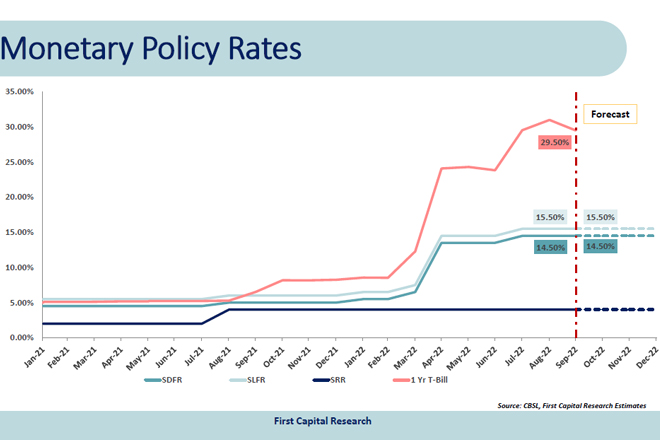

First Capital Research (FCR) believe that CBSL may consider maintaining the monetary policy rates at its current levels in the upcoming policy review meeting allowing a soft landing from its hawkish to dovish stance.

However, given the necessity to provide monetary stimulus to prevent further weakening of the economy and the notable improvement in majority of the key economic indicators, they have assigned a lower probability for a relaxation in the monetary policy to alleviate the overreacted interest rates in the tighter monetary environment.

"Thereby we have assigned a probability of 75 for rates to remain unchanged at the upcoming policy review while also assigning a 25 probability for a relaxation in policy rates," the First Capital Research said.

"However, considering the positive outlook over the next 6 - 12 months, we expect a complete normalization of the economy with the country being able to secure necessary financing from IMF and other multilateral creditors while regaining its access to the global capital market.

buy dapoxetine online buy dapoxetine online no prescription

"

Thus, the complete stabilization of economic indicators may give rise to a possibility of sizeable rate cuts towards 1Q 2023 with a significant probability to fast track the revival of the economy.

Economic activities in Sri Lanka have severely contracted during 2Q2022 to a GDP growth of 8.4%. Larger than expected slump in the economy is alarming for prompt remedial actions before it cascades to irrecoverable levels.

On the other hand, key economic variables such as forex rate, external sector activities, foreign activity as well as inflation that were dangerously heated during the heart of economic crisis have almost cooled off at a much more rapid rate than we expected and are positioned for a monetary stimulus to gear up the economy.

"The gradual transformation of the monetary policy stance that FCR projected to effect over the next 3 - 6 months is now accelerated and, we transition our perspective from hawkish to dovish," the First Capital Research said.

"Thus, we completely eliminate the possibility of a further monetary policy tightening while gradually increasing the probability of a monetary relaxation in the next 3 - 6 months."