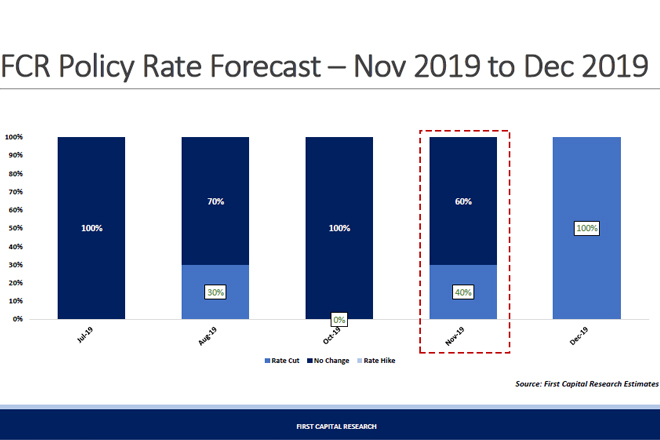

Nov 25, 2019 (LBO) – First Capital Research believes that there is a possibility for a rate cut considering the need to address the sluggishness in economic activity despite the 50 bps rate cuts each in May and Aug.

"The external outlook favouring SL, easing political uncertainty and positive macro environment provides an opportunity for monetary easing despite the risk in lower liquidity position," FC said in a research note.

"Accordingly, we do not rule out a possibility of a rate cut though at a lower probability of 40%. We are more biased towards a rate cut in Dec 2019 considering the risk in lower liquidity position.

"

Despite the Central Bank cutting rates in Aug 2019 for the second time, the decline in interest rates has been slow amidst the high level of NPLs in the system forcing CBSL to introduce lending caps to banks.

Post completion of the Presidential Election business activity and credit growth has shown slow progress but continues to remain below expectations calling for further monetary easing.

Strengthening macro economic indicators and the current high yields have been slowly attracting foreign inflows which is likely to further accelerate post-Presidential Election amidst easing political uncertainty to a certain extent.

With the support of foreign inflows, the currency has been strengthening over the past couple of weeks.

"We believe, a significantly undervalued rupee (as indicated by the REER) and lower credit growth, provides room for CBSL to buy dollars, strengthening the reserves and increasing liquidity in the system,"

Sri Lanka’s external position looks comfortable near term, with foreign reserves at 7.8 billion rupees as of Oct 2019 and the improved current account position.

The Central Bank plans to raise a Samurai bond of 500 million dollars in Dec 2019 further adding cushion to the foreign reserves.

"We expect reserves to hover comfortably around USD 8.0 Bn mark with sufficient foreign repayment cover during the rest of 2019," the firm said.

"Accordingly, we expect a comfortable position in the external sector to exert lower pressure on reserves."

The global move towards easing monetary policy creates a supportive environment for SL to provide further easing in the domestic economy.

Fed in late Oct 2019 cut benchmark overnight lending rate a quarter-point, the 3rd such move in 2019 while most of the committee members saw the moves as enough to support the outlook of moderate growth.

Following the US’s Fed move, China, Thailand and Gulf countries also joined a round of monetary easing.