to USD 5.0Bn by Jun 2021 while falling below comfortable levels to USD 4.0Bn by Dec 2021."

First Capital, however, expects Government to raise at least USD 2.5Bn via SWAPs from India and China combined while other channels of fund raising such as Commercial Loans and Bilateral or Multilateral funding may account for a further USD 1.5Bn. They also expect USD 600Mn to be generated via FDIs.

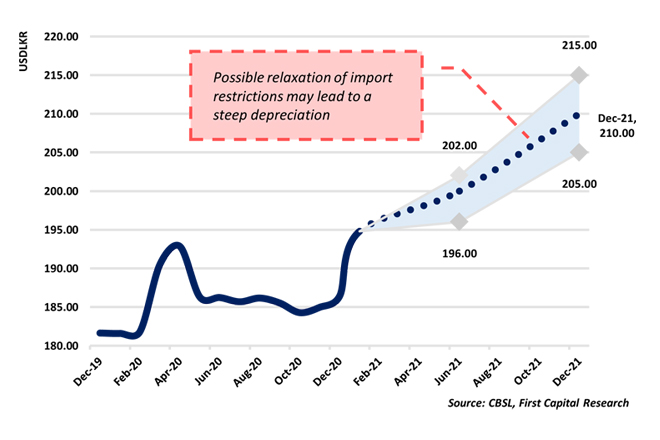

The weak foreign currency reserve position, high foreign currency debt repayment, and possible spike in consumer demand triggering higher imports are likely to result in a steep currency depreciation in 2021. First Capital expects LKR to depreciate approximately c.12.0% during the year.

Related: Gross official reserves estimated at USD 5.7bn at end 2020